- United States

- /

- Software

- /

- NasdaqGS:VRNS

Is Varonis Systems (VRNS) Offering Value After Recent Share Price Rebound?

Reviewed by Bailey Pemberton

- If you are wondering whether Varonis Systems at around US$35.25 is offering fair value or a potential opportunity, you are not alone in asking what the current price really reflects.

- The stock has returned 10.0% over the last 7 days and 6.4% over the last 30 days, yet the longer term picture includes a 10.0% year to date gain alongside a 21.1% decline over 1 year, a 43.2% return over 3 years and a 38.8% decline over 5 years.

- Recent news coverage has focused on Varonis Systems as a data security and compliance software provider and how investors weigh its long term prospects against past share price swings. Together with the mixed return record, this context helps explain why short term moves can attract attention from both cautious and optimistic investors.

- On our valuation checks, Varonis Systems scores 3 out of 6, and next we will look at what different valuation approaches say about that score and why an even richer way to assess value comes at the end of this article.

Find out why Varonis Systems's -21.1% return over the last year is lagging behind its peers.

Approach 1: Varonis Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of a company’s future cash flows and discounts them back to today’s dollars, aiming to translate long term cash generation into a single per share value.

For Varonis Systems, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections rather than earnings. The latest twelve month Free Cash Flow is about $138.0 million. Analysts provide projections for the coming years and, after that, Simply Wall St extrapolates the trend, with the model pointing to Free Cash Flow of $405.1 million in 2030 and extending further out to 2035 using the same framework.

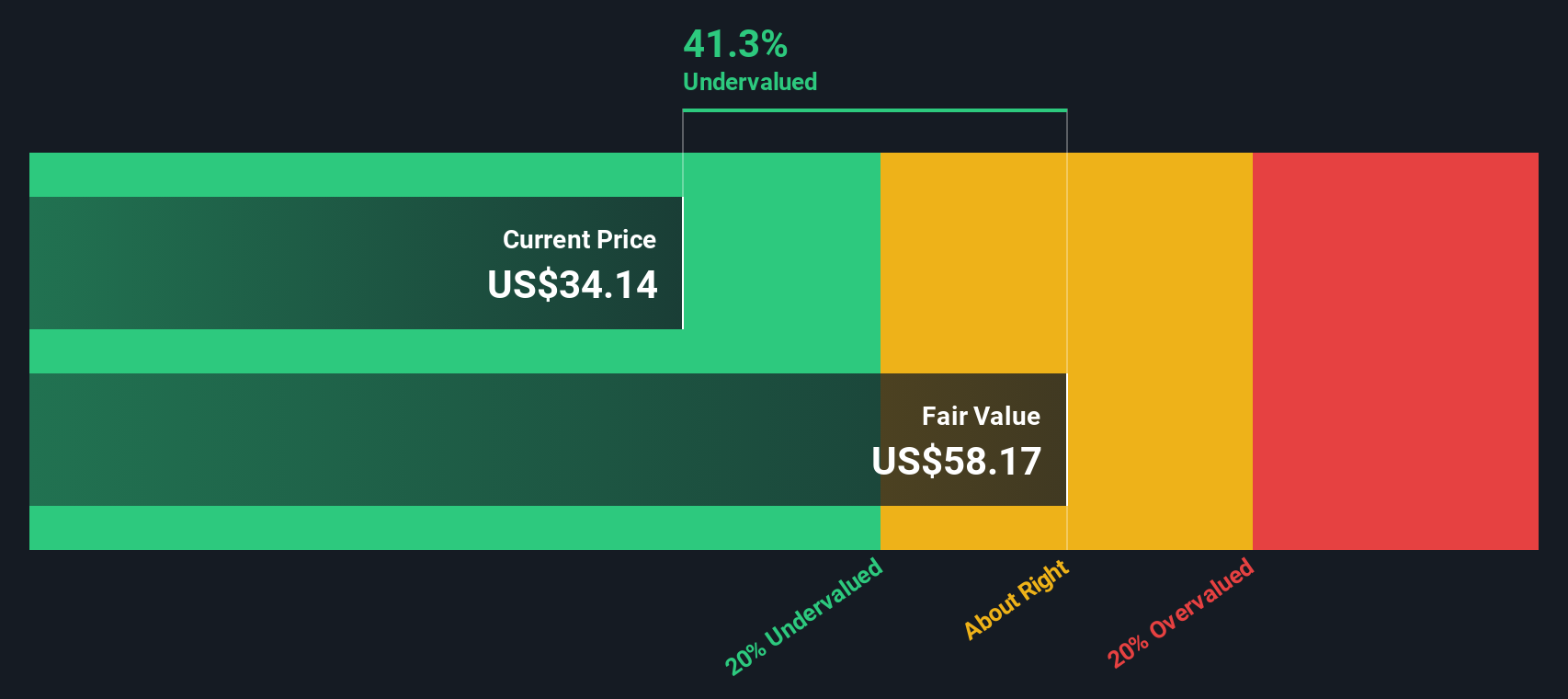

Putting those projected cash flows together and discounting them to today gives an estimated intrinsic value of about $63.74 per share. Compared with a recent share price around $35.25, the DCF output suggests the stock is trading at a 44.7% discount to this estimate, which indicates it may be undervalued on this specific cash flow based view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Varonis Systems is undervalued by 44.7%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Varonis Systems Price vs Sales

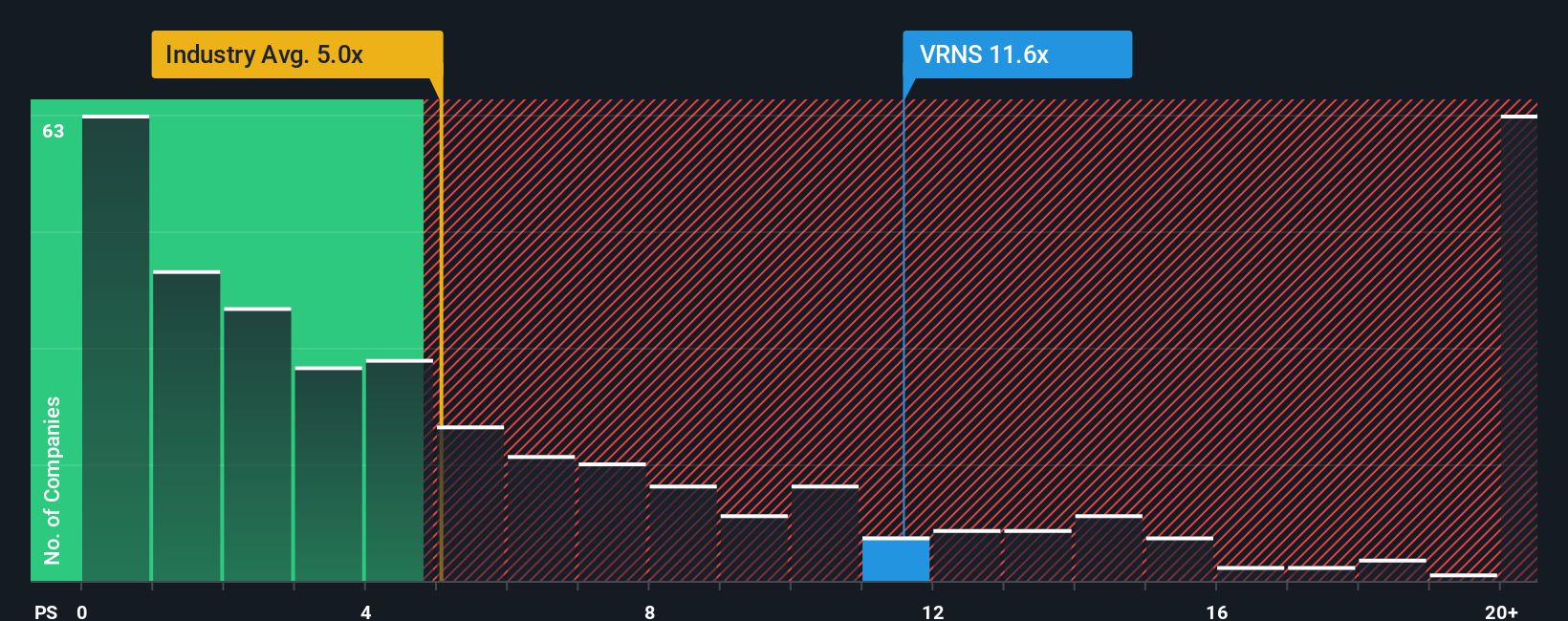

For companies where profits are limited or volatile, the P/S ratio is often a more useful yardstick than P/E because it focuses on revenue, which tends to be more stable and less affected by accounting choices.

In general, investors are usually willing to pay a higher P/S multiple for companies that are expected to grow revenues faster or that are perceived as lower risk, and a lower multiple for slower growth or higher perceived risk. This is why the idea of a single "normal" P/S is less helpful without context around growth and risk.

Varonis Systems currently trades on a P/S ratio of 6.83x. That sits above the Software industry average of 4.90x and also above the peer group average of 5.73x. Simply Wall St’s Fair Ratio for Varonis Systems is 6.07x, which is an estimate of the P/S investors might typically pay given factors such as the company’s earnings profile, industry, profit margin, market cap and risk characteristics. Because the Fair Ratio weights these company specific drivers, it can offer a more tailored yardstick than a simple comparison with broad industry or peer averages.

Compared with this Fair Ratio of 6.07x, the current P/S of 6.83x points to Varonis Systems looking overvalued on this metric.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Varonis Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can build or follow a Narrative, which is basically your story about Varonis Systems that links what you believe about its data security role, SaaS transition, AI exposure and risks to a specific forecast for future revenue, earnings and margins. This then connects to a Fair Value that you can compare with the current price to decide whether you see room to buy or sell. All of this sits within an easy to use Community page where Narratives are kept up to date as news, earnings and analyst targets change. One investor might lean toward a higher fair value closer to US$80, while another might anchor around US$47, and both views are clearly tied to their assumptions rather than just the latest share price moves.

Do you think there's more to the story for Varonis Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026