- United States

- /

- Software

- /

- NasdaqCM:OSPN

OneSpan Inc. (NASDAQ:OSPN) Shares Fly 27% But Investors Aren't Buying For Growth

OneSpan Inc. (NASDAQ:OSPN) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 84%.

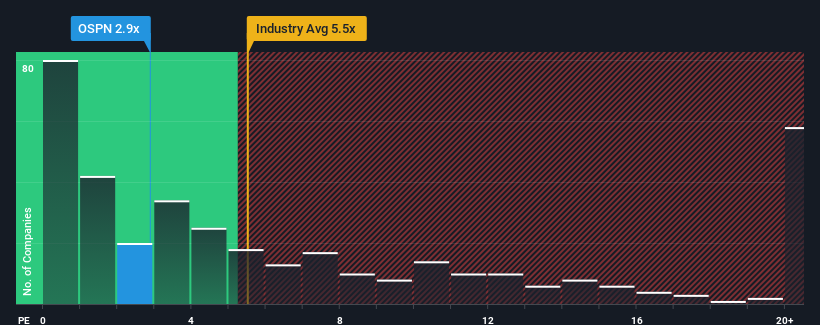

Even after such a large jump in price, OneSpan's price-to-sales (or "P/S") ratio of 2.9x might still make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 5.5x and even P/S above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for OneSpan

What Does OneSpan's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, OneSpan has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think OneSpan's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For OneSpan?

There's an inherent assumption that a company should underperform the industry for P/S ratios like OneSpan's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.1%. The latest three year period has also seen a 18% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 0.5% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is noticeably more attractive.

In light of this, it's understandable that OneSpan's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On OneSpan's P/S

Despite OneSpan's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of OneSpan's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with OneSpan.

If you're unsure about the strength of OneSpan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OSPN

OneSpan

Provides digital solutions for security, authentication, identity, electronic signature, and digital workflow products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.