- United States

- /

- Software

- /

- NasdaqCM:RIOT

Investors Appear Satisfied With Riot Platforms, Inc.'s (NASDAQ:RIOT) Prospects As Shares Rocket 28%

Riot Platforms, Inc. (NASDAQ:RIOT) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

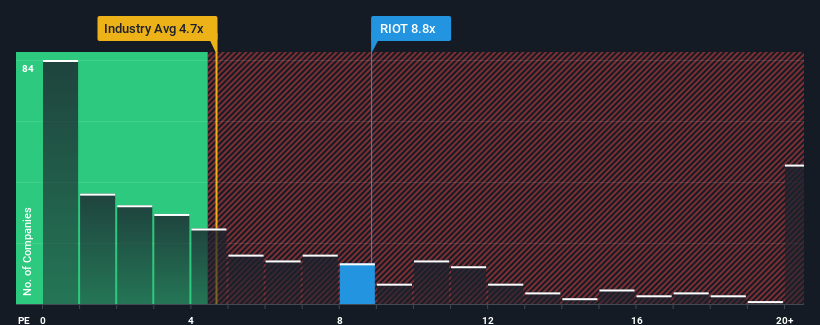

Following the firm bounce in price, Riot Platforms' price-to-sales (or "P/S") ratio of 8.8x might make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 4.7x and even P/S below 1.9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Riot Platforms

How Riot Platforms Has Been Performing

With revenue growth that's inferior to most other companies of late, Riot Platforms has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Riot Platforms.Do Revenue Forecasts Match The High P/S Ratio?

Riot Platforms' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 9.2% gain to the company's revenues. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, even though the last 12 months were fairly tame in comparison. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 122% over the next year. That's shaping up to be materially higher than the 24% growth forecast for the broader industry.

With this information, we can see why Riot Platforms is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Riot Platforms' P/S Mean For Investors?

Shares in Riot Platforms have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Riot Platforms maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Riot Platforms (3 make us uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives