- United States

- /

- Software

- /

- NasdaqGS:VRNS

A Look at Varonis Systems's Valuation After Launching AI-Powered Interceptor for Advanced Cybersecurity Threats

Reviewed by Kshitija Bhandaru

Varonis Systems (VRNS) just launched Varonis Interceptor, an AI-driven platform targeting advanced phishing and social engineering attacks across email and collaboration tools. The move highlights how the company is responding to rapidly evolving cybersecurity threats.

See our latest analysis for Varonis Systems.

Varonis Systems’ share price has picked up steam lately, climbing 35.3% year-to-date, as the company’s new AI-powered initiatives and presence at high-profile industry events continued to stir interest among investors. Still, over the past year, its total shareholder return was a more moderate 6%, but a stellar 148% over three years points to long-term growth momentum.

If cutting-edge cybersecurity stories like these have you searching for other innovators, consider exploring the full range of leading tech and AI stocks in the See the full list for free..

With the stock gaining momentum yet still trading below analysts’ targets, investors might wonder whether there is further room for upside or if Varonis’s ambitious AI growth story is already reflected in the price.

Most Popular Narrative: 3.9% Undervalued

Compared to its last close at $59.98, the most popular analyst-driven narrative places Varonis Systems’ fair value at $62.43, suggesting there may still be more room for shares to rise. The narrative explains what would need to happen for that upside to be realized.

Continued SaaS transition and high NRR (notably for SaaS customers), combined with robust upsell momentum across cloud and multi-cloud environments, enhance ARR visibility and predictability. This drives durable earnings and margin expansion as the SaaS mix climbs and operational leverage improves after the transition.

Want to know which behind-the-scenes revenue accelerators and profit levers drive this ambitious valuation? One financial projection in the narrative may surprise you. Find out which future assumptions have analysts expecting Varonis to defy the sector’s usual profit hurdles. The key metric is not what you might guess.

Result: Fair Value of $62.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including persistent margin pressure from the SaaS transition and ongoing dilution risk. These factors could challenge the bullish outlook.

Find out about the key risks to this Varonis Systems narrative.

Another View: What Do Multiples Say?

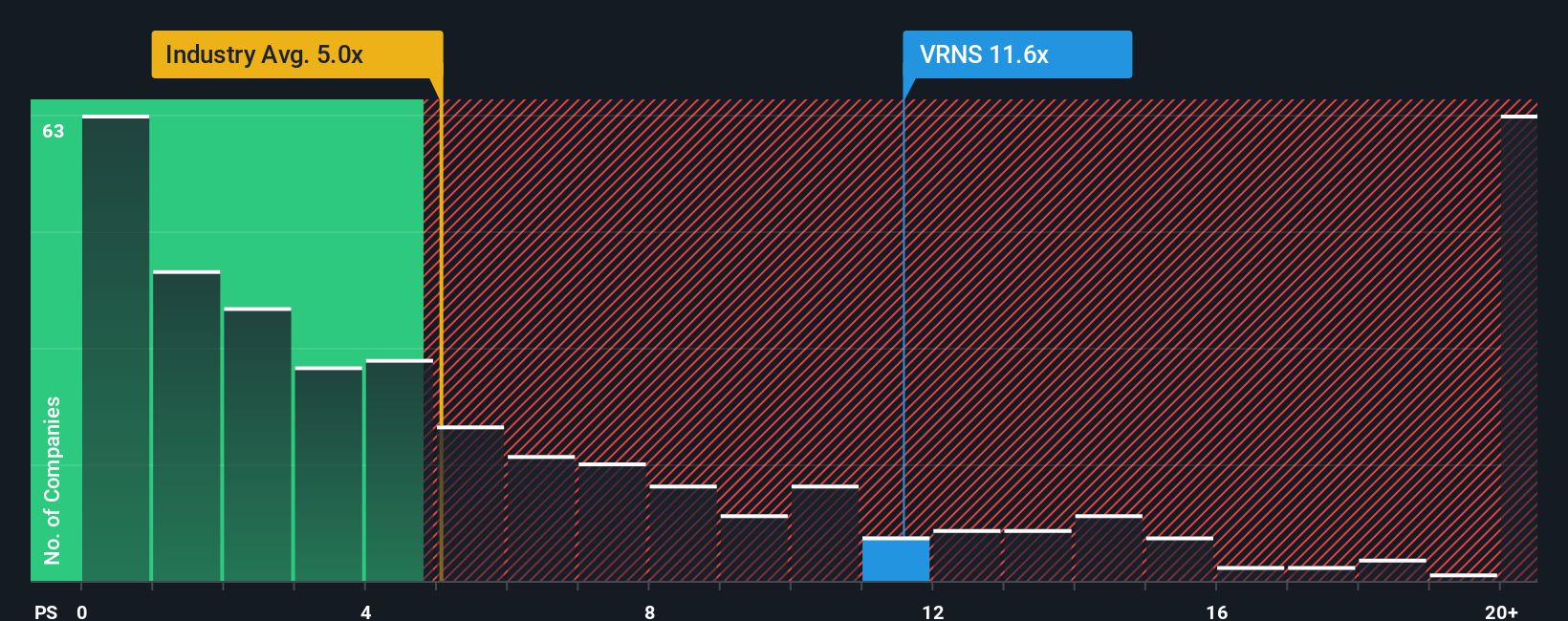

While some analysts argue Varonis Systems is undervalued compared to fair value estimates, looking at price-to-sales tells a different story. The company trades at 11.3x sales, which is much higher than its peer average of 6.1x and the US Software industry’s 5.3x. Even the market's fair ratio of 7.3x suggests Varonis carries valuation risk if sentiment shifts. Could this premium signal confidence in future growth or expose investors if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Varonis Systems Narrative

If you want to dig deeper or chart your own perspective, you can create a custom data-driven narrative in under three minutes. Do it your way

A great starting point for your Varonis Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize the opportunity to find your next standout stock. Don’t let great opportunities slip away when smart investors are already taking action. Try these handpicked approaches today:

- Power up your portfolio by evaluating these 25 AI penny stocks, which are capturing breakthroughs in artificial intelligence and automation.

- Maximize your yield potential and target steady income streams with these 19 dividend stocks with yields > 3%, featuring robust payouts over 3%.

- Capitalize on hidden value opportunities by examining these 898 undervalued stocks based on cash flows, poised for growth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives