Stock Analysis

- United States

- /

- Software

- /

- NYSE:PLTR

3 Growth Companies With High Insider Ownership And At Least 12% Revenue Growth

Reviewed by Sasha Jovanovic

Amid a buoyant U.S. stock market, bolstered by robust first-quarter earnings and the anticipation of interest rate cuts, investors are keenly observing various factors that could influence their investment decisions. In this context, growth companies with high insider ownership and significant revenue growth present an interesting opportunity for those looking to align with the confidence insiders are showing in their own companies.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.9% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

| Krystal Biotech (NasdaqGS:KRYS) | 12.1% | 39.1% |

| Li Auto (NasdaqGS:LI) | 29.3% | 22% |

| FTC Solar (NasdaqGM:FTCI) | 30.6% | 63.1% |

| Cipher Mining (NasdaqGS:CIFR) | 19.6% | 94.6% |

| Finance of America Companies (NYSE:FOA) | 17% | 93.8% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 23.6% | 76.5% |

Let's review some notable picks from our screened stocks.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation operates globally, focusing on the design, development, licensing, and maintenance of software products with a market capitalization of approximately $47.31 billion.

Operations: The company generates its revenue primarily from software and programming, totaling approximately $4.17 billion.

Insider Ownership: 39.4%

Revenue Growth Forecast: 17.5% p.a.

Atlassian, a notable player in the growth companies with high insider ownership segment, reported a significant recovery with Q3 2024 revenues reaching US$1.19 billion, up from US$915.45 million year-over-year, and shifting from a net loss to a net income of US$12.75 million. The company is poised for further expansion as it integrates AI tools through its recent partnership with Tabnine, enhancing its software development capabilities within the Atlassian platform. Despite some insider selling over the past three months, Atlassian's strategic focus on AI and expected revenue growth above the market average underscore its potential in both technology advancement and market performance.

- Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Atlassian is priced lower than what may be justified by its financials.

Palantir Technologies (PLTR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding in counterterrorism efforts across the U.S., the U.K., and other global regions, with a market capitalization of approximately $56.14 billion.

Operations: Palantir's revenue is divided into two main segments: Commercial, generating $1.00 billion, and Government, contributing $1.22 billion.

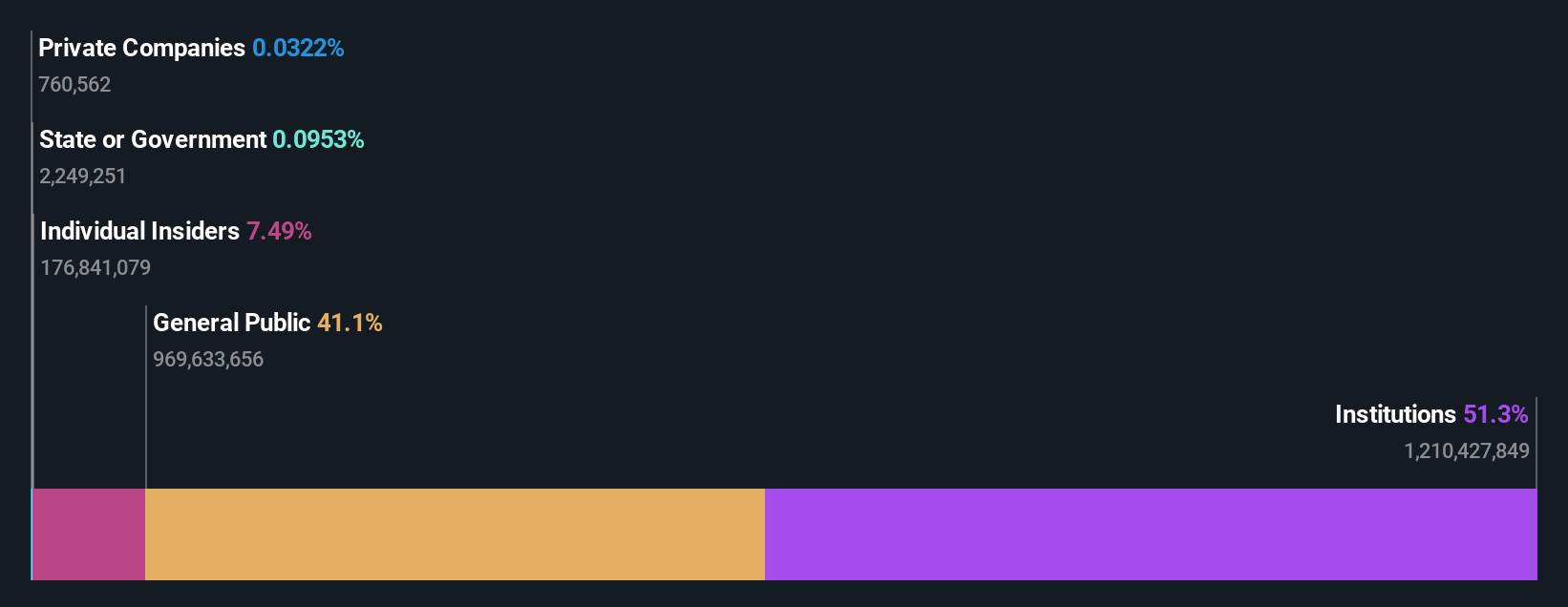

Insider Ownership: 14.0%

Revenue Growth Forecast: 15.9% p.a.

Palantir Technologies, a growth company with high insider ownership, recently demonstrated robust financial performance with first-quarter sales rising to US$634.34 million from US$525.19 million year-over-year and net income significantly increasing to US$105.53 million. The company's earnings are expected to grow by 26.76% annually, outpacing the U.S market average. Despite this strong growth trajectory and strategic partnerships enhancing its AI capabilities, shareholder dilution over the past year and a forecast of low return on equity (17.6%) in three years pose challenges for investor returns.

- Unlock comprehensive insights into our analysis of Palantir Technologies stock in this growth report.

- Our expertly prepared valuation report Palantir Technologies implies its share price may be too high.

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates globally, offering audio streaming subscription services, with a market capitalization of approximately $59.61 billion.

Operations: The company generates €12.10 billion from premium subscriptions and €1.74 billion from ad-supported streams.

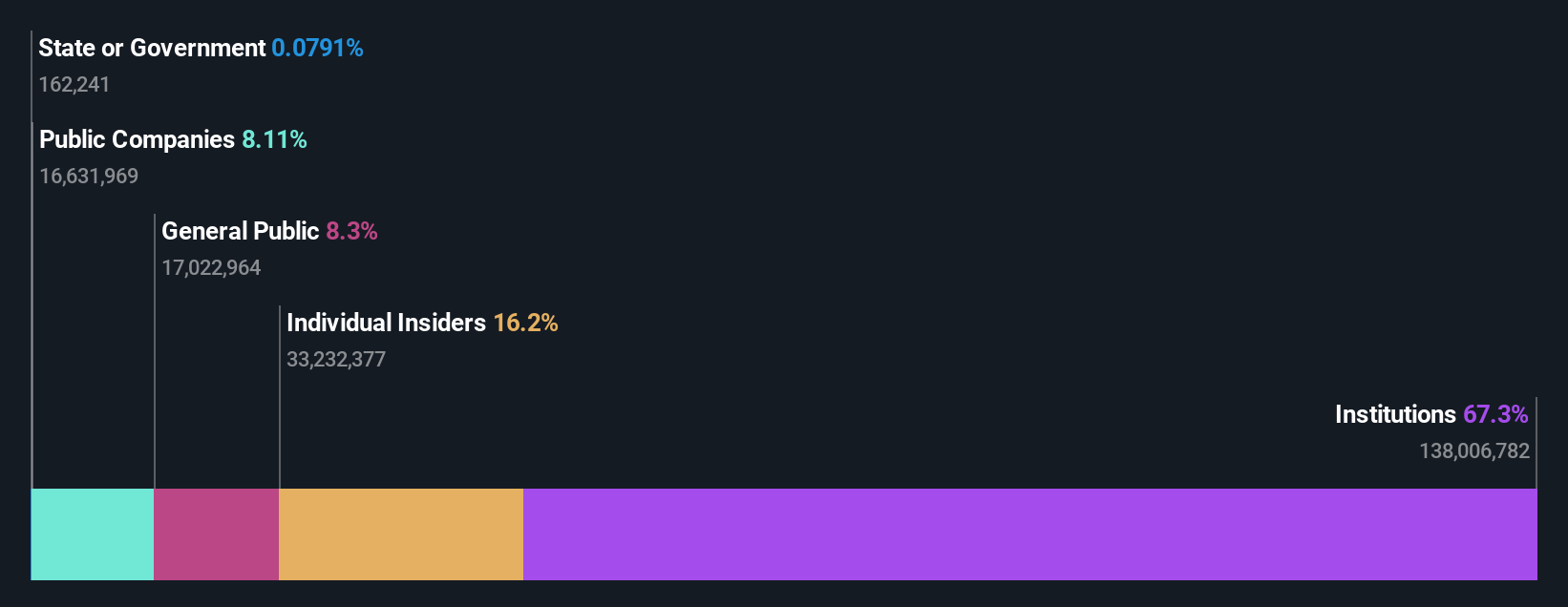

Insider Ownership: 17.9%

Revenue Growth Forecast: 12.2% p.a.

Spotify Technology, a growth company with substantial insider ownership, is trading 20.4% below its estimated fair value, indicating potential undervaluation. Expected to turn profitable within three years, Spotify's annual profit growth is set to outpace the market. Despite shareholder dilution in the past year, its forecasted return on equity of 26.9% is notably high. Recent earnings show significant improvement with net income of EUR 197 million compared to a loss last year, underscoring operational recovery and growth momentum.

- Navigate through the intricacies of Spotify Technology with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Spotify Technology's current price could be inflated.

Key Takeaways

- Dive into all 201 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Palantir Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.