- United States

- /

- Semiconductors

- /

- NYSE:ONTO

3 US Stocks Estimated To Be Trading Up To 36.1% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market takes a breather from its recent rally, investors are keeping a close eye on the upcoming jobs report and potential policy shifts that could impact economic growth. Amidst this cautious optimism, identifying undervalued stocks becomes crucial, as these opportunities can offer significant potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.05 | $53.21 | 49.2% |

| UMB Financial (NasdaqGS:UMBF) | $124.09 | $244.04 | 49.2% |

| West Bancorporation (NasdaqGS:WTBA) | $23.62 | $46.44 | 49.1% |

| Business First Bancshares (NasdaqGS:BFST) | $28.28 | $54.98 | 48.6% |

| Microchip Technology (NasdaqGS:MCHP) | $58.25 | $112.57 | 48.3% |

| Equity Bancshares (NYSE:EQBK) | $48.12 | $96.15 | 50% |

| U.S. Physical Therapy (NYSE:USPH) | $97.62 | $187.03 | 47.8% |

| First Advantage (NasdaqGS:FA) | $19.77 | $38.96 | 49.3% |

| Vasta Platform (NasdaqGS:VSTA) | $2.24 | $4.39 | 48.9% |

| Marcus & Millichap (NYSE:MMI) | $40.88 | $81.13 | 49.6% |

Let's review some notable picks from our screened stocks.

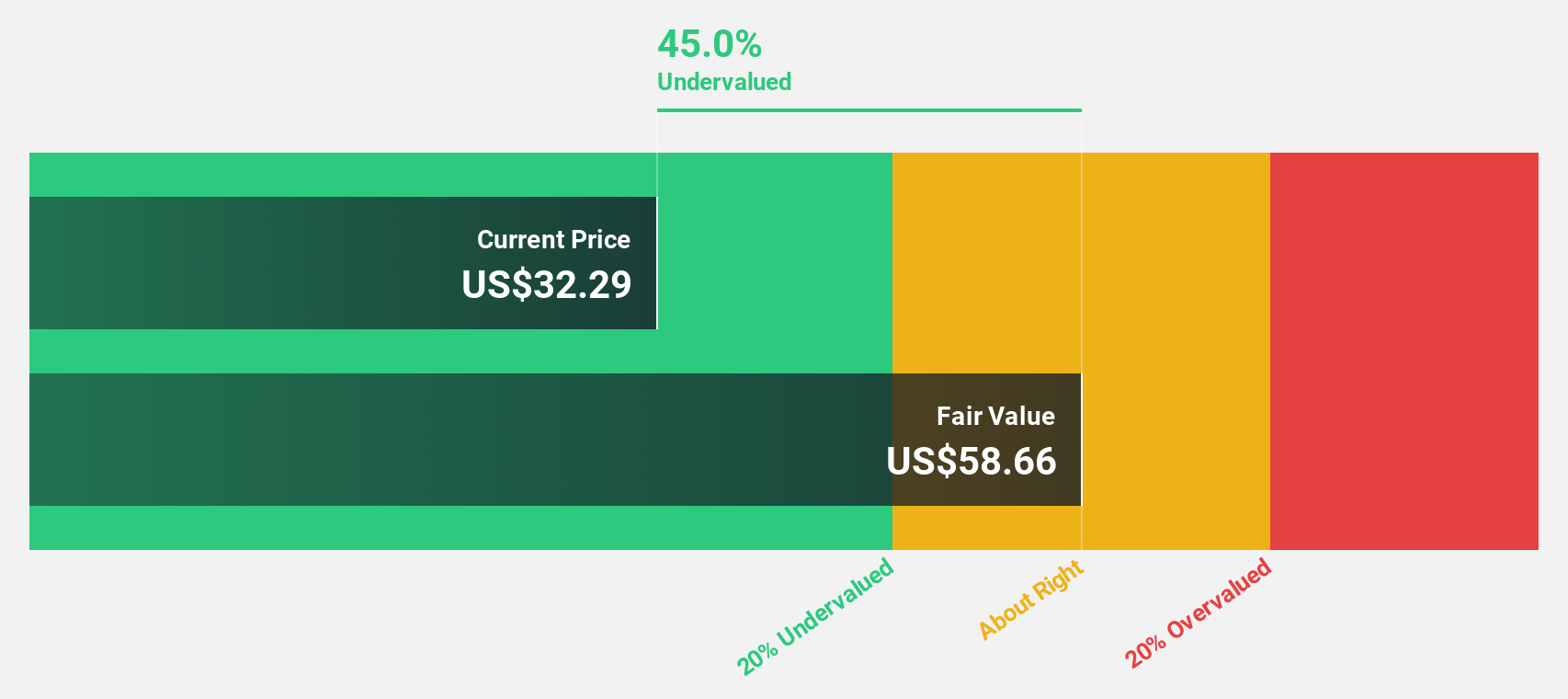

Tenable Holdings (NasdaqGS:TENB)

Overview: Tenable Holdings, Inc. offers cyber exposure solutions across various regions including the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan, with a market cap of approximately $5.13 billion.

Operations: The company's revenue primarily comes from its Security Software & Services segment, generating $877.60 million.

Estimated Discount To Fair Value: 36.1%

Tenable Holdings appears undervalued, trading 36.1% below its estimated fair value of US$68. The company reported third-quarter sales of US$227.09 million, up from US$201.53 million a year ago, with a reduced net loss of US$9.21 million compared to US$15.57 million previously. Despite past shareholder dilution and slower revenue growth forecasts at 9.3% annually, Tenable is expected to become profitable within three years, enhancing its investment appeal based on cash flows.

- Our comprehensive growth report raises the possibility that Tenable Holdings is poised for substantial financial growth.

- Get an in-depth perspective on Tenable Holdings' balance sheet by reading our health report here.

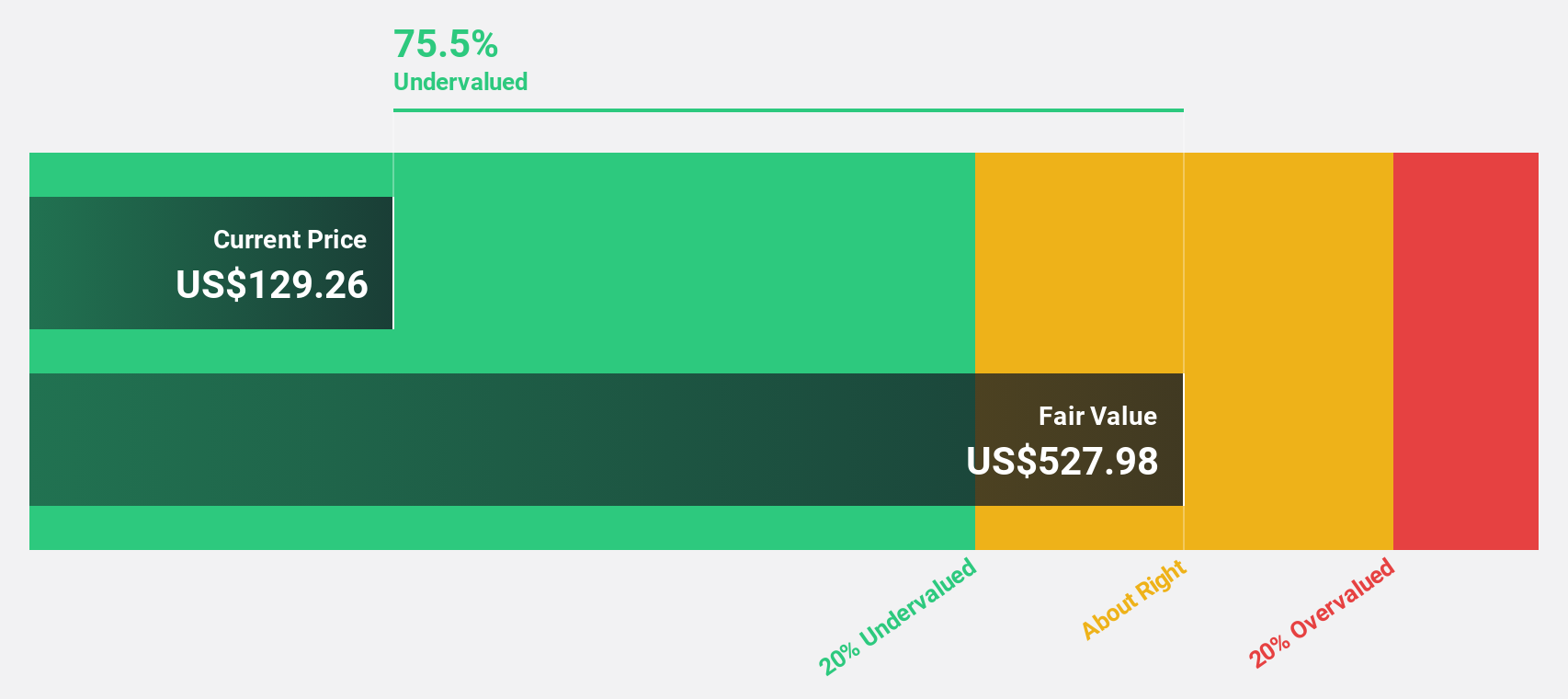

Clorox (NYSE:CLX)

Overview: The Clorox Company manufactures and markets consumer and professional products globally, with a market cap of approximately $20.74 billion.

Operations: The company's revenue segments include Health and Wellness at $2.68 billion, Household at $2.07 billion, Lifestyle at $1.37 billion, and International at $1.15 billion.

Estimated Discount To Fair Value: 35.2%

Clorox is trading at US$169.74, significantly below its estimated fair value of US$261.83, suggesting it may be undervalued based on cash flows. Recent earnings showed a notable increase with net income rising to US$99 million from US$22 million year-over-year. However, despite high forecasted earnings growth of 20.1% annually and a strong return on equity projection, Clorox faces challenges with debt levels and revenue growth lagging the broader market expectations.

- The analysis detailed in our Clorox growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Clorox.

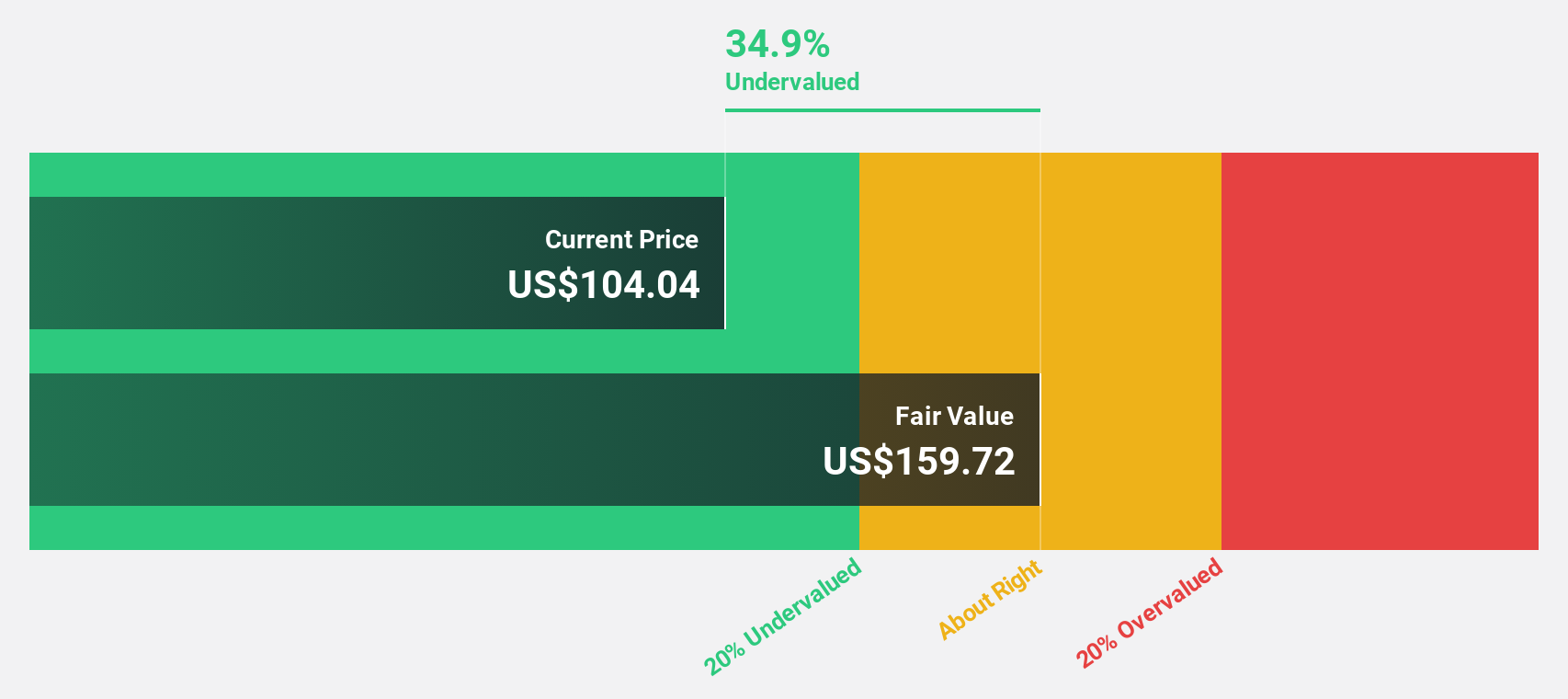

Onto Innovation (NYSE:ONTO)

Overview: Onto Innovation Inc. designs, develops, manufactures, and supports process control tools for optical metrology, with a market cap of approximately $8.40 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, totaling $942.24 million.

Estimated Discount To Fair Value: 12.1%

Onto Innovation, priced at US$164.99, trades below its estimated fair value of US$187.63. Its recent earnings report highlights robust growth with quarterly sales rising to US$252.21 million from US$207.19 million year-over-year and net income increasing to US$53.05 million from US$35.89 million. Despite slower revenue growth compared to some benchmarks, its projected significant annual earnings growth of 30.2% positions it favorably against the broader U.S market expectations.

- According our earnings growth report, there's an indication that Onto Innovation might be ready to expand.

- Unlock comprehensive insights into our analysis of Onto Innovation stock in this financial health report.

Where To Now?

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 191 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ONTO

Onto Innovation

Engages in the design, development, manufacture, and support of process control tools that performs optical metrology.

Flawless balance sheet with reasonable growth potential.