- United States

- /

- IT

- /

- NasdaqGS:SHOP

Can Shopify’s Recent AI Tools Launch Justify Its Soaring 86% Stock Gain?

Reviewed by Bailey Pemberton

If you’ve been watching Shopify’s wild ride lately, you’re not alone. With a stock price that recently closed at $152.88, investors are trying to figure out what move comes next. In just the past week, Shopify dipped by -5.2%. Zoom out to the past month and it’s up 6.6%. Step back further and things get even more interesting, with a 42.2% return year to date and an 86.6% gain over the last twelve months. Over three years, Shopify has soared 432.1%, though the five-year return is a more modest 44.7%.

Much of this momentum comes as the broader market reassesses risk and opportunity for growth businesses. Investors are weighing how shifts in e-commerce trends and digital adoption could affect Shopify’s future. Still, even with all the excitement, there is ongoing debate about whether the market has gotten ahead of itself.

When we dig in and run Shopify through six standard valuation checks, things get interesting. Shopify is actually scoring 0 out of 6 on value, meaning it does not come up as undervalued by any traditional metric. If that raises your eyebrows, you’re not alone; this is one of the areas where Shopify’s story sets itself apart from other growth names.

Let’s take a closer look at those valuation methods and see what they really reveal. There’s also an even more insightful way to think about Shopify’s value coming up at the end of the article.

Shopify scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Shopify Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting future cash flows and discounting them to their present value. Essentially, it is a way to try to figure out what Shopify should be worth today, based on how much cash the business will generate in years to come.

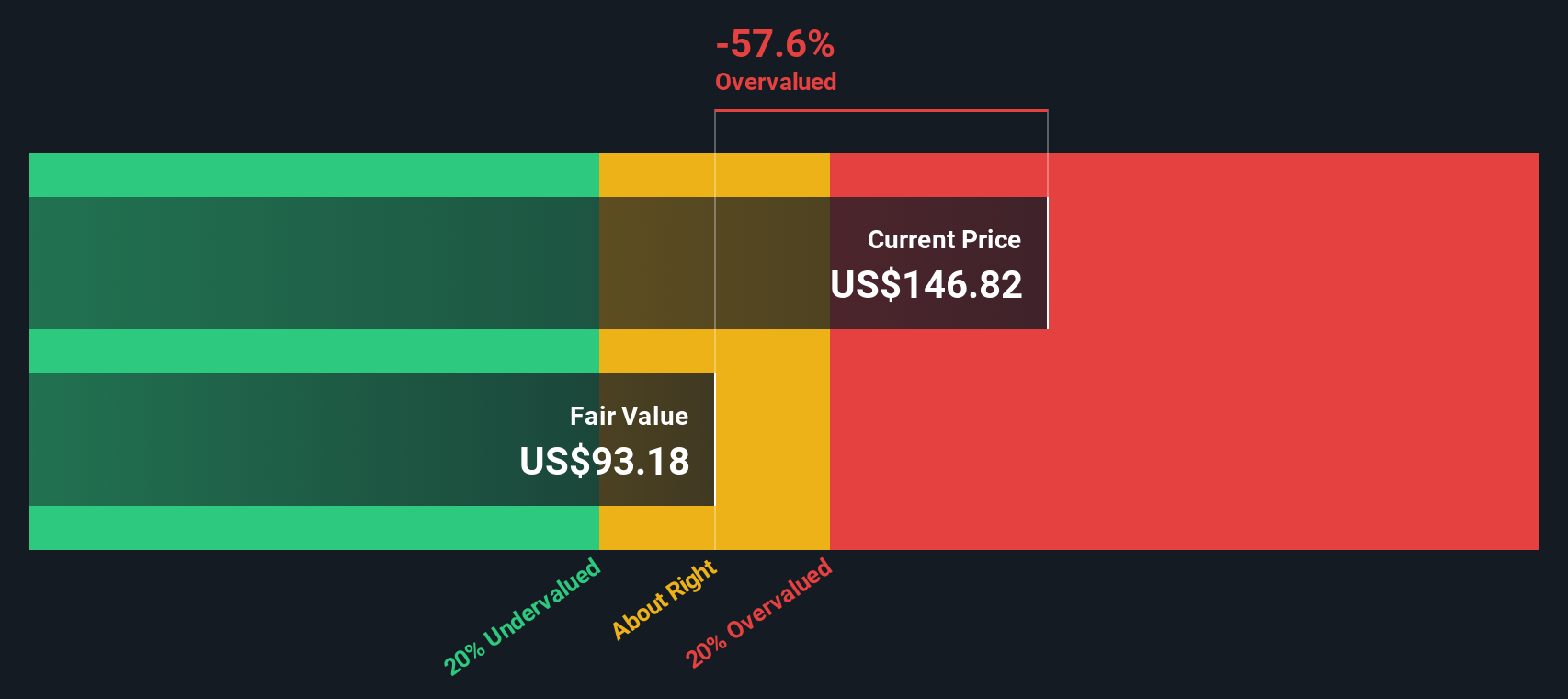

Currently, Shopify’s Free Cash Flow (FCF) sits at $1.8 Billion. Analysts forecast significant growth ahead, projecting $5.3 Billion in FCF for the year 2029. Estimates from analysts cover the next five years. After this period, projections are extended by Simply Wall St based on recent trends and assumptions.

Over the next decade, this path of growing cash flows leads to a DCF-derived fair value of $94.13 per share. At today’s price of $152.88, this suggests Shopify is trading at a steep premium, with the stock appearing 62.4% overvalued according to the DCF model. In other words, investors are paying well above what underlying cash flow projections would justify right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shopify may be overvalued by 62.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Shopify Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it shows how much investors are paying for each dollar of current earnings. It works well as a quick gauge of market expectations, as it reflects both the company’s earnings power and its future prospects.

Growth plays a key role in what constitutes a “normal” or “fair” PE ratio. Rapidly growing companies usually trade at higher multiples, as investors expect earnings to climb quickly. However, if risks are elevated or growth is slowing, a lower PE is often justified.

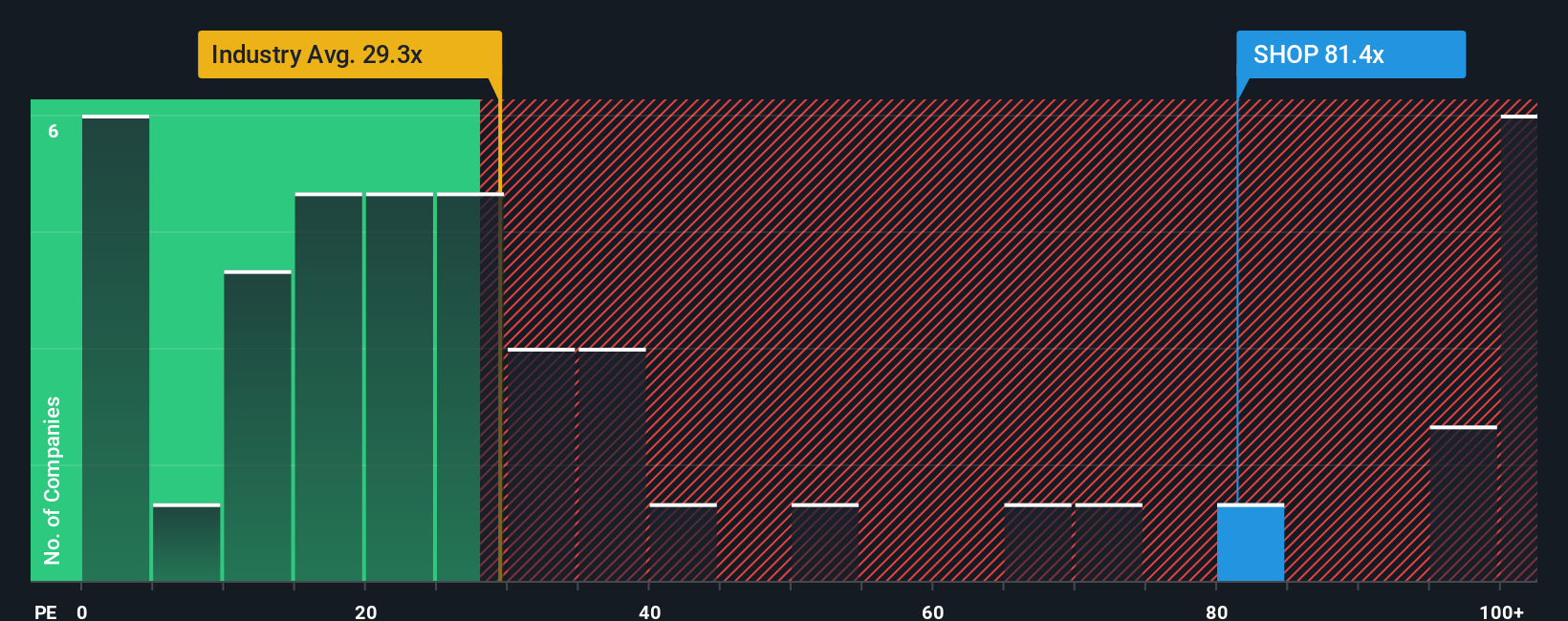

Shopify is currently trading at a lofty PE ratio of 84.7x. This is significantly higher than the industry average of 32.2x and above the average of its peer group, which sits at 43.0x. On the surface, these comparisons might suggest Shopify is overvalued, but this is not the whole story.

Simply Wall St’s proprietary “Fair Ratio” blends in key factors such as Shopify’s earnings growth forecast, profit margins, market cap, risks, and its place within the tech industry. This makes it a more complete benchmark than just comparing Shopify to peers or the broader industry. For Shopify, the Fair Ratio is calculated at 43.2x.

Comparing the Fair Ratio to Shopify’s current PE, the 84.7x multiple is almost double what would be justified by fundamentals and outlook. This signals that the stock is overvalued by the preferred multiple approach, even when accounting for the company’s strengths and growth potential.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shopify Narrative

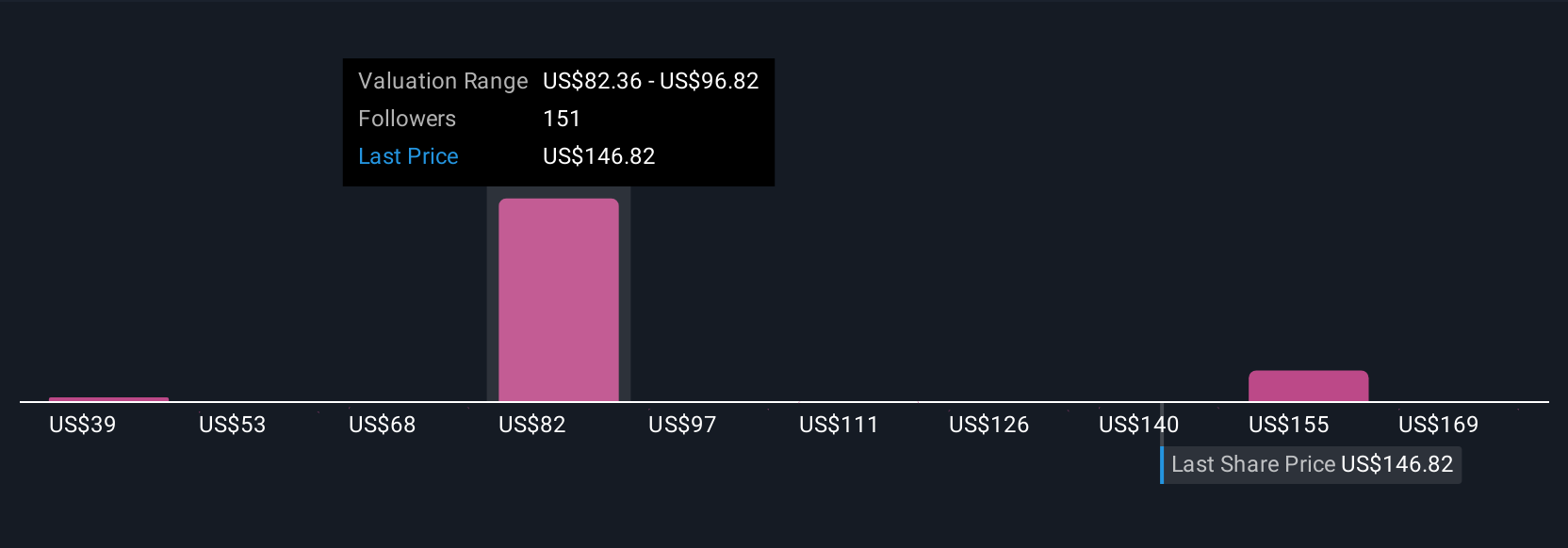

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story behind the numbers; it is how you connect what is happening in Shopify’s business (from international expansion to new product launches or competitive risks) directly to your own assumptions about future earnings, profit margins, and ultimately, what you believe the fair value should be.

Narratives bridge the company’s evolving story with a personalized financial forecast and a straightforward fair value calculation, helping you make sense of whether today’s price is justified. On Simply Wall St’s Community page, used by millions of investors, you can easily explore or create Narratives for Shopify, making sophisticated investment analysis both accessible and dynamic.

Narratives empower you to decide when to buy or sell by instantly comparing your calculated Fair Value against the live market Price, and they automatically update as fresh news or earnings come in. For example, one investor’s Narrative might set Shopify’s fair value as high as $200, reflecting confidence in global expansion and AI trends, while another might see fair value at just $114, focusing on competitive threats or profit margin pressures. With Narratives, your investment decisions become smarter, more proactive, and always connected to the real, changing story of Shopify.

Do you think there's more to the story for Shopify? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives