- United States

- /

- Software

- /

- NasdaqGM:RPD

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For Rapid7, Inc.'s (NASDAQ:RPD) CEO For Now

CEO Corey Thomas has done a decent job of delivering relatively good performance at Rapid7, Inc. (NASDAQ:RPD) recently. As shareholders go into the upcoming AGM on 10 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Rapid7

Comparing Rapid7, Inc.'s CEO Compensation With the industry

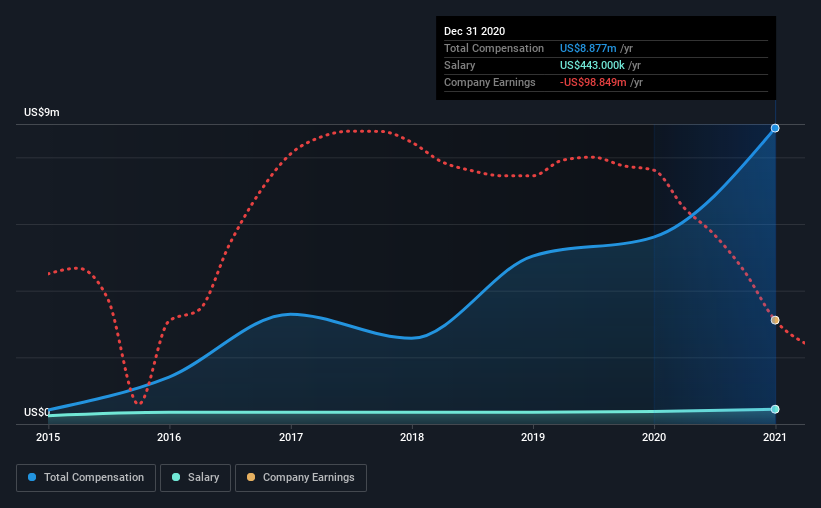

Our data indicates that Rapid7, Inc. has a market capitalization of US$4.6b, and total annual CEO compensation was reported as US$8.9m for the year to December 2020. We note that's an increase of 58% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$443k.

For comparison, other companies in the same industry with market capitalizations ranging between US$2.0b and US$6.4b had a median total CEO compensation of US$5.6m. Hence, we can conclude that Corey Thomas is remunerated higher than the industry median. What's more, Corey Thomas holds US$27m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$443k | US$375k | 5% |

| Other | US$8.4m | US$5.2m | 95% |

| Total Compensation | US$8.9m | US$5.6m | 100% |

Speaking on an industry level, nearly 11% of total compensation represents salary, while the remainder of 89% is other remuneration. Investors may find it interesting that Rapid7 paid a marginal salary to Corey Thomas, over the past year, focusing on non-salary compensation instead. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Rapid7, Inc.'s Growth

Over the last three years, Rapid7, Inc. has shrunk its earnings per share by 20% per year. Its revenue is up 25% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Rapid7, Inc. Been A Good Investment?

Boasting a total shareholder return of 161% over three years, Rapid7, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Rapid7 prefers rewarding its CEO through non-salary benefits. Although the company has performed relatively well, we still think there are some areas that could be improved. Until EPS growth picks back up, we think shareholders may find it hard to justify increasing CEO pay given that they are already paid above industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Rapid7 (1 is significant!) that you should be aware of before investing here.

Switching gears from Rapid7, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Rapid7, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives