- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian (NasdaqGS:TEAM) Welcomes Karen Dykstra to Board as Enrique Salem Retires

Reviewed by Simply Wall St

Atlassian (NasdaqGS:TEAM) recently experienced executive changes, with Enrique Salem retiring as a director and Karen Dykstra joining the board, which may have influenced its 8% stock price increase last week. This move aligns with the broader market trend where tech stocks, including Atlassian, saw gains; the market itself rose 7%. Dykstra’s addition to the board, given her extensive financial experience, especially in tech, might have added confidence to Atlassian's investors, complementing the overall market sentiment that lifted tech stocks during a volatile period influenced by trade talks and tariff adjustments.

We've identified 1 warning sign for Atlassian that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The executive changes at Atlassian, namely Enrique Salem's retirement and Karen Dykstra's addition to the board, appear aligned with strategic shifts towards enhancing financial leadership and governance. This development seems to have buoyed investor confidence, contributing to Atlassian's 8% stock price increase last week. Over a five-year timeframe, despite recent volatility, Atlassian's total shareholder return, including dividends, has been 31.68%. This longer-term context shows how the company has navigated various market conditions.

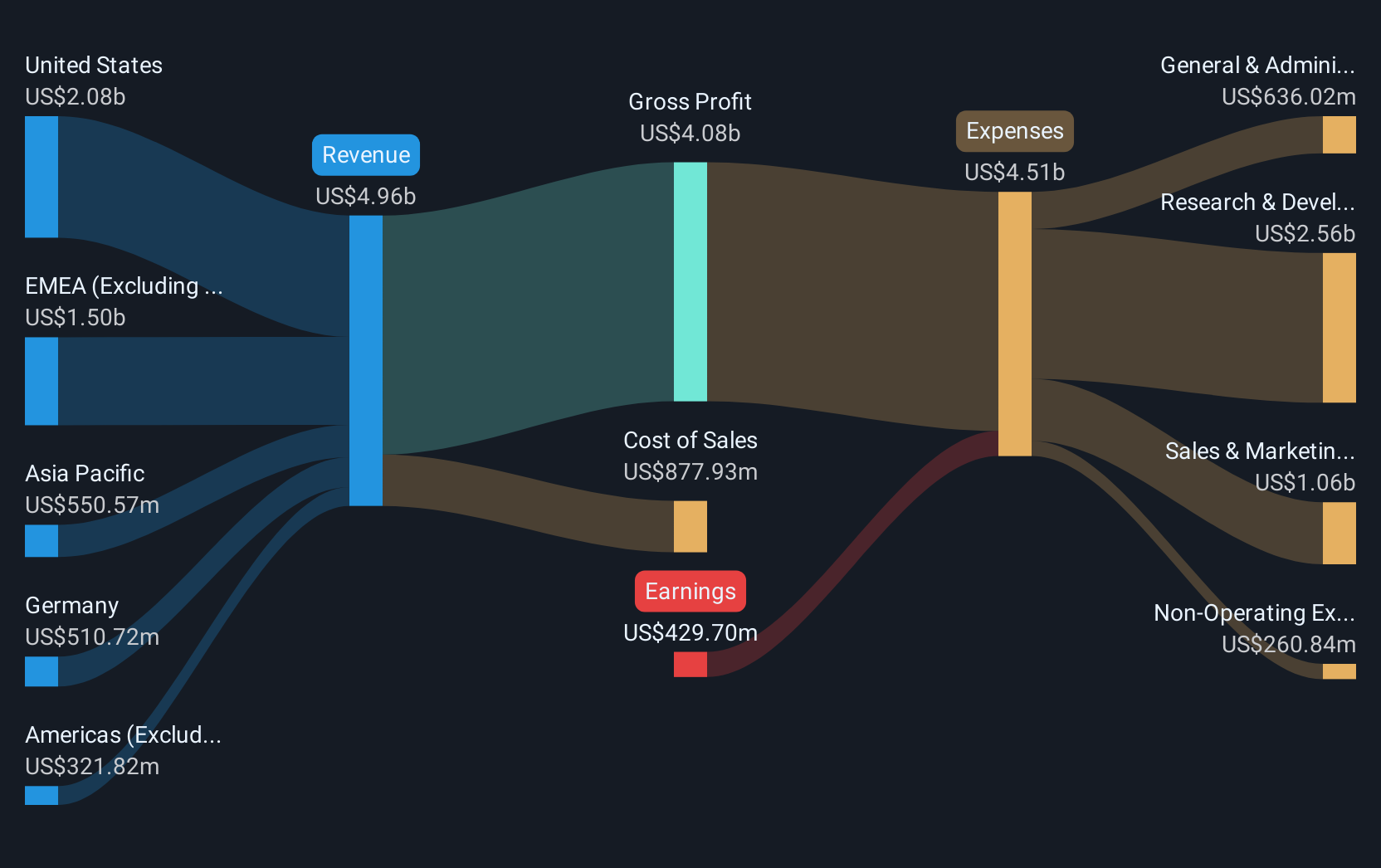

In comparison to broader metrics, Atlassian underperformed the US market, which returned 5.9% over the past year, yet exceeded the US Software industry, which returned 1.5%. Looking ahead, Dykstra's expertise might positively influence revenue and earnings prospects, aligning with Atlassian's focus on AI innovations and enterprise penetration. Currently, the share price is at US$183.84, below the consensus price target of US$328.99, indicating a roughly 44.1% potential upside. With revenue forecast to grow annually by 19% over the next three years and an anticipated swing to profitability, these strategic board movements could reinforce these expected outcomes.

Explore Atlassian's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives