- United States

- /

- Software

- /

- NasdaqGS:OTEX

Here's Why Shareholders May Want To Be Cautious With Increasing Open Text Corporation's (NASDAQ:OTEX) CEO Pay Packet

Key Insights

- Open Text will host its Annual General Meeting on 14th of September

- Salary of US$950.0k is part of CEO Mark Barrenechea's total remuneration

- The overall pay is 68% above the industry average

- Open Text's EPS declined by 13% over the past three years while total shareholder loss over the past three years was 0.6%

In the past three years, shareholders of Open Text Corporation (NASDAQ:OTEX) have seen a loss on their investment. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 14th of September and vote on resolutions including executive compensation, which studies show may have an impact on company performance. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Open Text

How Does Total Compensation For Mark Barrenechea Compare With Other Companies In The Industry?

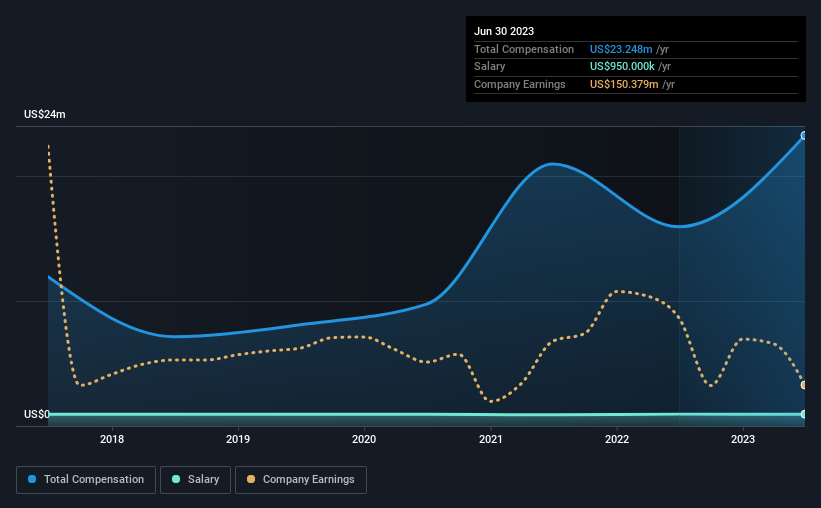

At the time of writing, our data shows that Open Text Corporation has a market capitalization of US$10b, and reported total annual CEO compensation of US$23m for the year to June 2023. We note that's an increase of 46% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$950k.

In comparison with other companies in the American Software industry with market capitalizations over US$8.0b, the reported median total CEO compensation was US$14m. This suggests that Mark Barrenechea is paid more than the median for the industry. What's more, Mark Barrenechea holds US$44m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$950k | US$950k | 4% |

| Other | US$22m | US$15m | 96% |

| Total Compensation | US$23m | US$16m | 100% |

On an industry level, roughly 10% of total compensation represents salary and 90% is other remuneration. Investors may find it interesting that Open Text paid a marginal salary to Mark Barrenechea, over the past year, focusing on non-salary compensation instead. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Open Text Corporation's Growth

Open Text Corporation has reduced its earnings per share by 13% a year over the last three years. Its revenue is up 28% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Open Text Corporation Been A Good Investment?

Given the total shareholder loss of 0.6% over three years, many shareholders in Open Text Corporation are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Open Text primarily uses non-salary benefits to reward its CEO. The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 5 warning signs for Open Text you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success