- United States

- /

- Software

- /

- NasdaqGS:TENB

Is There an Opportunity in Tenable After a 22.7% Drop in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do next with Tenable Holdings stock? You are not alone. The cybersecurity specialist has had a rocky ride lately, leaving many investors watching closely for clues about its true value and long-term potential. Over the past week, the stock managed a 2.3% uptick, but zoom out and you will see a different story, with a 22.7% year-to-date drop and a 25.4% loss over the last year. Even over the last five years, Tenable is still down 16.1%.

So, is there a hidden opportunity despite the downward pressure? There has been no dramatic earnings update recently, but sector-wide momentum and increased attention on digital security have played into the sentiment. The narrative is not just about price declines. Changes in risk perception and hopes for stronger long-term growth continue to influence daily moves. As security headlines dominate the news cycle, Tenable’s position at the forefront keeps it on analyst radars.

If you are looking for a clear sense of Tenable’s value right now, here is a number that stands out: the company scores an impressive 6 out of 6 based on multiple undervaluation checks. That means it ticks every box in our valuation screen. But as any market-watcher knows, great scores do not always translate into instant price gains. Wondering how that score was calculated and if there is more to the story? Let’s break down the different approaches to valuing Tenable. Later, we will dig even deeper to see if there is a smarter way to truly gauge its worth.

Why Tenable Holdings is lagging behind its peers

Approach 1: Tenable Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting them back to today’s dollars. This approach is especially useful for businesses like Tenable Holdings, where future growth and profitability may differ significantly from past results.

For Tenable Holdings, the most recent Free Cash Flow reported is $250.2 Million. Analysts project this to grow steadily, reaching $332 Million by the end of 2027. Beyond that, longer-term forecasts based on industry expectations suggest Free Cash Flow could rise to approximately $517 Million by 2035. All cash flows are presented in US dollars.

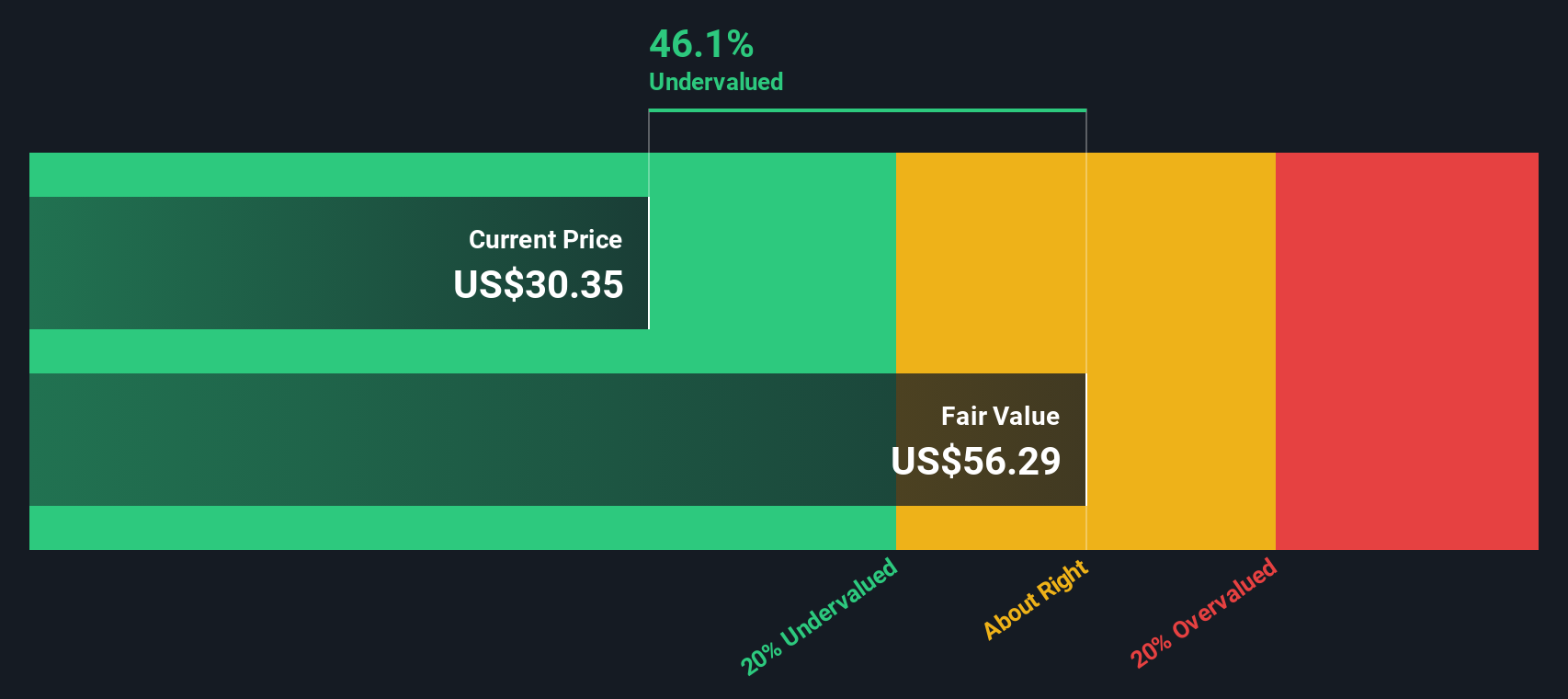

Based on these projections, the DCF model estimates an intrinsic value of $55.16 per share for Tenable Holdings. This figure is about 45.4% higher than the current trading price, indicating a substantial undervaluation by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tenable Holdings is undervalued by 45.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Tenable Holdings Price vs Sales

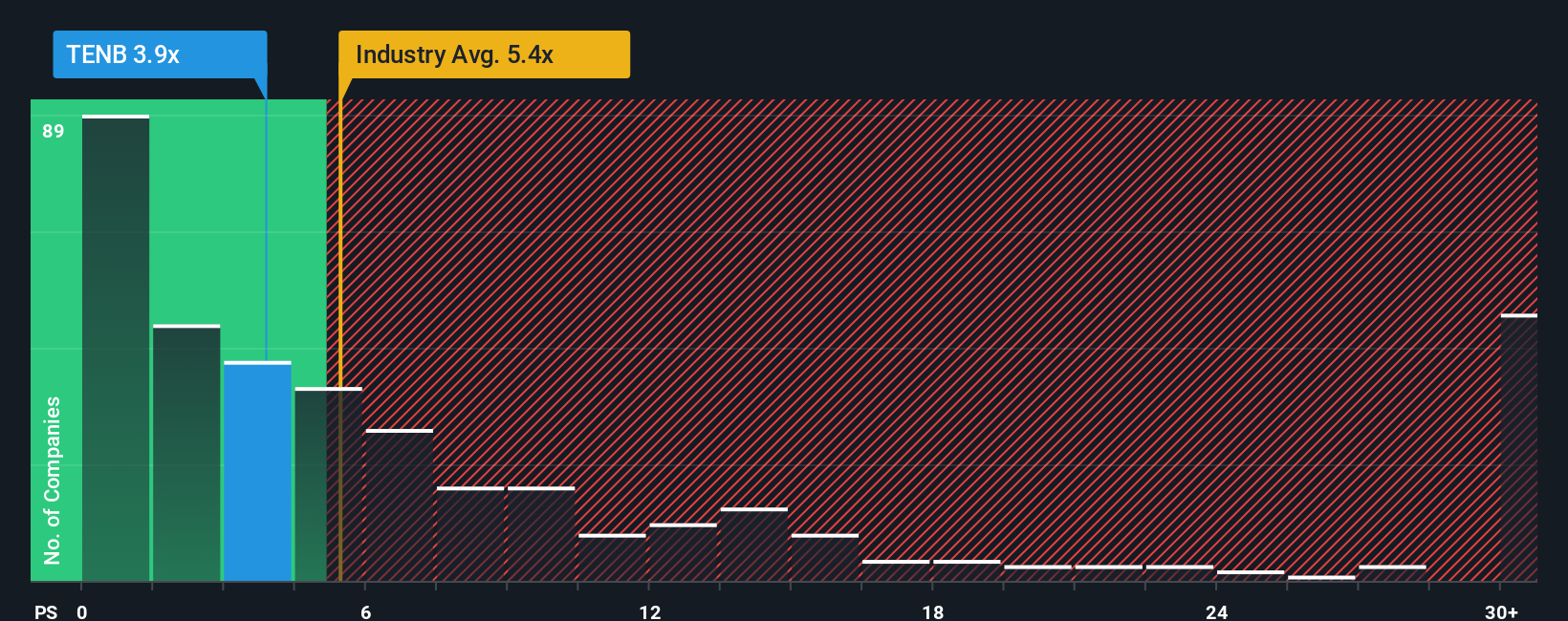

The Price-to-Sales (P/S) ratio is a favored metric for valuing growth-focused technology and software companies, especially those still building profitability or reinvesting heavily. Since many firms in this sector prioritize revenue expansion over bottom-line profits, P/S provides a cleaner yardstick for comparing opportunities across the industry.

The appropriate multiple for any stock is shaped by its growth prospects, risk profile, and market sentiment. Faster growing, less risky companies tend to justify higher P/S ratios, while riskier or more volatile firms may deserve a discount. For Tenable Holdings, the current P/S ratio sits at 3.84x. This is below both the software industry average of 5.17x and the peer average of 4.69x. This suggests that Tenable is valued more conservatively by the market.

Simply Wall St's Fair Ratio sharpens this comparison by taking into account company-specific factors like growth outlook, profit margins, industry dynamics, and company size. With a Fair Ratio of 4.63x for Tenable, this proprietary metric provides a more tailored benchmark than a simple peer or industry average. Since Tenable’s P/S ratio is notably lower than the Fair Ratio, this valuation method supports the view that the stock is undervalued based on its revenue potential and fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tenable Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story behind Tenable Holdings’ numbers, your personal perspective on what the business might achieve, grounded in your own assumptions about its future revenue, earnings, and margins.

This approach connects the dots from a company’s unique story to a financial forecast, then directly to a fair value. Narratives are not just for seasoned analysts. On Simply Wall St’s Community page, millions of investors already use Narratives as an easy, interactive tool to express their outlooks and compare ideas.

What makes Narratives powerful is how they let you see, at a glance, whether your beliefs suggest Tenable Holdings is a buy or a sell, by comparing your Fair Value estimate to the current share price. As new news, data, or earnings releases arrive, Narratives are automatically refreshed, ensuring your view stays up to date without extra work.

For example, one investor might see Tenable’s AI innovation and global expansion as reasons for a bullish Narrative with a higher Fair Value, while another might focus on rising costs, competitive risks, and project a more conservative value. This shows how diverse stories drive very different investment conclusions, and smart decision making starts when you define your own Narrative.

Do you think there's more to the story for Tenable Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives