- United States

- /

- Software

- /

- NasdaqGS:TENB

Tenable Holdings (NASDAQ:TENB) shareholder returns have been favorable, earning 63% in 3 years

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, the Tenable Holdings, Inc. (NASDAQ:TENB) share price is up 63% in the last three years, clearly besting the market return of around 50% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 25%.

Since the stock has added US$357m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Tenable Holdings

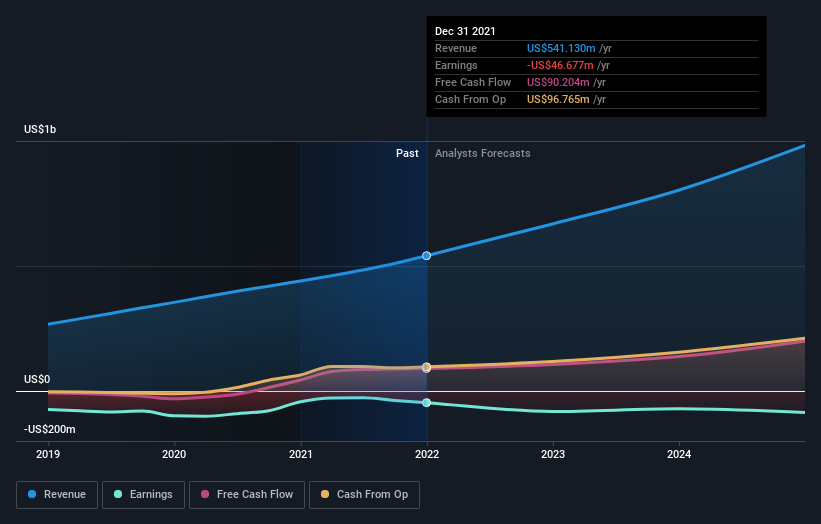

Given that Tenable Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Tenable Holdings saw its revenue grow at 22% per year. That's much better than most loss-making companies. The share price rise of 18% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. If that's the case, now might be the time to take a close look at Tenable Holdings. If the company is trending towards profitability then it could be very interesting.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Tenable Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Tenable Holdings rewarded shareholders with a total shareholder return of 25% over the last year. That's better than the annualized TSR of 18% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Tenable Holdings better, we need to consider many other factors. Take risks, for example - Tenable Holdings has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course Tenable Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives