- United States

- /

- Software

- /

- NasdaqGS:TENB

Some Shareholders Feeling Restless Over Tenable Holdings, Inc.'s (NASDAQ:TENB) P/S Ratio

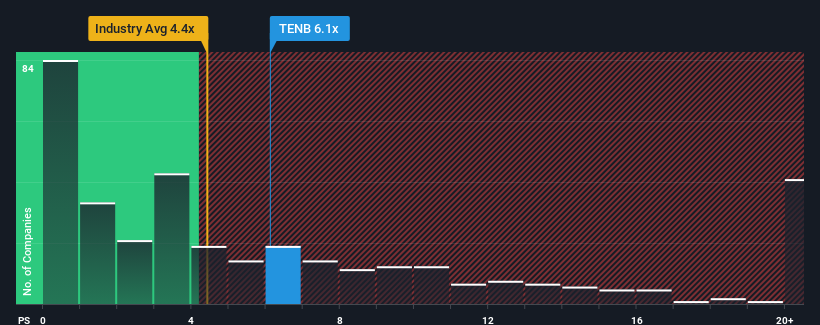

Tenable Holdings, Inc.'s (NASDAQ:TENB) price-to-sales (or "P/S") ratio of 6.1x might make it look like a sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.4x and even P/S below 1.6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Tenable Holdings

What Does Tenable Holdings' Recent Performance Look Like?

There hasn't been much to differentiate Tenable Holdings' and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Tenable Holdings will help you uncover what's on the horizon.How Is Tenable Holdings' Revenue Growth Trending?

Tenable Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 79% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 15% per annum over the next three years. That's shaping up to be similar to the 15% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Tenable Holdings' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Tenable Holdings' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Tenable Holdings' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Tenable Holdings that you need to be mindful of.

If you're unsure about the strength of Tenable Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026