- United States

- /

- Software

- /

- NasdaqGS:ROP

Roper Technologies (ROP) Margin Compression Challenges Bullish Earnings Growth Narrative

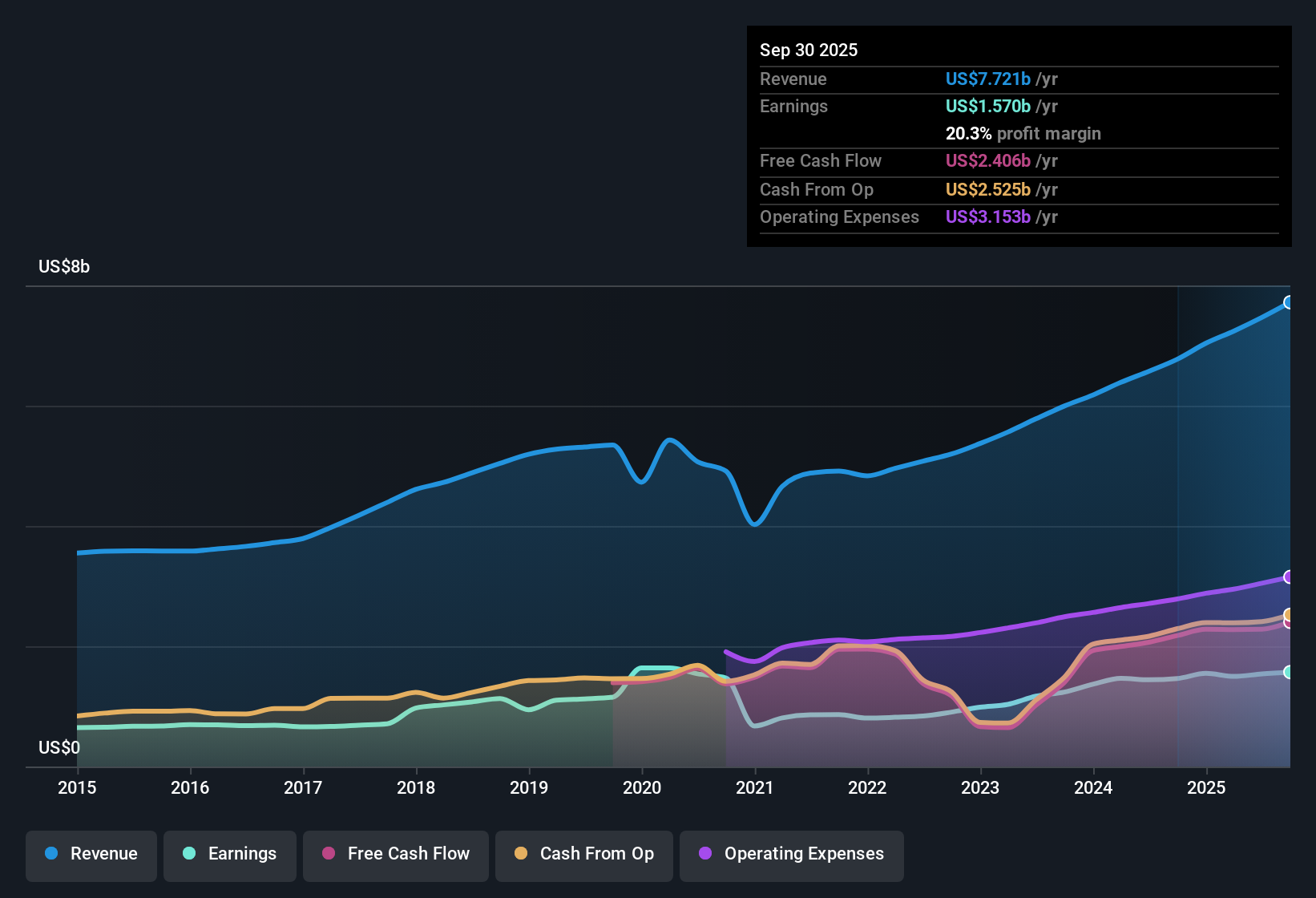

Roper Technologies (ROP) has wrapped up FY 2025 with fourth quarter revenue of US$2.1 billion and basic EPS of US$4.00, alongside net income of US$428.4 million. The company has seen quarterly revenue move from US$1.88 billion in Q1 2025 to US$2.1 billion in Q4 2025. Quarterly basic EPS has ranged from US$3.08 to US$4.00 over the same period, giving investors a clear view of how the top and bottom line have tracked together through the year. With trailing 12 month net profit margin at 19.4% versus 22% a year earlier, the latest print lands in a context where revenue is still growing but investors are watching how efficiently that growth converts into profits.

See our full analysis for Roper Technologies.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the widely held narratives around Roper, highlighting where the story is confirmed and where the data starts to push back.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings growth sits above revenue

- On a trailing 12 month basis, earnings are forecast to grow about 12.2% per year while revenue is forecast at about 9.3% per year, with total trailing revenue at US$7.9b and net income at US$1.5b.

- What is interesting for the bullish view is that this growth backdrop sits alongside a trailing net profit margin that has moved from 22% to 19.4%, so:

- Forecast earnings growth of roughly 12.2% is being assessed against a margin profile that is currently lower than a year ago. This gives bulls a stronger story on growth, but a more cautious one on profitability quality.

- Revenue forecasts around 9.3% each year, on top of US$7.9b in trailing sales, support the idea of a solid top line base. However, the margin step down means bullish investors still have to watch how much of that forecast growth converts into profit.

Profit margin at 19.4% puts focus on efficiency

- Trailing net profit margin stands at 19.4% on US$7.9b of revenue and US$1.5b of net income, compared with 22% a year earlier. This keeps attention on how efficiently Roper converts sales into profit.

- Bears often focus on profitability quality, and the move from a 22% margin to 19.4% gives that cautious view something concrete to point to, yet there are some checks to that stance:

- Five year earnings compound growth of about 17% per year and a history of high quality earnings sit alongside the current margin level. This challenges a bearish claim that profitability is weak in absolute terms.

- At the same time, the step down from 22% to 19.4% is consistent with bearish concerns that the recent period has put pressure on efficiency, so both sides can find support in the same margin data.

P/E of 25.9x and DCF fair value gap

- Roper trades on a P/E of 25.9x compared with the US Software industry average of 30.4x and a peer average of 47.8x, and the current share price of US$369.27 is about 35.1% below a DCF fair value of roughly US$569.01.

- For the bullish camp, valuation metrics heavily support the idea that the shares are not priced aggressively, yet some elements from the data keep that enthusiasm grounded:

- The gap between the US$369.27 share price and the DCF fair value of around US$569.01, plus an analyst price target of about US$522.07, aligns with bullish arguments that upside exists based on models, while also reminding investors that these are estimates, not guarantees.

- At the same time, the high level of debt identified in the risk summary means that even with a P/E below industry and peers, bulls still have to factor in balance sheet risk when deciding how comfortable they are with those valuation signals.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Roper Technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Roper's lower net profit margin compared with a year earlier and the highlighted high debt level put the quality and resilience of its earnings under scrutiny.

If that mix of pressured margins and heavier leverage makes you cautious, use our solid balance sheet and fundamentals stocks screener (387 results) today to zero in on companies built on sturdier finances and healthier cushions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROP

Roper Technologies

Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.