- United States

- /

- Software

- /

- NasdaqGS:OPRA

Market Might Still Lack Some Conviction On Opera Limited (NASDAQ:OPRA) Even After 29% Share Price Boost

The Opera Limited (NASDAQ:OPRA) share price has done very well over the last month, posting an excellent gain of 29%. The last 30 days bring the annual gain to a very sharp 60%.

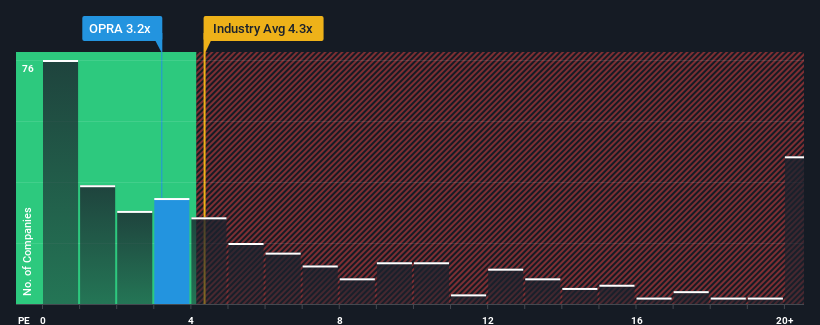

Although its price has surged higher, Opera may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.2x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 4.3x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Opera

What Does Opera's Recent Performance Look Like?

Opera certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Opera.How Is Opera's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Opera's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an excellent 140% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the six analysts watching the company. That's shaping up to be similar to the 15% per year growth forecast for the broader industry.

In light of this, it's peculiar that Opera's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Opera's P/S?

Opera's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Opera's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Opera that we have uncovered.

If you're unsure about the strength of Opera's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives