- United States

- /

- Software

- /

- NasdaqCM:RDVT

Red Violet, Inc.'s (NASDAQ:RDVT) P/S Is Still On The Mark Following 28% Share Price Bounce

Red Violet, Inc. (NASDAQ:RDVT) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 9.6% isn't as impressive.

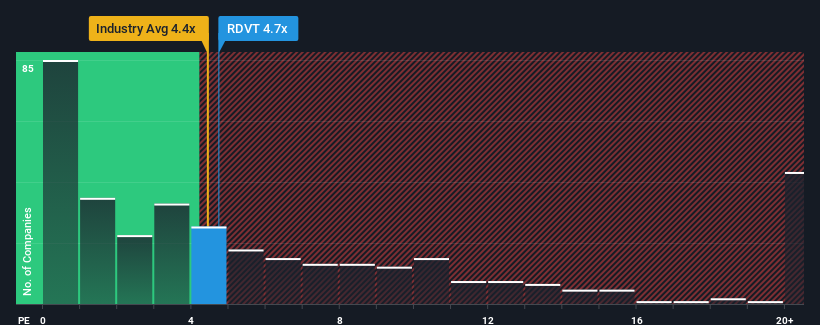

In spite of the firm bounce in price, it's still not a stretch to say that Red Violet's price-to-sales (or "P/S") ratio of 4.7x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 4.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Red Violet

How Has Red Violet Performed Recently?

There hasn't been much to differentiate Red Violet's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on Red Violet will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Red Violet's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Red Violet's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen an excellent 78% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is not materially different.

With this in mind, it makes sense that Red Violet's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Red Violet's P/S Mean For Investors?

Red Violet appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Red Violet's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 1 warning sign for Red Violet that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RDVT

Red Violet

An analytics and information solutions company, specializes in proprietary technologies and applying analytical capabilities to deliver identity intelligence in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives