- United States

- /

- Software

- /

- NasdaqCM:VERB

Auditors Are Concerned About Verb Technology Company (NASDAQ:VERB)

Unfortunately for shareholders, when Verb Technology Company, Inc. (NASDAQ:VERB) reported results for the period to December 2020, its auditors, Weinberg & Company, P.A., expressed uncertainty about whether it can continue as a going concern. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

See our latest analysis for Verb Technology Company

What Is Verb Technology Company's Net Debt?

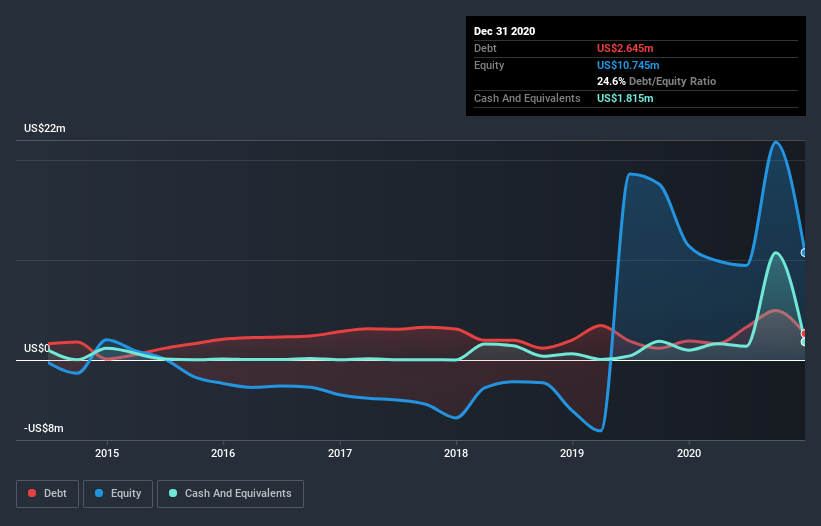

As you can see below, at the end of December 2020, Verb Technology Company had US$2.65m of debt, up from US$1.91m a year ago. Click the image for more detail. However, because it has a cash reserve of US$1.82m, its net debt is less, at about US$830.0k.

How Strong Is Verb Technology Company's Balance Sheet?

The latest balance sheet data shows that Verb Technology Company had liabilities of US$16.9m due within a year, and liabilities of US$4.92m falling due after that. On the other hand, it had cash of US$1.82m and US$919.0k worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$19.1m.

While this might seem like a lot, it is not so bad since Verb Technology Company has a market capitalization of US$80.6m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. Carrying virtually no net debt, Verb Technology Company has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Verb Technology Company's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Verb Technology Company wasn't profitable at an EBIT level, but managed to grow its revenue by 9.2%, to US$10.0m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Over the last twelve months Verb Technology Company produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable US$25m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$17m of cash over the last year. So suffice it to say we consider the stock very risky. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 6 warning signs for Verb Technology Company you should be aware of, and 3 of them are significant.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Verb Technology Company, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:VERB

Verb Technology Company

Through its subsidiaries, develops Software-as-a-Service applications platform.

Flawless balance sheet moderate.