- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN) Soars 48% Last Quarter

Reviewed by Simply Wall St

SoundHound AI (SOUN) recently caught attention with a 48% price increase over the last quarter, which coincided with a notable partnership with Primary Health Solutions to launch an AI-powered patient platform and the introduction of SoundHound Chat AI Automotive in Jeep vehicles. These initiatives reflect the company's effort in enhancing both healthcare and automotive experiences, potentially supporting its market position amid broader industry trends toward AI integration. During this period, the market saw a general uplift, influenced by rate cut expectations, which likely provided additional momentum to SOUN's performance alongside broader tech gains.

The recently announced partnership with Primary Health Solutions and the integration of SoundHound Chat AI Automotive in Jeep vehicles could bolster SoundHound AI's revenue streams as it continues to diversify its market presence across healthcare and automotive sectors. These developments align with the narrative's focus on expanding adoption and partnerships, which are crucial for increasing recurring revenue opportunities and positioning the company favorably amid industry trends. However, the sustained losses and unpredictable revenue growth remain significant challenges, as highlighted in the narrative.

Over the past three years, SoundHound AI's total return, including share price appreciation and dividends, was 323.19%, reflecting substantial growth. Comparatively, over the past year, SoundHound AI outperformed the US Software industry, which returned 26.4%. This indicates a stronger performance relative to industry peers. The recent share price movement, driven by market uplift and company-specific factors, has brought the stock closer to the analyst consensus price target of US$15.31, representing an 8.99% discount from its current price of US$14.05.

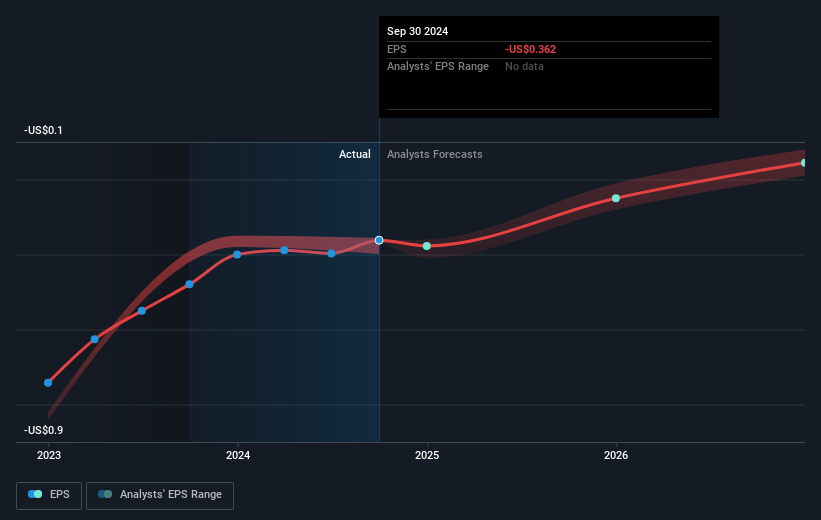

The potential impact on earnings forecasts from the new partnerships is tied to the company's ability to leverage these initiatives to drive revenue growth. Analysts currently expect revenue to grow by approximately 32.9% annually over the next three years, but do not forecast profitability within this period. The price movement, placing the stock just below the price target, reflects market optimism mixed with cautious acknowledgment of ongoing financial challenges.

Evaluate SoundHound AI's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives