- United States

- /

- Software

- /

- NasdaqGM:RPD

Did You Miss Rapid7's (NASDAQ:RPD) Impressive 265% Share Price Gain?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For example, the Rapid7, Inc. (NASDAQ:RPD) share price has soared 265% in the last three years. Most would be happy with that. It's also good to see the share price up 29% over the last quarter. But this move may well have been assisted by the reasonably buoyant market (up 13% in 90 days).

See our latest analysis for Rapid7

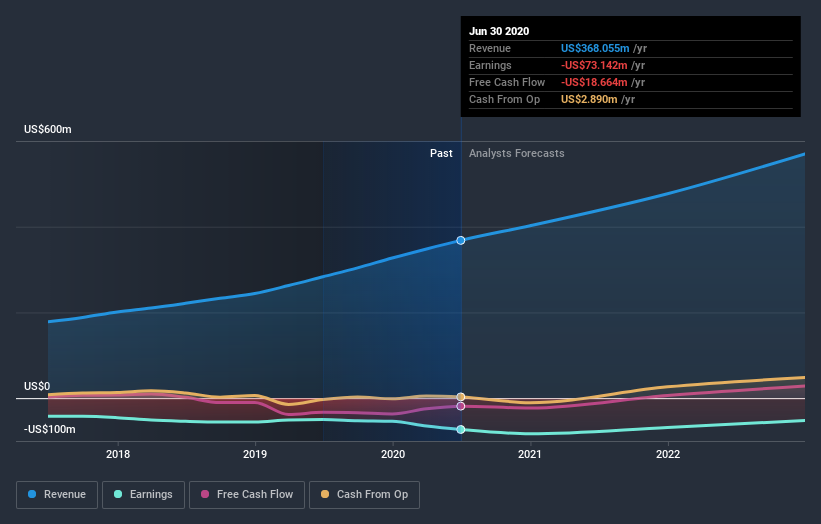

Rapid7 isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Rapid7 saw its revenue grow at 24% per year. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 54% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say Rapid7 is still worth investigating - successful businesses can often keep growing for long periods.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Rapid7 is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Rapid7 will earn in the future (free analyst consensus estimates)

A Different Perspective

It's good to see that Rapid7 has rewarded shareholders with a total shareholder return of 23% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 22% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Rapid7 better, we need to consider many other factors. For instance, we've identified 2 warning signs for Rapid7 that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Rapid7, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives