- United States

- /

- IT

- /

- NasdaqGS:VNET

Rising Returns and China’s Tech Support Could Be a Game Changer for VNET Group (VNET)

Reviewed by Simply Wall St

- In recent days, VNET Group has reported a substantial increase in its returns on capital employed over the past five years and has significantly expanded its capital base, signaling improved operational efficiency and pursuit of new growth opportunities.

- These operational gains come amid robust government support for technology and AI businesses across China, positioning VNET Group to potentially benefit from a sector-wide push driven by new funding initiatives and regulatory backing.

- We'll explore how VNET Group's improved capital efficiency supports its investment narrative in the context of expanding AI and data center demand.

VNET Group Investment Narrative Recap

To be a shareholder in VNET Group, you need confidence in the Chinese data center and AI sector’s growth, as well as faith in the company’s ongoing capital efficiency improvements. While the substantial rise in returns on capital employed points to operational progress, the biggest short-term catalyst remains execution on new order wins; meanwhile, the largest risk, the impact of heightened capital expenditures on cash flow, does not appear immediately affected by this news, but remains core to the near-term outlook.

VNET’s recent earnings guidance raise, projecting 2025 revenues between RMB 9,150 million and RMB 9,350 million, aligns with signs of improved capital productivity and points to optimism about strong demand. This improved outlook supports the narrative that operational enhancements must keep pace with heavy new investments to achieve sustained growth and meet rising expectations from both customers and investors.

Yet, in contrast, investors should be aware that the recent acceleration in capital expenditure could challenge margins if revenue growth does not…

Read the full narrative on VNET Group (it's free!)

VNET Group's narrative projects CN¥13.8 billion revenue and CN¥451.2 million earnings by 2028. This requires 17.2% yearly revenue growth and a CN¥333.6 million earnings increase from the current CN¥117.6 million.

Uncover how VNET Group's forecasts yield a $12.79 fair value, a 46% upside to its current price.

Exploring Other Perspectives

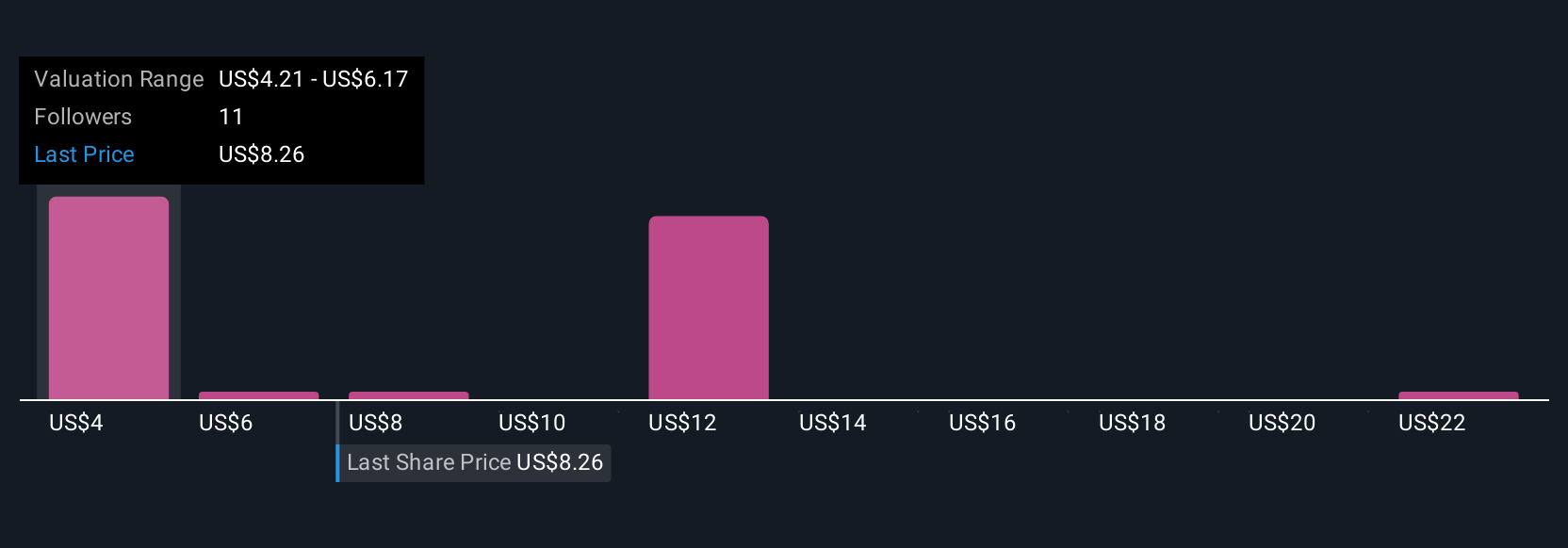

Seven members of the Simply Wall St Community provided fair value estimates for VNET, ranging widely from US$4.21 to US$23.79. With accelerating capital expenditures a key concern, consider how future earnings and cash flows could impact these projections as you explore other viewpoints.

Build Your Own VNET Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VNET Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VNET Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VNET Group's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives