- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies (PGY) Raises 2025 Guidance with Expected Revenue Up to US$1.325 Billion

Reviewed by Simply Wall St

Pagaya Technologies (PGY) recently reported substantial improvements in its financials, including a turnaround from a net loss to positive net income, and subsequently raised both quarterly and full-year guidance, which reflects a robust recovery. The company's share price experienced a notable rise of 110% over the last quarter, likely fueled by this optimism. The broader market environment also saw gains, with major indexes posting solid weekly advances, further propelling investor confidence. Pagaya's strategic initiatives, including a successful debt financing and new product launch, likely added weight to this strong share price performance against a similarly favorable market backdrop.

We've identified 2 possible red flags for Pagaya Technologies that you should be aware of.

The recent positive news about Pagaya Technologies has brightened the company's narrative, as its turnaround to positive net income and raised guidance suggest potential improvements in revenue and earnings forecasts. The company's strategic initiatives, including debt financing and a product launch, provide additional support for future growth prospects. In terms of longer-term performance, the company's shares have delivered a substantial total return of 102.78% over the past year, showcasing significant growth. This broad period performance is enhanced by the fact Pagaya exceeded both the US Market, which returned 19.9%, and the US Software industry, which returned 34.7%, over the same timeframe.

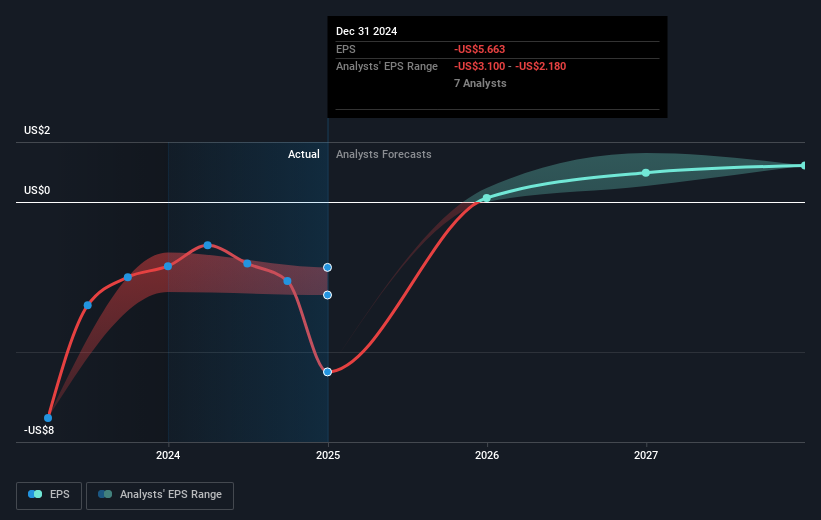

Considering the current share price of US$30.62 relative to the consensus price target of US$34.88, a share price discount of approximately 13.90% suggests that market optimism may not yet fully reflect analyst expectations. This gap underscores the potential for further upside should Pagaya continue to execute on its digital transformation and AI initiatives. Moreover, analysts predict revenue growth of 14.7% per year alongside expectations for profitability in the next three years. Overall, while there are foreseeable risks, Pagaya's share price trajectory indicates a promising outlook against the backdrop of its enhanced operational execution.

Learn about Pagaya Technologies' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives