- United States

- /

- Software

- /

- NasdaqGS:SNPS

Synopsys (NasdaqGS:SNPS) Surges 41% Over Last Quarter

Reviewed by Simply Wall St

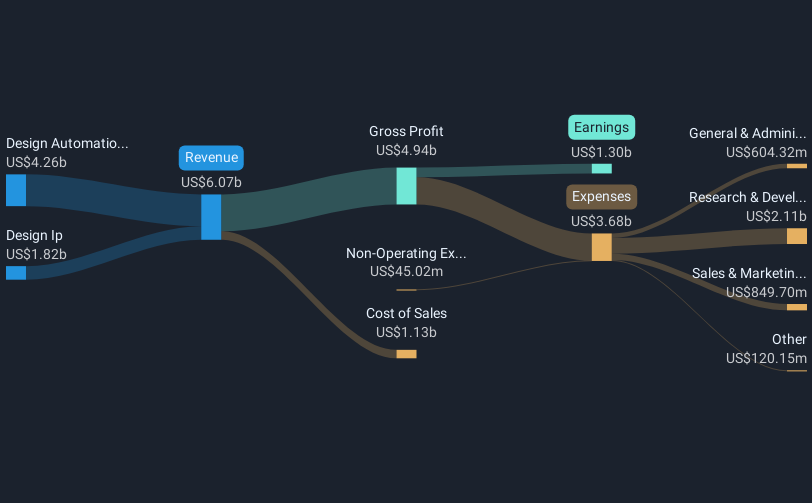

Synopsys (NasdaqGS:SNPS) recently saw a significant share price increase of 41% over the last quarter, likely influenced by several key developments. The company's addition to multiple Russell indices, such as the Russell 1000 and 3000 Value Benchmarks, may have bolstered investor confidence, reflecting its strengthened market position. Additionally, strategic collaborations with Broadcom and Keysight Technologies showcased its commitment to enhancing AI infrastructures and RF design migration, potentially boosting market sentiment. While the broader market rose 2% recently, Synopsys's performance surpassed broader trends, underscoring these events' potential impact on its stock's robust upward movement.

Buy, Hold or Sell Synopsys? View our complete analysis and fair value estimate and you decide.

The recent developments surrounding Synopsys, including its notable share price increase of 41% over the last quarter, underscore its strengthened market position and investor confidence. The inclusion in the Russell indices and strategic collaborations with Broadcom and Keysight Technologies are pivotal in projecting a positive market sentiment, fortifying narrative expectations that Synopsys will further its Electronic Design Automation (EDA) industry leadership with advancements in AI and potential acquisition of Ansys. These moves can potentially bolster revenue growth and cement Synopsys’s role in providing innovative design solutions.

For context, Synopsys has delivered a substantial total return of 168.27% over the past five years, highlighting its capacity for sustained long-term growth. Compared to the broader market and the US Software industry, the company's one-year performance, reflecting declines in both earnings and stock price relative to market averages, shows room for improvement. However, the anticipated revenue growth of 11.3% per year, which outpaces the US market's 8.7%, suggests potential recovery and alignment with analyst predictions.

With earnings forecasts aiming for US$2.3 billion by 2028, up from US$1.35 billion today, these strategic initiatives may have a significant impact on Synopsys's financial trajectory. The current analyst price target of US$595.21, compared to the present share price of US$473.55, implies a 20.4% potential upside. Investors may find value in considering whether the projected PE ratio of 50.0 times by 2028 aligns with their expectations and market conditions. It is essential to weigh these forecasts against potential risks and market challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives