- United States

- /

- IT

- /

- NasdaqGS:SHOP

Assessing Shopify (SHOP) Valuation as Revenue, GMV Growth and AI Investments Draw Fresh Investor Attention

Reviewed by Simply Wall St

Shopify (NasdaqGS:SHOP) has been back in focus as recent investor letters spotlight its 31% year over year revenue and gross merchandise value growth, supported by new enterprise wins and ongoing investments in AI driven commerce tools.

See our latest analysis for Shopify.

Those growth signals have not gone unnoticed, with Shopify’s share price now at $159.89 and a strong year to date share price return of 48.69% pointing to building momentum. Its three year total shareholder return of 318.12% underlines how long term believers have already been rewarded.

If Shopify’s AI driven commerce story has you thinking bigger about the space, this could be a good moment to explore other high growth tech and AI names through high growth tech and AI stocks.

With revenue still compounding at a rapid clip and the share price already up sharply, the core question now is whether Shopify’s fundamentals justify even richer valuations, whether there is still a buying opportunity, or whether the market has fully priced in future growth.

Most Popular Narrative: 8.9% Undervalued

With Shopify last closing at $159.89 and the most followed narrative pointing to a fair value near $175, expectations are running ahead of current pricing.

The company is aggressively integrating AI driven capabilities (for example, Sidekick, an AI store builder, and conversational commerce integrations with large language models). These tools enable merchants to launch, manage, and scale stores with less friction and greater efficiency, which may support faster merchant acquisition, improved retention, and higher margins through automation and new high value features.

Want to see why this story supports a richer price tag? The narrative quietly leans on potential growth, shifting margins, and a notable future earnings multiple. Curious which assumptions really move the fair value dial?

Result: Fair Value of $175.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could crack if intensifying competition or a sharper than expected macro slowdown dents merchant growth and pressures Shopify’s premium multiple.

Find out about the key risks to this Shopify narrative.

Another Lens on Valuation

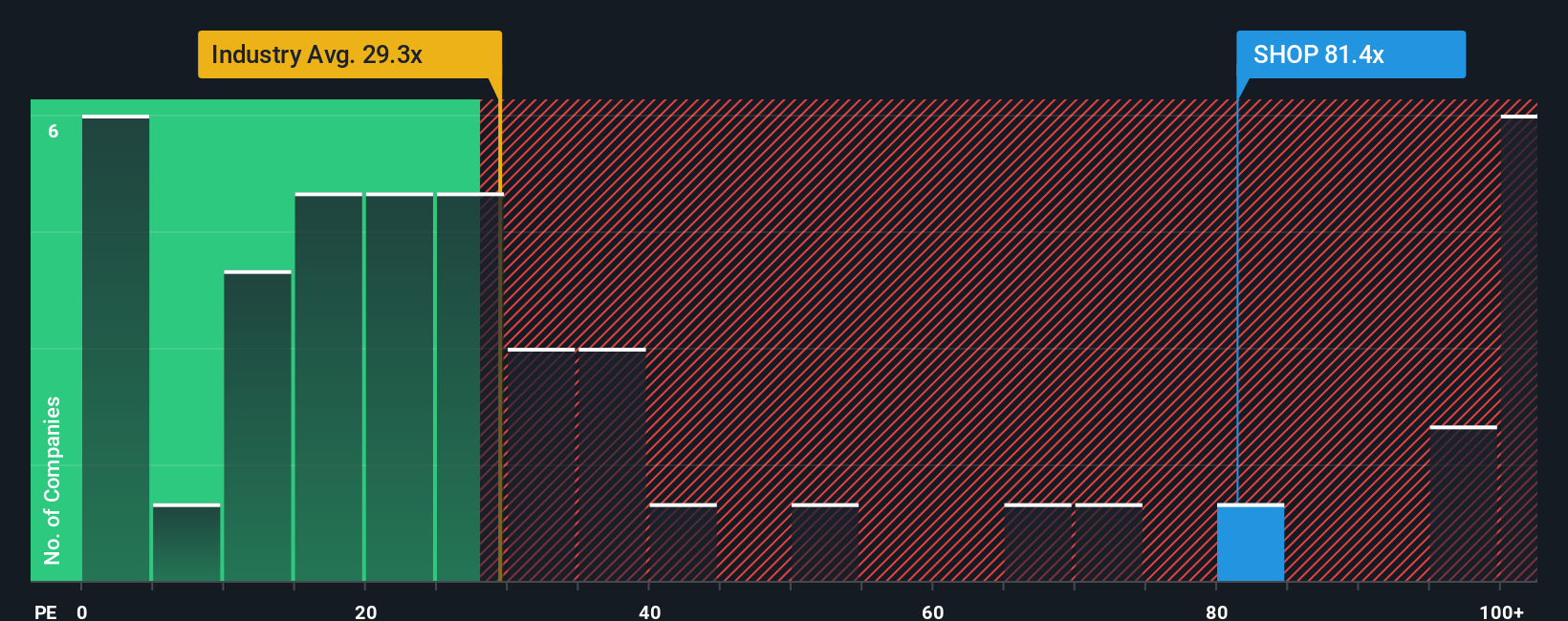

Step away from narratives and the numbers look very different. Shopify trades on a 116.9x P E ratio versus about 38.1x for peers and a fair ratio of 49.2x. This implies the market could cut the multiple materially if growth ever stumbles. Is that risk worth paying up for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shopify Narrative

If you would rather dig into the numbers yourself and stress test different assumptions, you can build a complete Shopify narrative in minutes: Do it your way.

A great starting point for your Shopify research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to help identify opportunities most investors may be overlooking.

- Target income and potential stability by scanning these 15 dividend stocks with yields > 3% that can add cash returns to your portfolio.

- Explore structural trends by focusing on these 30 healthcare AI stocks at the intersection of innovation and essential services.

- Look for potential mispricings by zeroing in on these 903 undervalued stocks based on cash flows that the market may be underestimating today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)