- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

3 Stocks Currently Estimated To Be Up To 28.5% Below Their Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs, buoyed by optimism surrounding potential interest rate cuts and stable inflation figures, investors are keenly evaluating opportunities that may be undervalued amidst the broader surge. In this context, identifying stocks estimated to be significantly below their intrinsic value can offer a strategic advantage, especially in a market environment characterized by strong performance across major indices like the S&P 500 and Nasdaq Composite.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Willdan Group (WLDN) | $118.63 | $232.57 | 49% |

| UMB Financial (UMBF) | $114.55 | $225.65 | 49.2% |

| Udemy (UDMY) | $6.86 | $13.24 | 48.2% |

| Shoals Technologies Group (SHLS) | $4.62 | $8.99 | 48.6% |

| Royal Gold (RGLD) | $172.34 | $331.91 | 48.1% |

| First Commonwealth Financial (FCF) | $16.82 | $32.97 | 49% |

| First Busey (BUSE) | $23.25 | $45.40 | 48.8% |

| Excelerate Energy (EE) | $23.98 | $46.38 | 48.3% |

| e.l.f. Beauty (ELF) | $116.75 | $224.59 | 48% |

| Dime Community Bancshares (DCOM) | $29.01 | $56.20 | 48.4% |

Underneath we present a selection of stocks filtered out by our screen.

ON Semiconductor (ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions across various regions including Hong Kong, Singapore, the United Kingdom, and the United States with a market cap of approximately $19.26 billion.

Operations: The company's revenue is primarily derived from its Power Solutions Group ($2.98 billion), Intelligent Sensing Group ($1.03 billion), and Analog & Mixed-Signal Group ($2.39 billion).

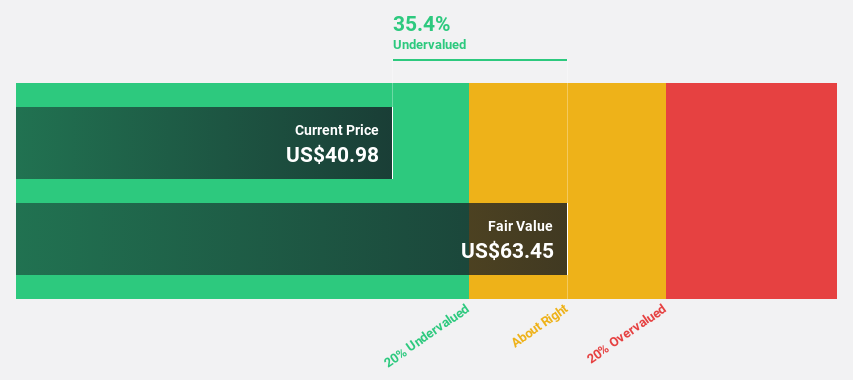

Estimated Discount To Fair Value: 15.8%

ON Semiconductor's recent financial results show a decline in sales and net income, but the company remains undervalued based on cash flows, trading at US$50.01 against an estimated fair value of US$59.38. Despite lower profit margins this year, earnings are expected to grow significantly at 40.3% annually over the next three years, outpacing market growth. The company's strategic moves in EV technology and data center power solutions may bolster future performance despite current challenges.

- The analysis detailed in our ON Semiconductor growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of ON Semiconductor.

Palo Alto Networks (PANW)

Overview: Palo Alto Networks, Inc. provides cybersecurity solutions worldwide and has a market cap of approximately $112.33 billion.

Operations: The company's revenue segment is primarily composed of Security Software & Services, generating approximately $8.87 billion.

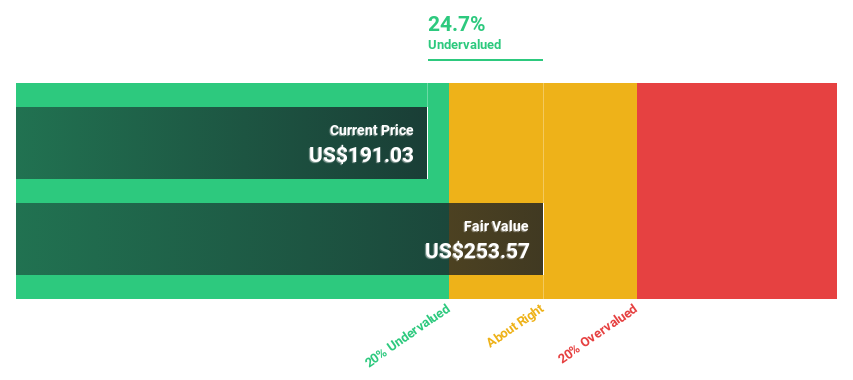

Estimated Discount To Fair Value: 28.5%

Palo Alto Networks is trading at US$175.4, significantly below its estimated fair value of US$245.31, indicating potential undervaluation based on cash flows. Recent product announcements, like the Cortex Cloud ASPM, enhance its security offerings and may drive future growth. Despite a drop in profit margins from last year, earnings are projected to grow annually by 18.9%, surpassing the broader market's pace. The company's strategic acquisitions could further strengthen its market position and operational capabilities.

- According our earnings growth report, there's an indication that Palo Alto Networks might be ready to expand.

- Unlock comprehensive insights into our analysis of Palo Alto Networks stock in this financial health report.

Take-Two Interactive Software (TTWO)

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions globally and has a market cap of approximately $41.08 billion.

Operations: The company's revenue primarily comes from its publishing segment, which generated $5.80 billion.

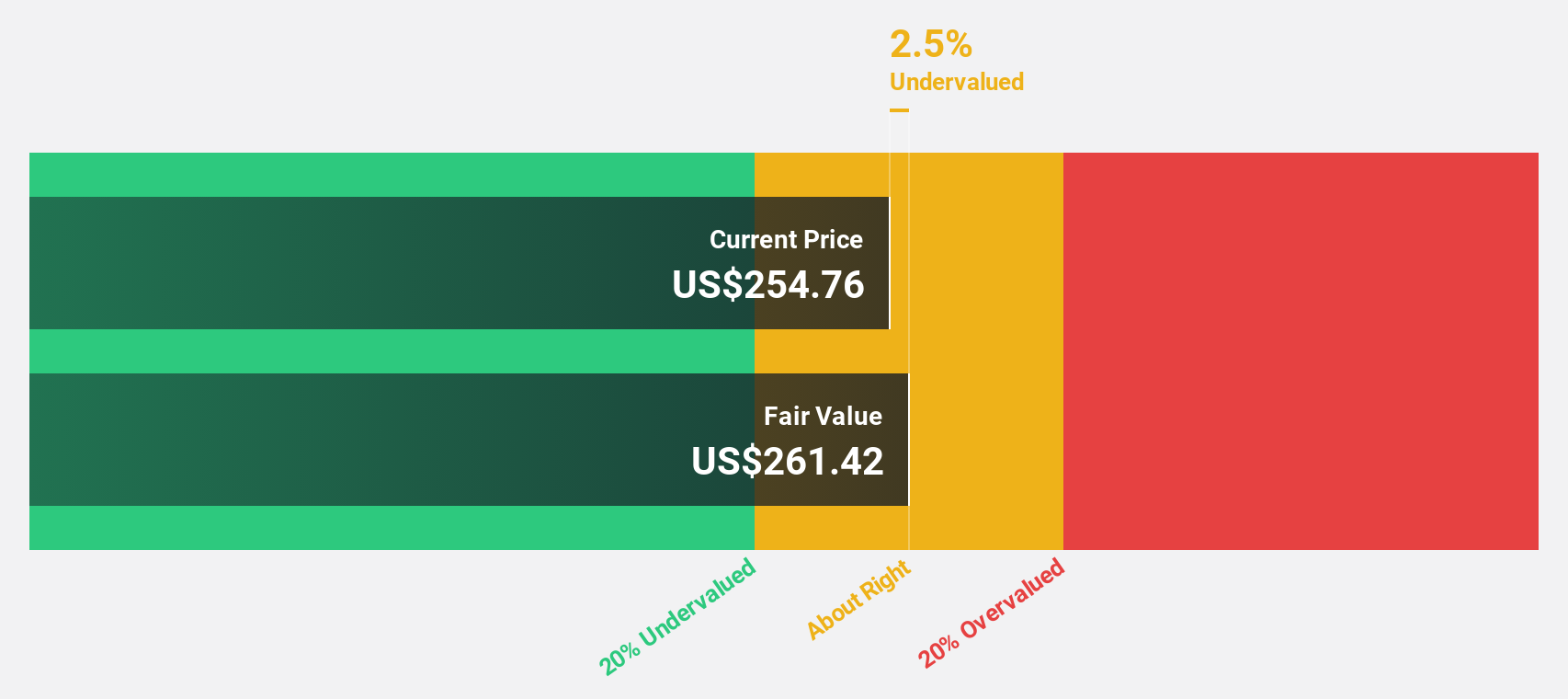

Estimated Discount To Fair Value: 10.4%

Take-Two Interactive Software is trading at US$232.56, slightly below its estimated fair value of US$259.64, suggesting potential undervaluation based on cash flows. The company's revenue is projected to grow annually by 13.4%, outpacing the broader U.S. market's growth rate of 9.4%. Despite recent losses, Take-Two expects profitability within three years, supported by strong product releases like NBA 2K26 and Borderlands 4 that could drive future revenue streams.

- Upon reviewing our latest growth report, Take-Two Interactive Software's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Take-Two Interactive Software.

Key Takeaways

- Embark on your investment journey to our 182 Undervalued US Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives