- United States

- /

- Software

- /

- NasdaqGS:PANW

Investing in Palo Alto Networks (NASDAQ:PANW) five years ago would have delivered you a 356% gain

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. For example, the Palo Alto Networks, Inc. (NASDAQ:PANW) share price is up a whopping 356% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 22% in about a quarter. But this could be related to the strong market, which is up 11% in the last three months.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Palo Alto Networks

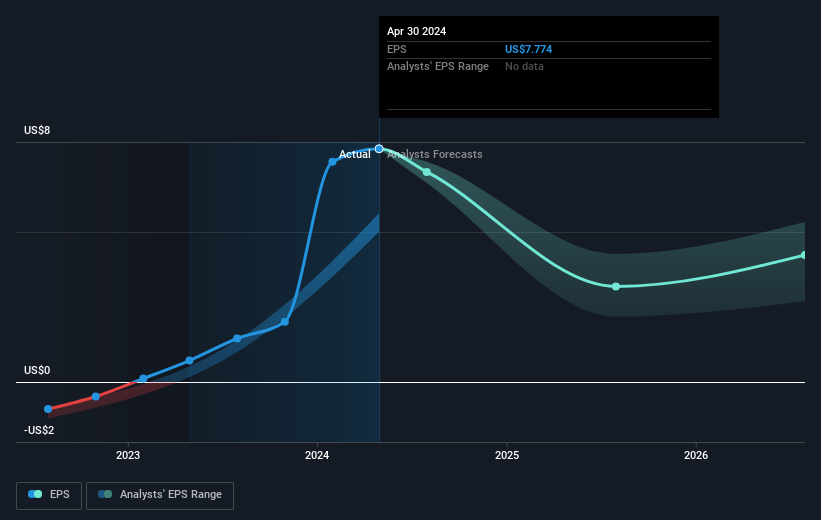

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Palo Alto Networks moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Palo Alto Networks has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Palo Alto Networks' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Palo Alto Networks shareholders have received a total shareholder return of 35% over one year. However, that falls short of the 35% TSR per annum it has made for shareholders, each year, over five years. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Palo Alto Networks (1 makes us a bit uncomfortable) that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives