- United States

- /

- Software

- /

- NasdaqGS:OPRA

Does Opera’s Recent Dip Signal an Opportunity After Three-Year 356% Rally?

Reviewed by Bailey Pemberton

If you’re thinking about whether Opera is a buy, sell, or just one to keep on your watchlist, you’re not alone. In the last week, the stock slipped by 3.2%, following a choppier month where it dropped 17.2%. That might make some investors uneasy, but if you zoom out, Opera’s story gets a lot more interesting. Despite the recent turbulence, the stock is still up a massive 356.5% over three years and 116.2% over the last five years. So, what’s driving these swings, and what could that mean for your next move?

Recently, attention has focused on Opera’s expanding presence in key international markets and its steady release of new browser features catering to tech-savvy users. These developments have not always been fully reflected in the stock price, setting up intriguing possibilities for those watching valuation metrics. While last year’s modest decline of 1.5% hints at some market uncertainty, there is a sense that risks are front-loaded and much of the market is still catching up to Opera’s value proposition.

On paper, Opera’s valuation is turning heads. The company scores a 6 out of 6 on our value score, indicating that it is checking every box for being undervalued across several tested valuation methods. But how do these traditional valuation tools stack up, and is there a better way to read Opera’s market potential? Let’s dig into what each valuation method really tells us before exploring a different approach at the end of this article.

Why Opera is lagging behind its peers

Approach 1: Opera Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates a company's worth by projecting its future cash flows and discounting them back to their present value. This allows investors to see what the business might be worth today based on its ability to generate cash in the future.

For Opera, the current Free Cash Flow (FCF) stands at $86.1 million. Looking forward, analyst estimates suggest steady growth, with projected FCFs reaching $200 million by 2029. Projections beyond five years are extrapolated, with rising expectations each year. However, such forecasts carry added uncertainty. All cash flows are provided in US dollars, as reported.

When these numbers are entered into the DCF model, Simply Wall St’s analysis yields an intrinsic value of $48.06 per share using a 2 Stage Free Cash Flow to Equity method. Compared to the current share price, this suggests the stock is about 67.6% undervalued according to this method. This reflects a potentially significant disconnect between Opera’s fundamentals and its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Opera is undervalued by 67.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Opera Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for assessing the valuation of profitable companies like Opera because it directly relates a company's share price to its per-share earnings. This ratio provides a quick sense of how much investors are willing to pay today for a dollar of earnings, making it especially useful when comparing established technology firms with consistent profits.

What constitutes a fair PE ratio isn't always straightforward. Higher growth expectations and lower risk profiles typically justify a loftier PE, while slower growth or higher risk would warrant a lower one. For context, Opera currently trades at a PE ratio of 17.3x. This is notably below the Software industry average of 33.3x and also trails its peer group, which sits at 30.0x.

However, rather than relying solely on broad industry benchmarks or peer comparisons, Simply Wall St introduces the “Fair Ratio.” This proprietary metric estimates what Opera's PE should be when accounting for company-specific factors like earnings growth, risk profile, profit margins, size, and its market environment. According to this model, Opera’s Fair Ratio is 29.1x, which is much higher than its current PE. This suggests that Opera shares may be significantly undervalued based on its true fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Opera Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a dynamic approach that puts your story at the center of investment decisions. A Narrative is simply your perspective on Opera, combining your assumptions about its future growth, profit margins, and risks with a transparent financial forecast and fair value estimate.

Instead of relying only on numbers, Narratives help you connect the actual business story, such as Opera’s rapid expansion into AI and fintech, with the forecasted financial outcomes. This user-friendly feature, available for everyone within the Simply Wall St Community, allows millions of everyday investors to map their reasoning and see how their fair value compares to the current share price, helping clarify whether Opera is a buy or sell.

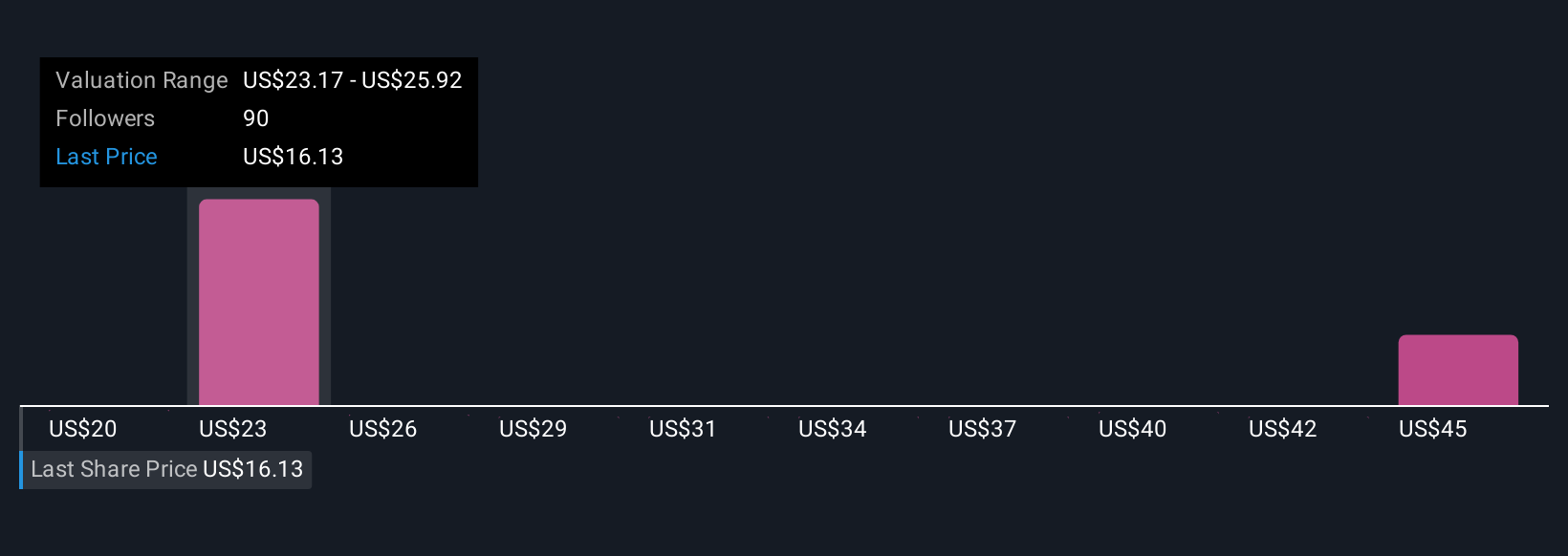

The real power of Narratives is that they update automatically whenever important news or earnings come out, so your perspective is always current. For example, while one investor might create a bullish Narrative with a price target of $33.0 based on rapid AI-driven growth, another could be more cautious, assigning a fair value of $23.0 if they see risks in regulatory or advertising revenue headwinds. Different stories lead to different numbers and smarter decisions, all in one place.

Do you think there's more to the story for Opera? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)