- United States

- /

- Software

- /

- NasdaqGS:ROP

Should You Think About Buying Roper Technologies, Inc. (NASDAQ:ROP) Now?

Let's talk about the popular Roper Technologies, Inc. (NASDAQ:ROP). The company's shares had a relatively subdued couple of weeks in terms of changes in share price, which continued to float around the range of US$523 to US$562. However, is this the true valuation level of the large-cap? Or is it currently undervalued, providing us with the opportunity to buy? Let’s take a look at Roper Technologies’s outlook and value based on the most recent financial data to see if there are any catalysts for a price change.

See our latest analysis for Roper Technologies

Is Roper Technologies Still Cheap?

Good news, investors! Roper Technologies is still a bargain right now. Our valuation model shows that the intrinsic value for the stock is $724.06, but it is currently trading at US$546 on the share market, meaning that there is still an opportunity to buy now. Roper Technologies’s share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. If you believe the share price should eventually reach its true value, a low beta could suggest it is unlikely to rapidly do so anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range.

Can we expect growth from Roper Technologies?

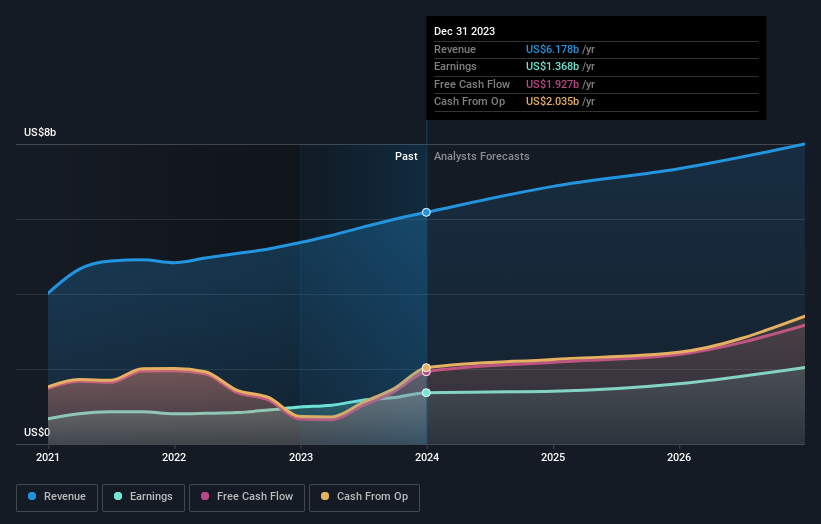

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. Roper Technologies' earnings over the next few years are expected to increase by 49%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? Since ROP is currently undervalued, it may be a great time to increase your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on ROP for a while, now might be the time to enter the stock. Its buoyant future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy ROP. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

It can be quite valuable to consider what analysts expect for Roper Technologies from their most recent forecasts. So feel free to check out our free graph representing analyst forecasts.

If you are no longer interested in Roper Technologies, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)