- United States

- /

- Entertainment

- /

- NYSE:EDR

Pagaya Technologies And 2 Other High Growth Tech Stocks In The US

Reviewed by Simply Wall St

The United States market has been flat over the last week but is up 22% over the past year, with earnings expected to grow by 15% per annum in the coming years. In this context, identifying high growth tech stocks like Pagaya Technologies can be crucial for investors seeking to capitalize on sectors poised for expansion and innovation.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Bitdeer Technologies Group | 51.56% | 122.57% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.88% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI-powered technology to serve financial institutions and investors across the United States, Israel, the Cayman Islands, and internationally, with a market cap of approximately $769.70 million.

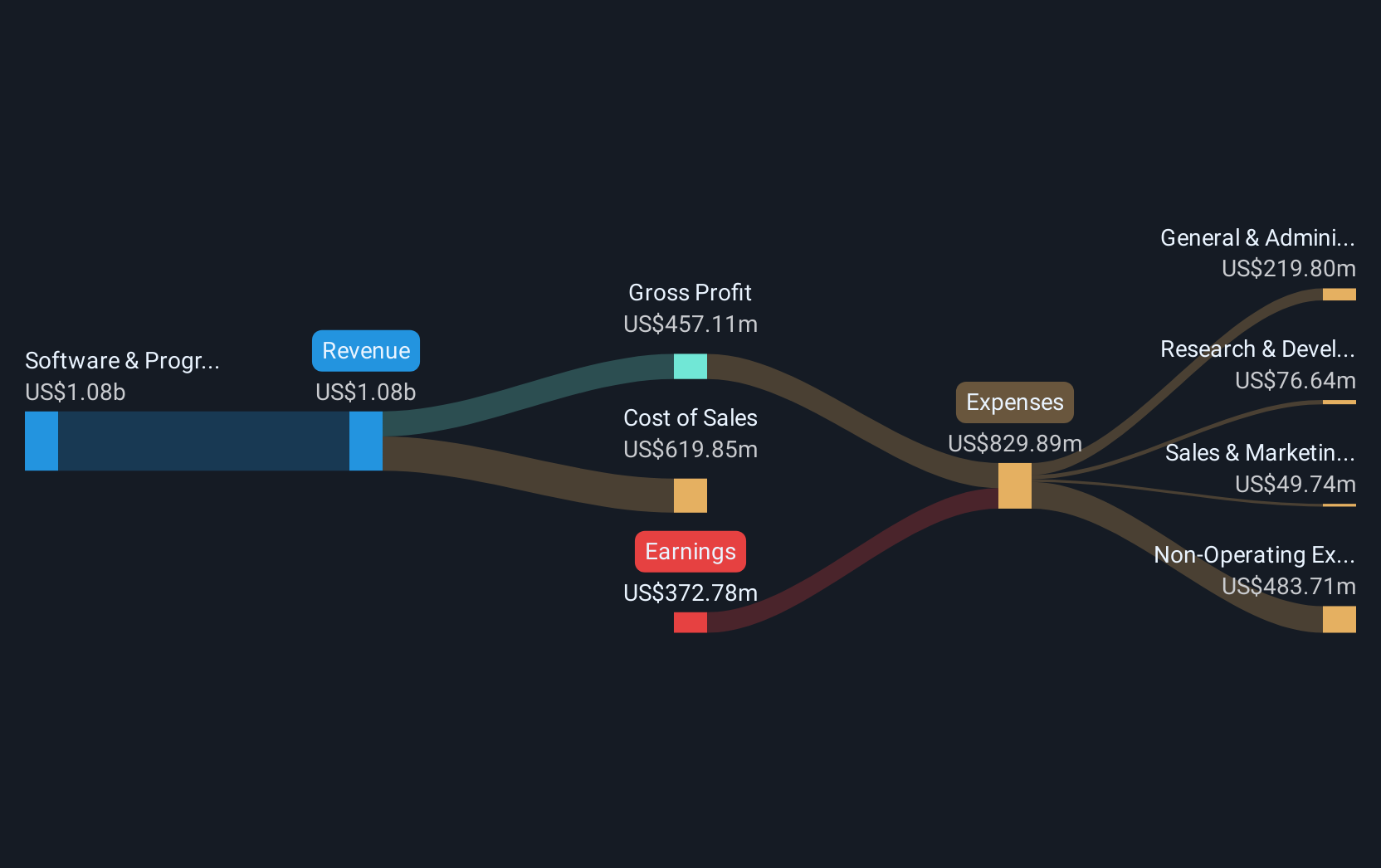

Operations: Pagaya Technologies Ltd. generates revenue primarily through its Software & Programming segment, amounting to $970.90 million. The company leverages data science and AI technology to provide solutions for financial institutions and investors globally.

Pagaya Technologies, amid a flurry of strategic board appointments and significant financial transactions, demonstrates a dynamic approach to governance and market engagement. Recently, the company enhanced its board with financial veterans Asheet Mehta and Alison Davis, signaling a robust strategic direction. Additionally, Pagaya closed a $600 million asset-backed securities transaction, underscoring strong market demand for its AI-driven credit solutions. These moves coincide with an expected annual revenue growth of 15.2% and forecasted earnings growth of 115.87%, positioning Pagaya as an emerging force in tech despite current unprofitability and market volatility.

- Get an in-depth perspective on Pagaya Technologies' performance by reading our health report here.

Explore historical data to track Pagaya Technologies' performance over time in our Past section.

Alvotech (NasdaqGM:ALVO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alvotech, with a market cap of $3.78 billion, develops and manufactures biosimilar medicines for patients globally through its subsidiaries.

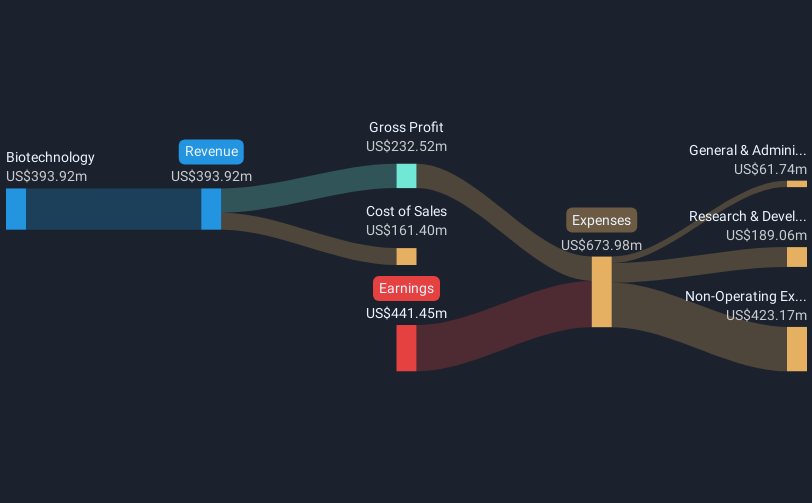

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $393.92 million. The focus on biosimilar medicines positions it within the global pharmaceutical landscape, leveraging its expertise in development and manufacturing through subsidiaries.

Alvotech, amidst a transformative phase, has shown promising advancements in the biotech sector, particularly with its recent FDA filings for biosimilars which could significantly impact treatment options for inflammatory conditions. With an expected annual revenue growth of 35.5% and earnings forecast to surge by 99% per year, the company is on a robust trajectory despite current unprofitability and a short cash runway. These developments are complemented by strategic partnerships and product approvals that enhance its market presence, notably with Teva Pharmaceuticals enhancing its portfolio with FDA-approved biosimilars like SIMLANDI® and SELARSDITM.

Endeavor Group Holdings (NYSE:EDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Endeavor Group Holdings, Inc. is a sports and entertainment company with operations in the United States, the United Kingdom, and internationally, and has a market cap of approximately $14.45 billion.

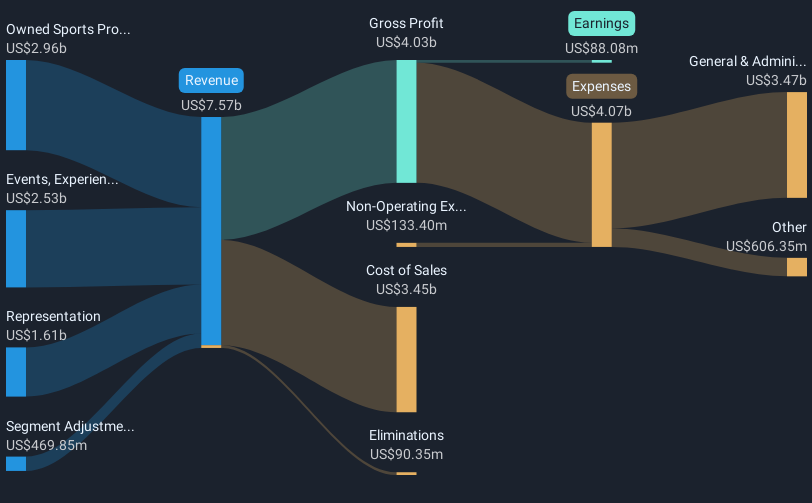

Operations: Endeavor Group Holdings generates revenue primarily through its Owned Sports Properties, which contribute approximately $2.96 billion, and its Events, Experiences & Rights segment, accounting for around $2.53 billion. The Representation segment adds another significant portion with $1.61 billion in revenue.

Endeavor Group Holdings, despite a challenging year with a net loss widening to $616.53 million from a previous profit, continues to pay dividends, signaling confidence in its financial health. The firm declared a quarterly dividend of $0.06 per share, maintaining shareholder returns amidst adversity. With earnings forecasted to grow by 41.8% annually, the company's resilience is evident as it navigates through fluctuations in the entertainment sector where it reported substantial revenue growth to $5.54 billion over nine months—an increase from $4.02 billion in the same period last year. This performance underscores Endeavor's potential to stabilize and capitalize on market opportunities despite current volatilities.

Summing It All Up

- Get an in-depth perspective on all 231 US High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endeavor Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EDR

Endeavor Group Holdings

Operates as a sports and entertainment company in the United States, the United Kingdom, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives