- United States

- /

- Software

- /

- NasdaqGS:ROP

Roper Technologies Shares Signal Opportunity After Latest Free Cash Flow Forecasts for 2025

Reviewed by Bailey Pemberton

If you are undecided about what to do with Roper Technologies stock, you are not alone. The past few months have presented mixed signals for this industrial software and tech giant, leaving investors debating whether now is the time to buy, hold, or wait. While the share price recently closed at $499.95, short-term performance has been muted, with returns down -0.2% over the past week and -3.6% over the past month. Year to date, the stock is off by -2.7%, and over the last twelve months, it is down by -6.3%.

Despite these lackluster short-term returns, the bigger picture is much brighter. Over the past three years, Roper Technologies has gained 39.4%, and over five years, shares are up 22.0%. Much of this long-term strength can be traced back to Roper’s strategy of recurring revenue acquisitions and broad exposure across resilient industries. This approach continues to resonate with long-term investors. Market sentiment may have cooled recently, possibly reflecting shifting risk perceptions and macroeconomic themes, but the company’s core growth story remains intact.

The key point is that by our numbers, Roper Technologies currently scores a 6 out of 6 on our valuation checklist, meaning it appears undervalued in every major metric we track. This makes it stand out for anyone hunting for value in a market where bargains are tough to find. How do these valuation checks work, and what are the best ways to judge if Roper really is attractively priced today? Here is a breakdown of the main approaches to valuation, along with a look at a smarter way to evaluate the company that many overlook.

Why Roper Technologies is lagging behind its peers

Approach 1: Roper Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to their present value. This approach is favored for its focus on actual cash generation rather than accounting profits. It helps investors judge whether the stock price reflects real earning potential.

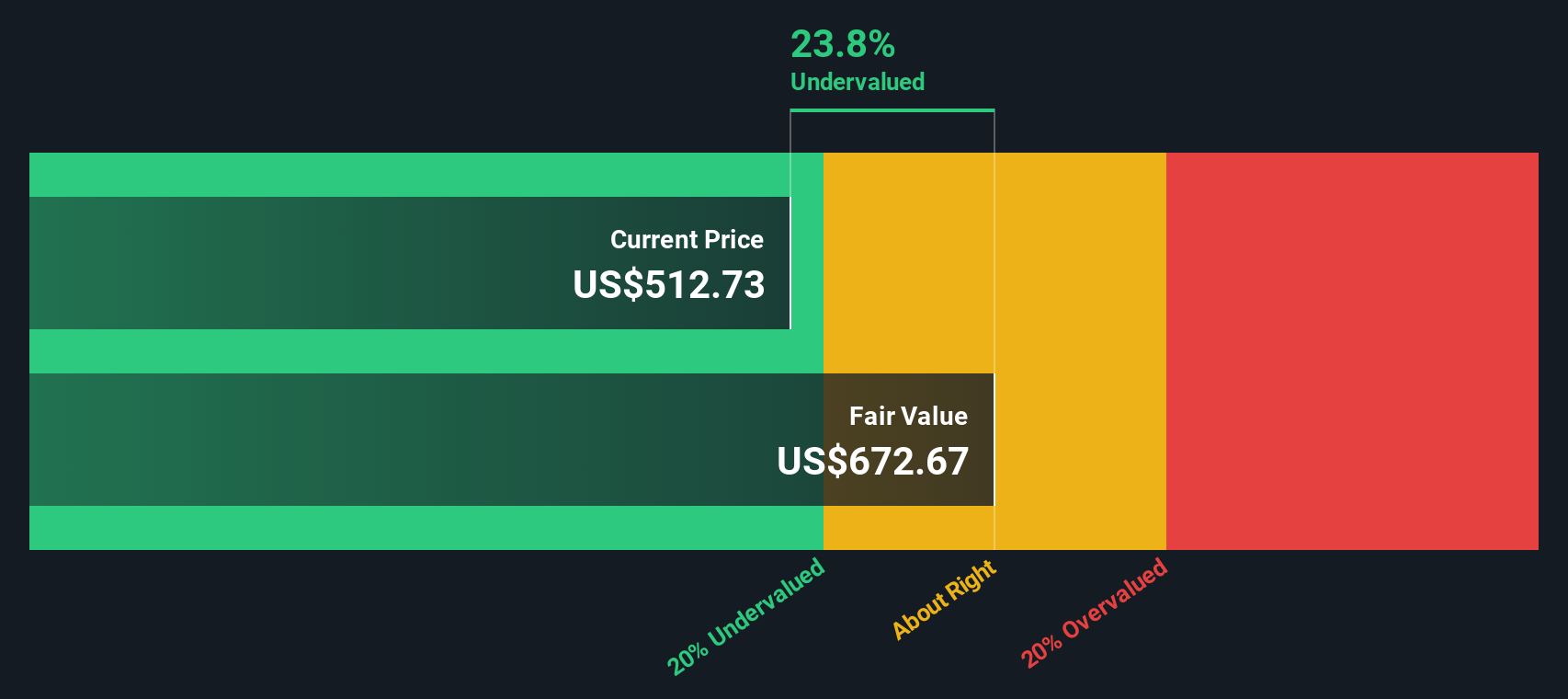

For Roper Technologies, the most recent full-year Free Cash Flow stood at $2.29 billion. Analysts forecast steady growth over the next several years, with projections rising from $2.74 billion in 2026 to $3.81 billion by the end of 2028. For the years beyond, Simply Wall St extrapolates continued increases, with Free Cash Flow estimates exceeding $5.90 billion by 2035. All cash flows are reported in US dollars.

Based on these projections and discounting them to today’s terms, the DCF model produces an intrinsic share value of $668.79. This suggests the stock is about 25% undervalued compared to its recent closing price of $499.95, which may indicate a significant margin of safety for value-driven investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roper Technologies is undervalued by 25.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Roper Technologies Price vs Earnings (PE)

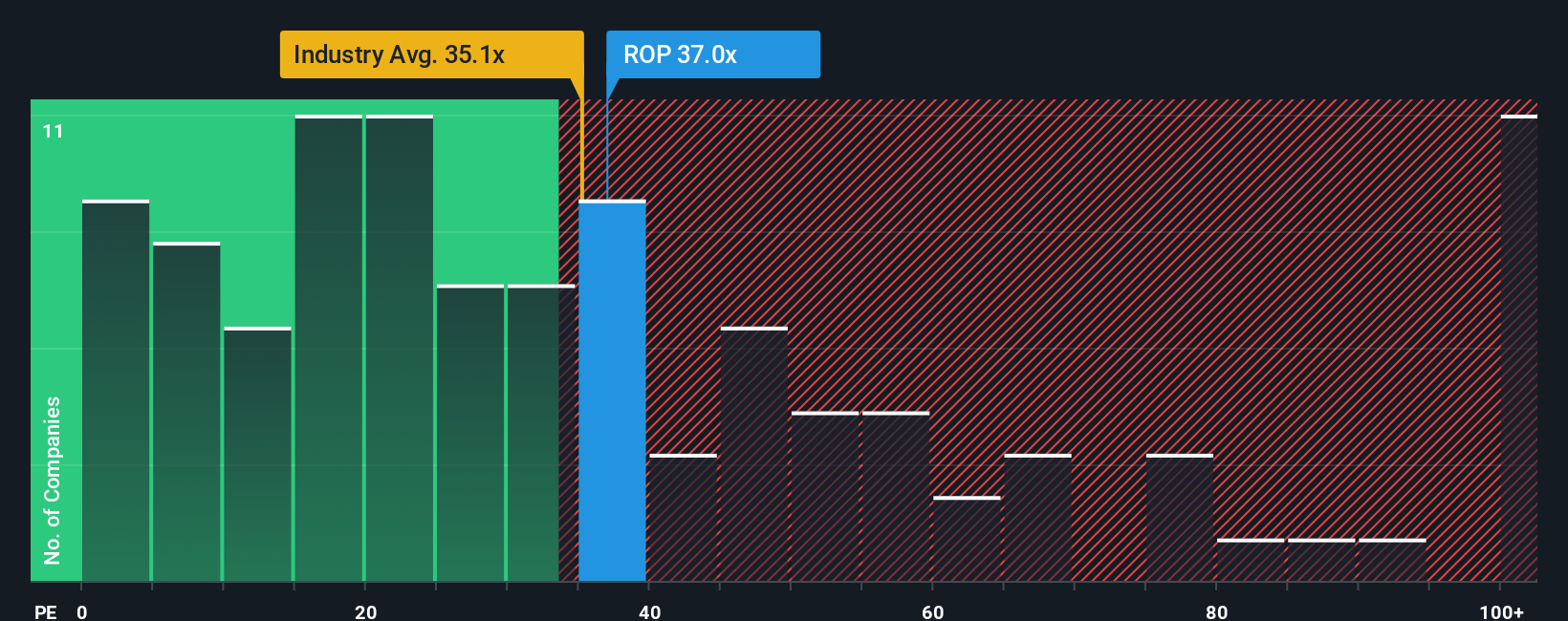

The Price-to-Earnings (PE) ratio is generally considered the most suitable valuation tool for profitable companies like Roper Technologies. It gives investors a direct sense of how much they are paying for every dollar of the company’s earnings, making it a core metric in assessing whether a stock is good value.

Interpreting a PE ratio is not just about the raw number. Growth prospects, risk profile, and comparisons with peers and the broader market all influence what investors view as a "normal" or "fair" PE ratio. Higher growth and more predictable earnings typically justify a higher PE, while elevated risks or slowing growth often result in a lower PE.

At present, Roper Technologies trades on a PE of 34.95x. This is just below the Software industry average of 35.73x and significantly beneath the peer average of 79.57x. However, a simple comparison does not capture the full story. Simply Wall St’s proprietary "Fair Ratio" metric sets Roper’s fair PE at 35.74x, reflecting an expectation in line with the company’s growth outlook, margins, industry, and risk profile. Unlike basic averages, the Fair Ratio provides a more tailored assessment by combining all these critical factors. As a result, investors receive a valuation gauge that is specific to Roper’s circumstances rather than relying solely on industry comparisons.

With Roper’s actual PE almost identical to the Fair Ratio, the evidence points to the shares being fairly valued on this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roper Technologies Narrative

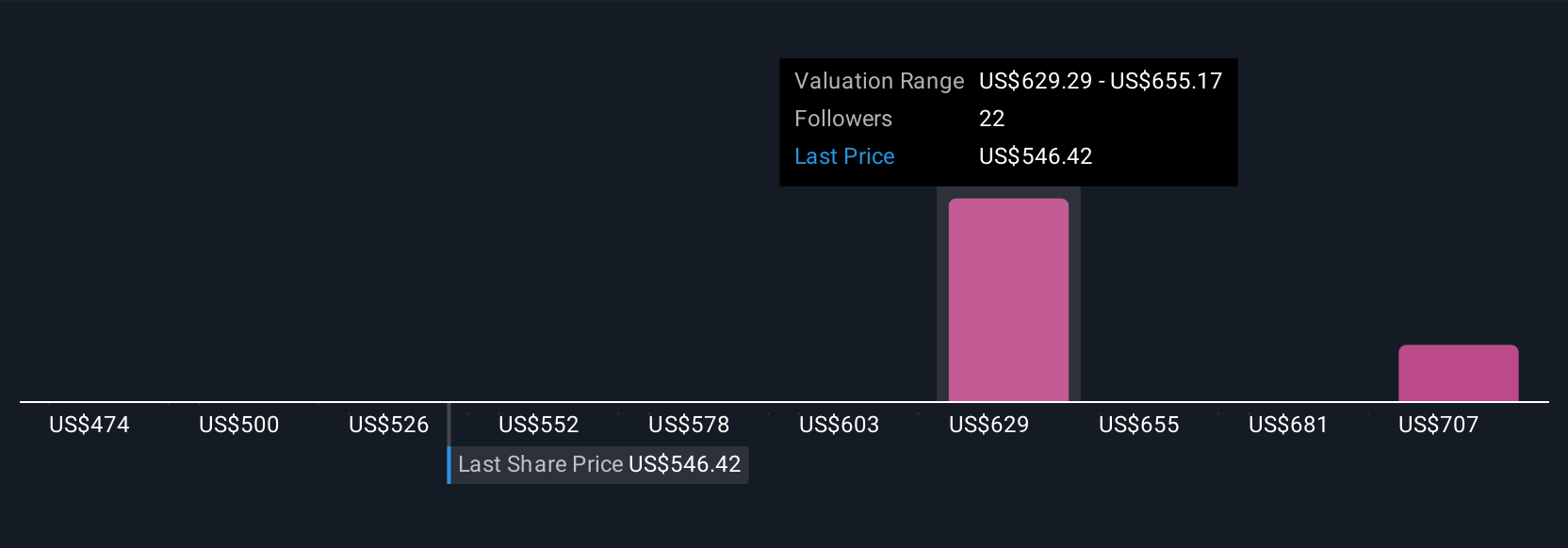

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a powerful, yet simple, tool that lets you create a story or perspective about a company, connecting your expectations for future revenue, margins, and fair value to an actual investment thesis. Narratives take the numbers behind a stock and blend them with your view of the company’s journey, then tie that to a fair value estimate.

This approach is available right within the Simply Wall St platform’s Community page, making it easy and accessible for investors at any level. Narratives help you decide whether to buy or sell by linking your Fair Value estimate to the current share price, and they update dynamically as new information arises, such as earnings releases or major news. For Roper Technologies, some investors are optimistic, expecting transformative growth in margins and setting price targets up to $714.0, while others see risks and keep their estimates closer to $460.0. Exploring different Narratives helps you clarify your own view and respond quickly as company fortunes evolve.

Do you think there's more to the story for Roper Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives