- United States

- /

- Software

- /

- NasdaqGM:RPD

Rapid7 (RPD): Valuation Check After Q2 Revenue Beat and Cautious Guidance

Reviewed by Simply Wall St

Most Popular Narrative: 20.4% Undervalued

The prevailing narrative sees Rapid7 as undervalued, suggesting significant upside potential if key catalysts play out as forecasted.

“Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments. This points to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity. Growing enterprise demand for AI-integrated, automated security operations is playing to Rapid7's strengths, with Agentic AI and proprietary SOC expertise embedded in offerings like Incident Command. These factors support product leadership and the potential for future topline and margin expansion as efficiency and differentiation improve.”

Want to know what fuels this double-digit undervaluation call? Behind the headline, the narrative relies on bold multi-year growth projections and margin leaps many investors aren’t expecting. Will Rapid7 outpace its competitors and deliver on these high-stakes targets? The full breakdown uncovers the assumptions that could reshape the company’s price for years to come.

Result: Fair Value of $24.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower sales cycles and growing competition could limit revenue acceleration. This may challenge expectations for margin gains and future outperformance.

Find out about the key risks to this Rapid7 narrative.Another View: Market Comparisons Tell a Different Story

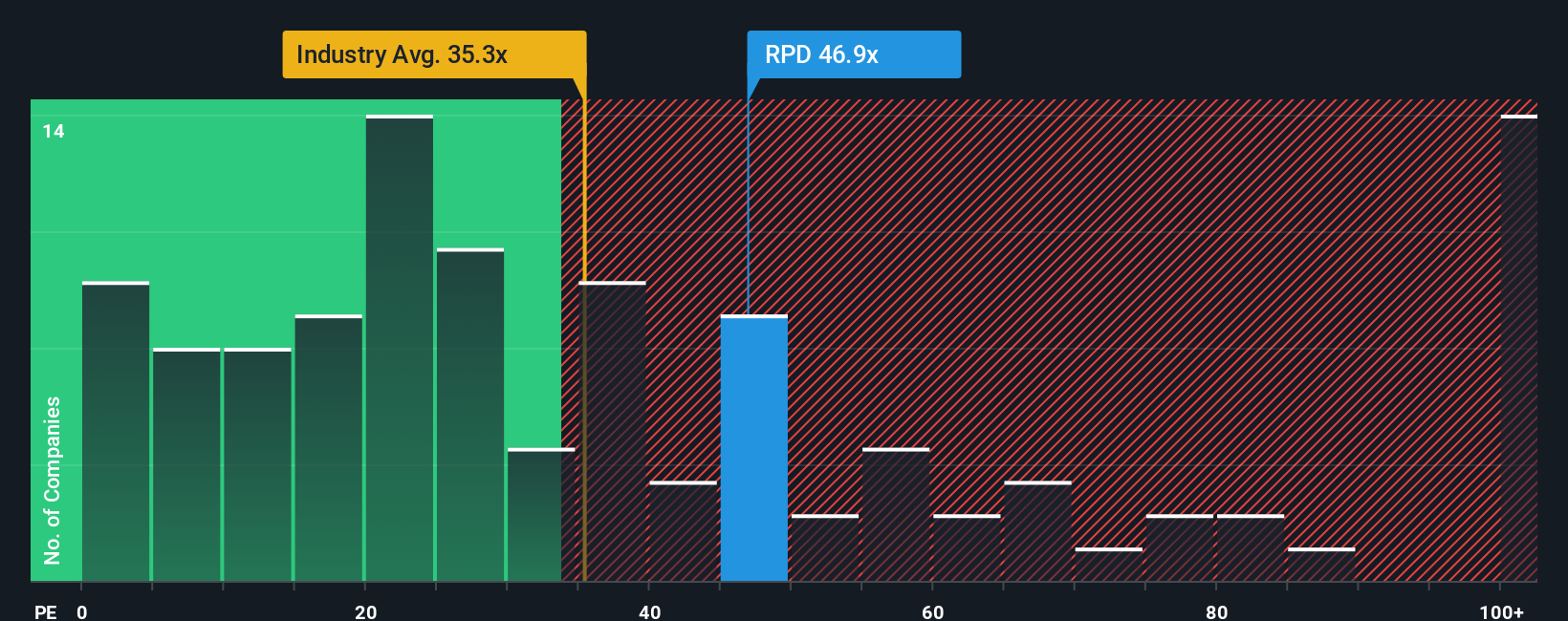

While the narrative and future earnings forecasts suggest Rapid7 is undervalued, a look at current market pricing tells a different story. Compared to industry norms, Rapid7 is trading at a much higher valuation. Can the stock’s strategic ambitions really justify paying a premium today? Is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you think there’s a different angle worth exploring, you can dive into the data and shape your own view in just minutes. Do it your way

A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that being ahead of the curve means acting on today’s best opportunities. Unlock your edge by checking out these high-potential market themes that are surging right now.

- Uncover value plays with strong fundamentals among smaller stocks by tapping into our selection of penny stocks with strong financials. These have the numbers to back up their upside.

- Target growth at the forefront of medicine and artificial intelligence through handpicked healthcare AI stocks companies that are redefining the future of healthcare.

- Supercharge your search for standout earnings and future gains by zeroing in on undervalued stocks based on cash flows, chosen for their attractive cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives