- United States

- /

- Software

- /

- NasdaqGS:OPRA

Opera (OPRA) Is Down 9.0% After Raising 2025 Guidance Amid AI and Fintech Expansion – What's Changed

Reviewed by Sasha Jovanovic

- Opera Limited recently reported its third quarter 2025 results, with revenue rising to US$151.94 million and net income reaching US$18.62 million, and the company raised its full-year revenue guidance to US$600 million–US$603 million.

- One unique insight is Opera’s ongoing focus on AI-powered browsing and fintech, as highlighted by the launch of Opera Neon and strong growth in its MiniPay wallet user base.

- We'll now examine how Opera’s raised annual revenue outlook, supported by AI and fintech momentum, could shape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Opera Investment Narrative Recap

To be an Opera shareholder today, you need to believe in the company’s ability to scale both AI-powered browser innovation and fintech adoption while withstanding pressure from larger competitors and volatile advertising markets. Opera’s raised full-year revenue outlook signals progress on short-term catalysts, particularly growth in MiniPay wallet adoption and AI browsing features, but does not materially change the biggest risk: ongoing dependence on third-party AI models and input costs.

Among the recent announcements, the launch of Opera Neon stands out as especially relevant. This new, AI-native browser aims to boost user engagement, introduce premium subscription opportunities, and support advertising revenue, all central to Opera’s growth narrative in light of the updated financial guidance.

However, investors should also be aware that reliance on external AI providers means that Opera’s cost structure and product differentiation could shift quickly if…

Read the full narrative on Opera (it's free!)

Opera's outlook anticipates $813.6 million in revenue and $135.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 13.6% and an increase in earnings of $55.2 million from the current $80.6 million.

Uncover how Opera's forecasts yield a $25.50 fair value, a 77% upside to its current price.

Exploring Other Perspectives

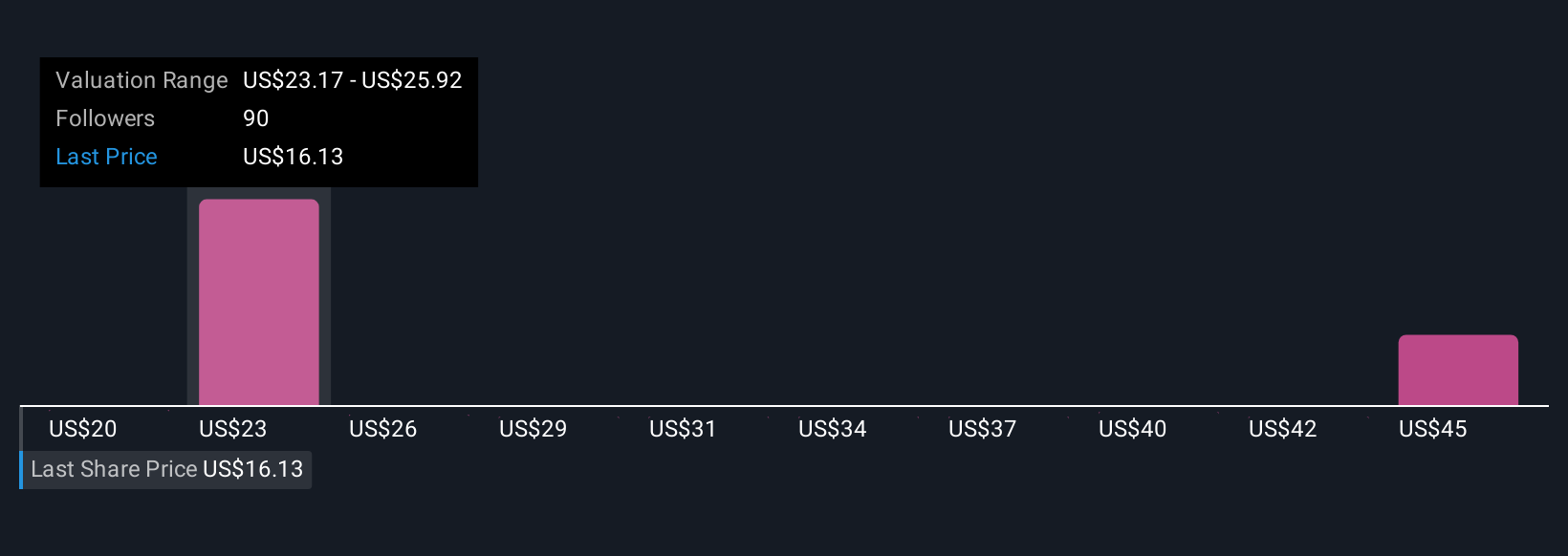

Six Simply Wall St Community members estimate Opera’s fair value between US$23 and US$48, with the widest spread nearing US$25. Meanwhile, as Opera doubles down on AI innovation, the company’s dependence on external technology partners could influence both future earnings and competitive positioning; contrasting opinions highlight why it’s worth reviewing a range of individual forecasts.

Explore 6 other fair value estimates on Opera - why the stock might be worth over 3x more than the current price!

Build Your Own Opera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Opera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opera's overall financial health at a glance.

No Opportunity In Opera?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026