- United States

- /

- Software

- /

- NasdaqGS:TTAN

Is ServiceTitan’s Valuation Still Justified After Recent Product Expansion and Share Price Slide?

Reviewed by Bailey Pemberton

- If you are wondering whether ServiceTitan is a smart buy at today’s price, you are not alone. This stock has quickly become a talking point for investors trying to separate hype from genuine value.

- After listing and then sliding to about $90 a share, the stock is down roughly 5.0% over the last month and about 11.3% year to date. This combination has some investors nervous and others quietly watching for an opportunity.

- Recent headlines have focused on ServiceTitan’s continued product expansion and partner ecosystem, including deeper integrations that aim to lock in trade contractors to its platform, while private market commentary has highlighted its role as a category leader in field service software. At the same time, analysts and industry blogs have zeroed in on its ability to convert small businesses to the cloud, framing the stock as a long runway growth story even as sentiment cools.

- On our numbers, ServiceTitan currently scores just 2/6 on our valuation checks, suggesting only a couple of metrics flag it as undervalued. We are going to break down what each valuation approach is seeing, and then finish with a more practical way to think about what the stock is really worth.

ServiceTitan scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ServiceTitan Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For ServiceTitan, the model used is a 2 Stage Free Cash Flow to Equity approach. This allows for faster growth in the early years before moderating later on.

ServiceTitan currently generates about $9.3 Million in free cash flow, and analysts expect this to scale rapidly, with projections rising to around $344.7 Million by 2030. Simply Wall St extends analyst forecasts beyond the usual 5 year window by extrapolating these trends out to 10 years. The discounted free cash flows in the later years are still reported to exceed $250 Million annually, reflecting strong growth expectations.

On this basis, the DCF model arrives at an intrinsic value of roughly $81.80 per share. Compared to the current share price, this suggests the stock is about 10.1% overvalued, indicating that a lot of future growth may already be priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ServiceTitan may be overvalued by 10.1%. Discover 930 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ServiceTitan Price vs Sales

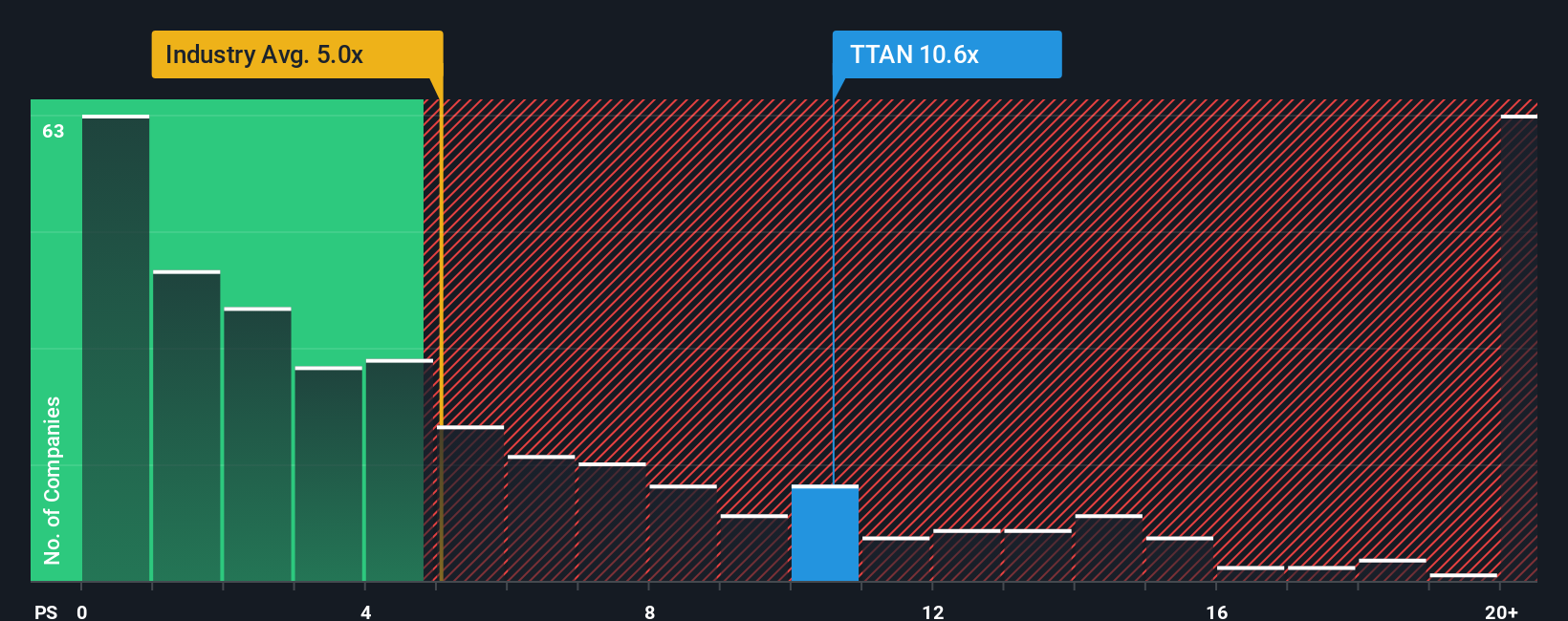

For high growth software names that are not yet consistently profitable, the Price to Sales ratio is usually the cleanest way to compare valuations, because it focuses on revenue traction rather than volatile or negative earnings.

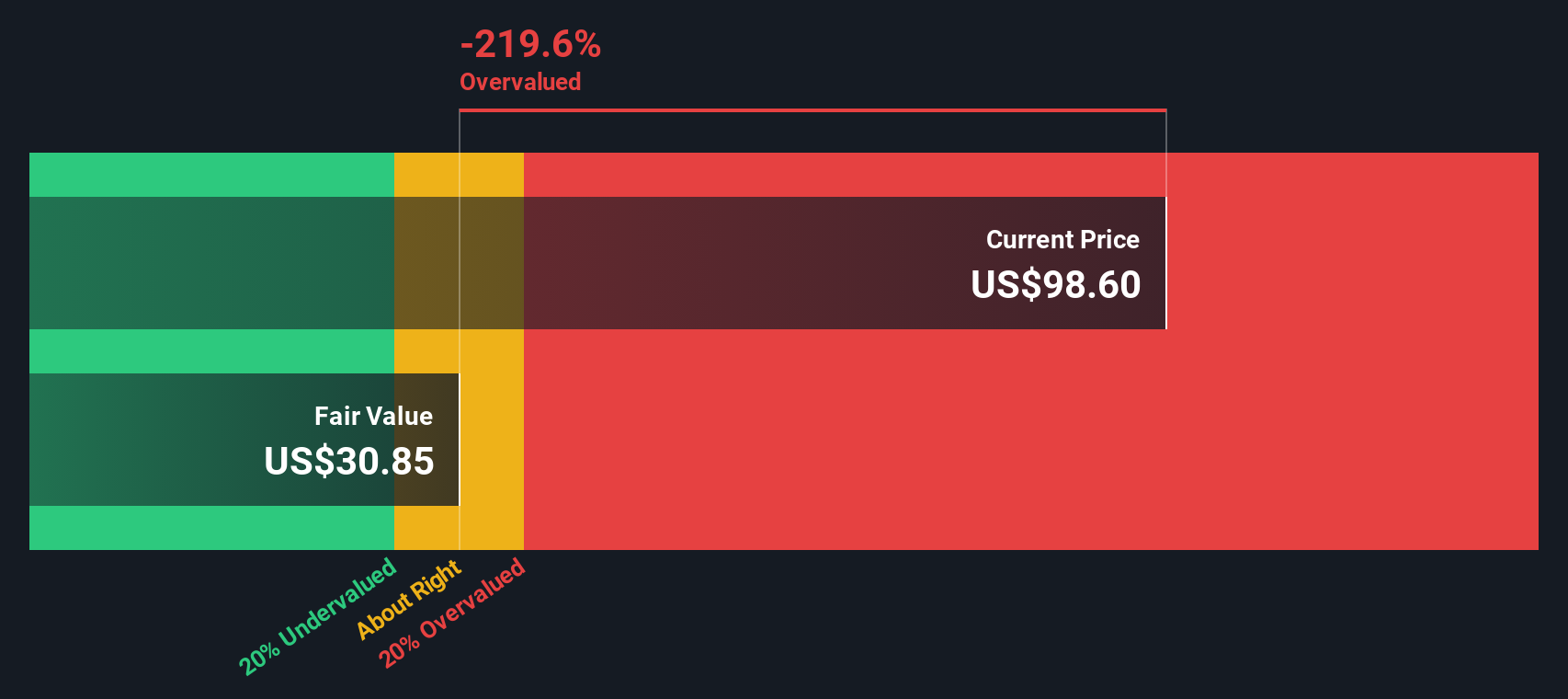

In general, faster and more predictable revenue growth, higher margins and lower risk justify a higher Price to Sales multiple, while slower growth or lumpier results usually deserve a discount. With that in mind, ServiceTitan currently trades at about 9.66x sales, which is roughly double the broader Software industry average of 4.82x and still below the peer group average of around 13.01x.

Simply Wall St’s Fair Ratio for ServiceTitan is 5.80x sales. This is a proprietary estimate of what a reasonable multiple should be once you factor in the company’s growth outlook, profitability profile, risk, industry positioning and size. This makes it more tailored than a simple comparison to peers or the sector, which can be skewed by a few extreme outliers or very different business models. Set against today’s 9.66x, the Fair Ratio suggests the stock is trading at a premium to what its fundamentals currently justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ServiceTitan Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by spelling out how you expect a company’s revenue, earnings and margins to evolve and what you think its fair value should be. A Narrative links three pieces together: the business story you believe in, the financial forecast that follows from that story, and the fair value estimate those forecasts imply. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy tool that lets you compare your own fair value to the current share price so you can quickly see whether your story suggests buy, hold or sell. They update dynamically as new information such as earnings reports or major news arrives, helping your view stay current without starting from scratch. For example, one ServiceTitan Narrative might see slower growth and a much lower fair value than another Narrative that expects sustained rapid adoption and assigns a significantly higher valuation.

Do you think there's more to the story for ServiceTitan? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTAN

ServiceTitan

Provides an end-to-end cloud-based software platform in the United States and Canada.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026