- United States

- /

- Software

- /

- NasdaqGM:RZLV

Rezolve AI (RZLV): Five-Year Losses Deepen, Profitability Hopes Rest on 95% Projected Revenue Growth

Reviewed by Simply Wall St

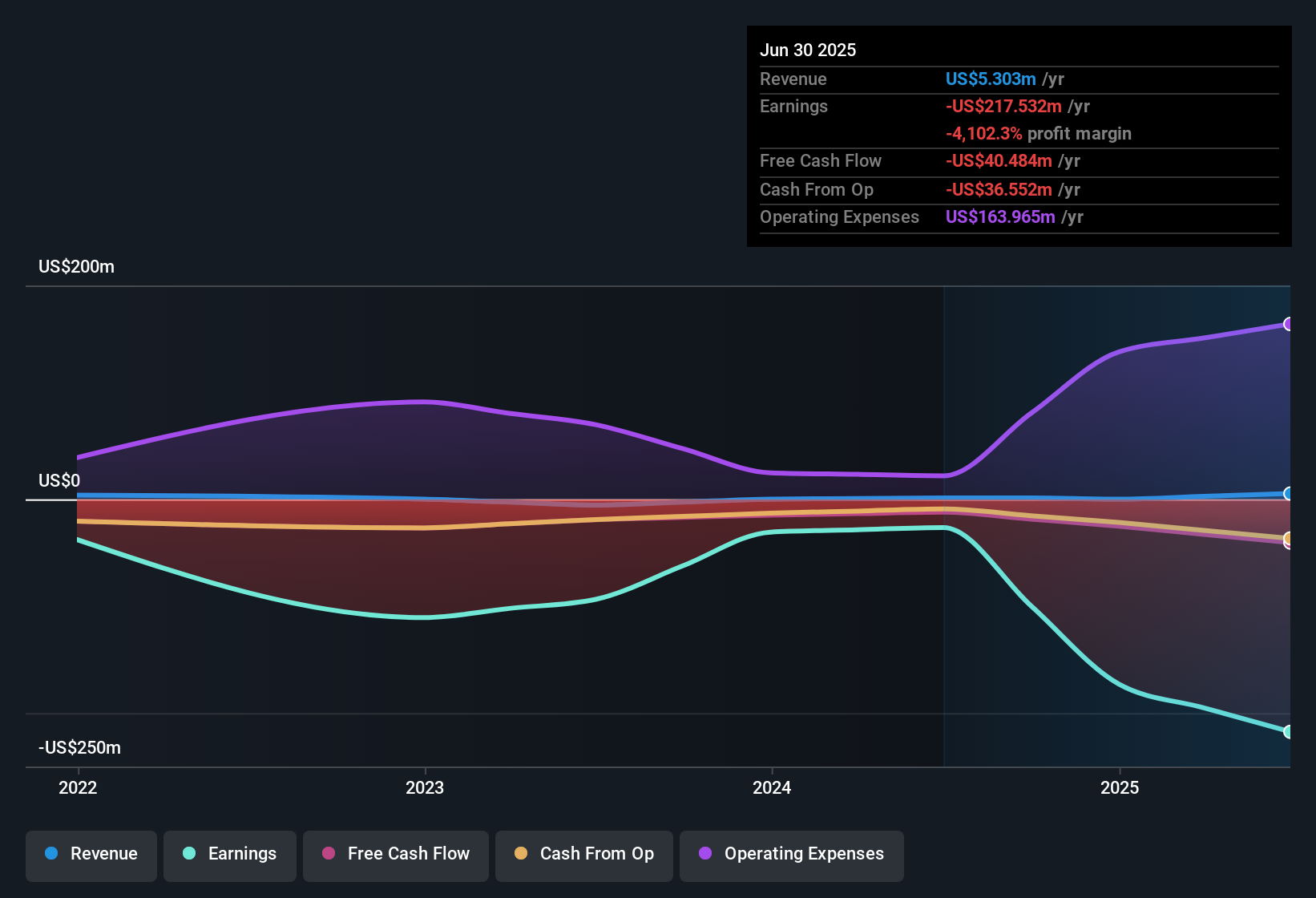

Rezolve AI (RZLV) remains unprofitable, with losses accelerating at an average annual rate of 38.9% over the past five years. Its net profit margin has not shown improvement. Despite negative equity and a sharp price-to-book ratio of -127.6x, the company stands out for its ambitious growth forecasts. Revenues are expected to rise 95% annually and earnings are anticipated to jump 117.9% per year, potentially achieving profitability within three years. With shares trading at $6.28, below at least one fair value estimate, investors face a tug-of-war between high growth prospects and persistent financial challenges.

See our full analysis for Rezolve AI.Up next, we'll see how these headline results measure up against the prevailing narratives that drive sentiment on Rezolve AI. Sometimes the data confirms the story, sometimes it flips the script.

Curious how numbers become stories that shape markets? Explore Community Narratives

Negative Equity Deepens Balance Sheet Worries

- Rezolve AI holds negative equity, paired with a steep price-to-book ratio of -127.6x. This signals that the company’s assets are less than its liabilities by a wide margin.

- The recent share dilution amplifies market risk, especially as the company’s net profit margin remains unchanged in negative territory.

- Persistent net losses, up 38.9% annually over five years, challenge hopes that rapid top-line growth alone will stabilize the balance sheet.

- Despite high expectations for future growth, this kind of capital structure means investors should expect continued volatility and refinancing pressure.

Share Price Lags DCF Fair Value

- With shares trading at $6.28, the stock currently sits well below its DCF fair value model estimate of $10.85. This highlights a sizeable theoretical upside.

- Prevailing market analysis highlights that the stock trades at a discount, but sector peers are still growing profits while RZLV remains unprofitable.

- Analysts and commentators stress that, while models suggest upside, negative equity and ongoing losses mean this valuation gap does not guarantee an easy rebound.

- The disconnect between future earnings projections and weak current fundamentals shapes the ongoing debate among investors.

Growth Targets Set a High Bar

- The company’s forecast revenue growth of 95% per year and an expected earnings jump of 117.9% annually are well above US market norms.

- This ambitious outlook draws attention to whether management can transform rapid growth projections into actual profitability and margin improvement.

- Commentators point out that sector excitement is driven more by scale-up potential than by recent operating performance.

- Any slip in delivering these targets may weigh heavily on both valuation sentiment and the company’s ability to attract new capital.

Have a read of the narrative in full and understand what's behind the forecasts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rezolve AI's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Rezolve AI’s persistent losses, negative equity, and balance sheet strains raise red flags for investors seeking financial stability and fewer refinancing risks.

If you want stocks built on firmer financial footing, use our solid balance sheet and fundamentals stocks screener to find companies designed to withstand turbulence and deliver greater confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RZLV

Rezolve AI

Provides generative AI solutions for the retail and e-commerce sectors.

High growth potential with low risk.

Market Insights

Community Narratives