- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Jumps 32% Over Last Quarter

Reviewed by Simply Wall St

The recent collaboration between Everfox and Palantir Technologies (NasdaqGS:PLTR) signifies a move into advanced software solutions for classified networks, potentially enhancing national security capabilities. This, alongside the launch of the R37 AI lab in partnership with R1 in healthcare, underscores Palantir's commitment to leveraging AI across critical sectors. These developments occurred against the backdrop of a 31.65% price increase over the last quarter, markedly outpacing the market's 3.6% annual rise. While the broader market exhibited modest growth, Palantir's targeted partnerships and robust sectoral focus likely added positive momentum to its stock performance.

You should learn about the 1 weakness we've spotted with Palantir Technologies.

Over the past three years, Palantir Technologies Inc. has achieved a very large total shareholder return of 612.96%. This remarkable growth contrasts with the more modest performance seen within the broader US Market, which rose 3.6% over the past year, highlighting Palantir's robust trajectory.

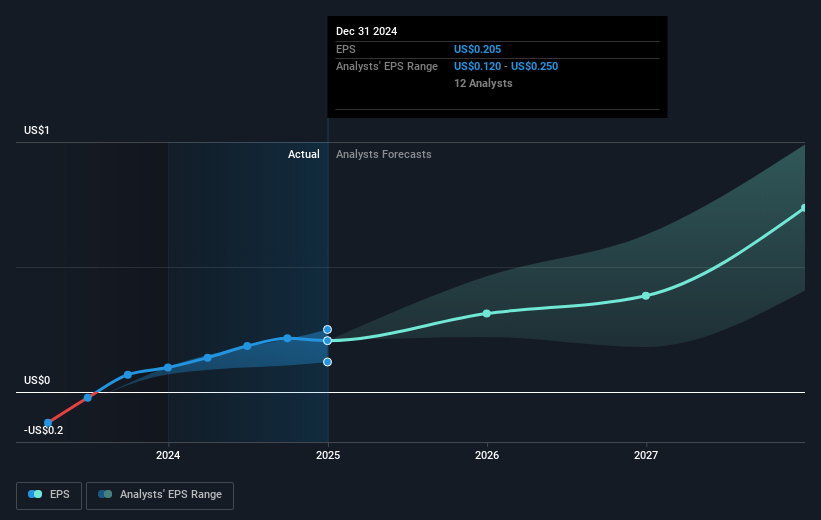

The recent collaborations and product initiatives discussed in the introduction are likely to influence Palantir's future performance positively. By expanding its presence in sectors such as national security and healthcare AI solutions, Palantir's revenue and earnings forecasts could see a strong upward trend, as evidenced by the company's recent earnings growth rate of 120.3% compared to the Software industry's 25.4%. Additionally, despite the recent 31.65% increase in stock price, it currently trades slightly below consensus analyst price targets, with a slight discount to the consensus fair value estimate of US$86.77, suggesting potential room for growth if current projects deliver their intended benefits.

Gain insights into Palantir Technologies' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives