- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms, Inc. (NASDAQ:RIOT) Looks Just Right With A 66% Price Jump

Riot Platforms, Inc. (NASDAQ:RIOT) shares have continued their recent momentum with a 66% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.9% over the last year.

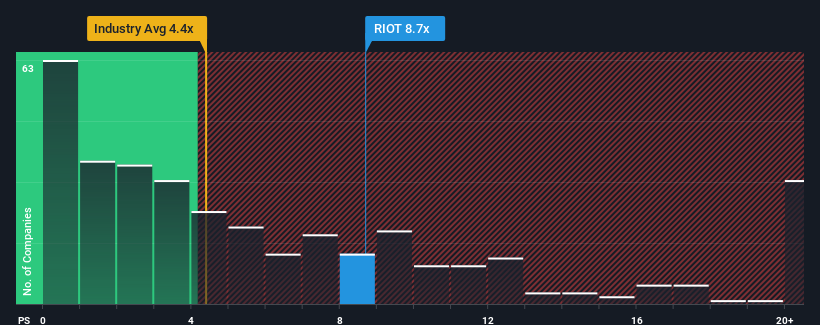

Following the firm bounce in price, Riot Platforms may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 8.7x, since almost half of all companies in the Software industry in the United States have P/S ratios under 4.4x and even P/S lower than 1.9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Riot Platforms

How Riot Platforms Has Been Performing

Recent times have been advantageous for Riot Platforms as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying to much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Riot Platforms will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Riot Platforms?

The only time you'd be truly comfortable seeing a P/S as steep as Riot Platforms' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 44% as estimated by the nine analysts watching the company. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Riot Platforms' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Riot Platforms' P/S

The strong share price surge has lead to Riot Platforms' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Riot Platforms maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Riot Platforms (2 don't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Riot Platforms, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives