- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN): Valuation Check After Expanding Parkopedia Partnership in Automotive Voice Commerce

Reviewed by Simply Wall St

SoundHound AI (SOUN) just took a meaningful step deeper into automotive AI, expanding its partnership with Parkopedia to power a voice driven parking agent that handles discovery, comparison and payment from inside the car.

See our latest analysis for SoundHound AI.

That momentum in automotive AI comes after a volatile year, with a strong multi year total shareholder return of 1039.29% and a steep year to date share price return of negative 36.71%, suggesting long term optimism clashing with near term valuation worries.

If this kind of voice first growth story has your attention, it could be a good moment to explore other high growth tech names and AI leaders via high growth tech and AI stocks.

With Q3 revenue still growing at a rapid clip and the stock now trading roughly one third below the average analyst target, is SoundHound quietly resetting for its next leg higher, or is future growth already fully priced in?

Most Popular Narrative: 24.7% Undervalued

With the most popular narrative setting fair value at $16.94 versus a last close of $12.76, the implied upside leans heavily on aggressive growth and margin expansion.

Robust technological differentiation from the in house Polaris AI platform (beating legacy competitors and big tech peers in accuracy and latency), plus seamless migration of acquisitions to SoundHound's proprietary stack, yield operational cost synergies and improved gross margins, positioning the company to achieve near term profitability.

Want to see how fast growing revenue, rising margins and a premium future earnings multiple all combine into that upside case, and what assumptions really power it? Read on to unpack the full logic behind this fair value call.

Result: Fair Value of $16.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and lumpy enterprise deals could derail the path to profitability, especially if revenue growth slows or large contracts are delayed.

Find out about the key risks to this SoundHound AI narrative.

Another Lens on Valuation

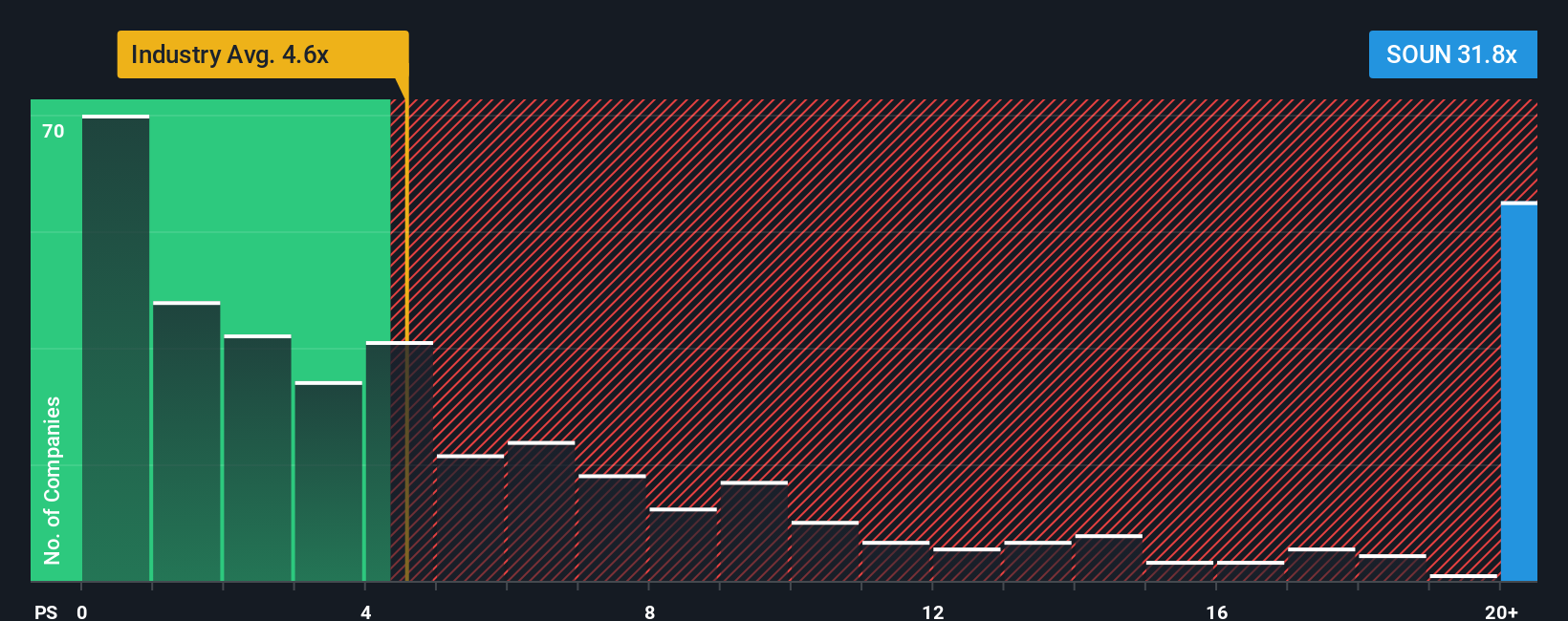

Looking at price to sales, the story flips. SoundHound trades at about 36.1 times sales versus 20.6 times for peers and just 4.9 times for the wider US software sector. Our fair ratio sits near 6.1 times, which raises the risk that sentiment, not fundamentals, is doing the heavy lifting here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoundHound AI Narrative

If this perspective does not fully align with your own, or you prefer hands on research, you can spin up a custom view in minutes: Do it your way.

A great starting point for your SoundHound AI research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused, data driven stock ideas tailored to your strategy.

- Secure your cash flow goals by zeroing in on dependable payouts through these 15 dividend stocks with yields > 3% that can support long term, income focused portfolios.

- Ride structural growth in intelligent software by targeting innovators at the frontier of automation and language models with these 27 AI penny stocks.

- Capitalize on potential mispricings the market has overlooked by sorting companies trading below intrinsic value via these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026