- United States

- /

- Software

- /

- NasdaqGS:TEAM

Atlassian (NasdaqGS:TEAM) Stock Jumps 16% In Last Month

Reviewed by Simply Wall St

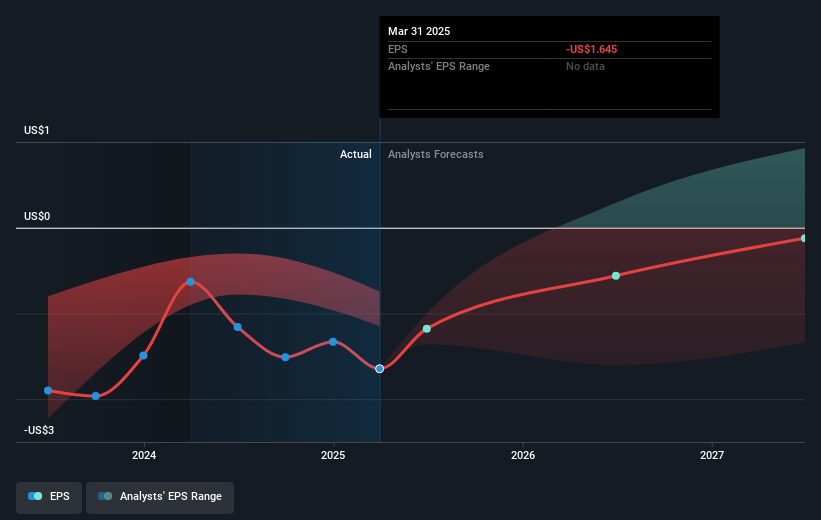

Atlassian (NasdaqGS:TEAM) has recently made headlines with its third-quarter earnings announcement, reporting a significant increase in revenue to $1,357 million, despite a net loss of $71 million. Additionally, the company updated its fourth-quarter revenue guidance, forecasting between $1,349 million and $1,359 million. Alongside this, a board reshuffle took place with Enrique Salem's retirement and the appointment of Karen Dykstra as a director. Over the last month, Atlassian's stock price rose 16%, a move surpassing the broader market's 4% rise, possibly underscoring investor confidence in the company's growth prospects and leadership changes.

Atlassian has 1 warning sign we think you should know about.

Atlassian's recent financial results and leadership changes may influence its forward-looking narrative significantly. The company's revenue guidance suggests a stable outlook despite a net loss, while the reshuffling of the board could introduce new strategic directions. The market's strong response, with a 16% rise in one month, indicates investor support, potentially spurred by Atlassian's integration of AI, expected to bolster long-term growth through enhanced product offerings and cloud adoption.

Looking at historical performance, Atlassian's total shareholder return over the past three years was 31.58%, demonstrating substantial value creation for long-term investors. Within the past year, Atlassian outperformed the broader US Software industry, which returned 17.8%, highlighting its relative strength in the tech sector, especially with the recent progress in AI and cloud advancements.

The integration of AI and improvements in cloud services as highlighted in the company's narrative may contribute to boosting revenue and earnings forecasts. This enhanced product stickiness and increased platform adoption among enterprises could translate into healthier profit margins. While the consensus analyst price target of US$279.95 reflects positive sentiment, the current share price of US$207.89 leaves a considerable gap to be covered. This suggests potential optimism for further share price appreciation, provided the company realizes its projected growth metrics.

Jump into the full analysis health report here for a deeper understanding of Atlassian.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives