- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA): Reassessing Valuation After Strong Q3 Results and Upbeat Growth Guidance

Reviewed by Simply Wall St

Okta (OKTA) just turned in another profitable quarter, with Q3 revenue up to $742 million and net income nearly tripling year over year, and management followed that up with fresh guidance pointing to continued growth.

See our latest analysis for Okta.

The earnings beat and upbeat guidance have helped steady sentiment after a choppy few months, with the share price at around $85.90 and a modest positive year to date share price return. Longer term total shareholder returns still reflect the hangover from earlier selloffs, which suggests that momentum is stabilising rather than surging.

If Okta’s move toward profitable growth has caught your eye, this could be a good moment to explore other high potential names through high growth tech and AI stocks and see what else fits your watchlist.

Yet with shares still well below their five year highs but trading at a premium to many software peers, is the market underestimating Okta’s improving profitability or already pricing in the next leg of growth?

Most Popular Narrative Narrative: 28% Undervalued

With Okta closing at $85.90 against a narrative fair value near $118.80, the valuation case hinges heavily on how identity demand evolves.

The rising frequency and sophistication of cyberattacks, combined with tightening regulatory mandates (especially in the public sector and large enterprises), are establishing identity as a mission-critical, recurring investment category. This aligns with Okta's increased penetration in federal and enterprise verticals, which enhances revenue durability and long-term earnings visibility.

Curious how recurring identity spend, rising margins and ambitious earnings targets all intersect in one valuation story? The narrative’s core assumptions might surprise you.

Result: Fair Value of $118.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from broader security platforms and any stumble integrating new AI driven products could quickly challenge the current undervalued thesis.

Find out about the key risks to this Okta narrative.

Another Lens On Valuation

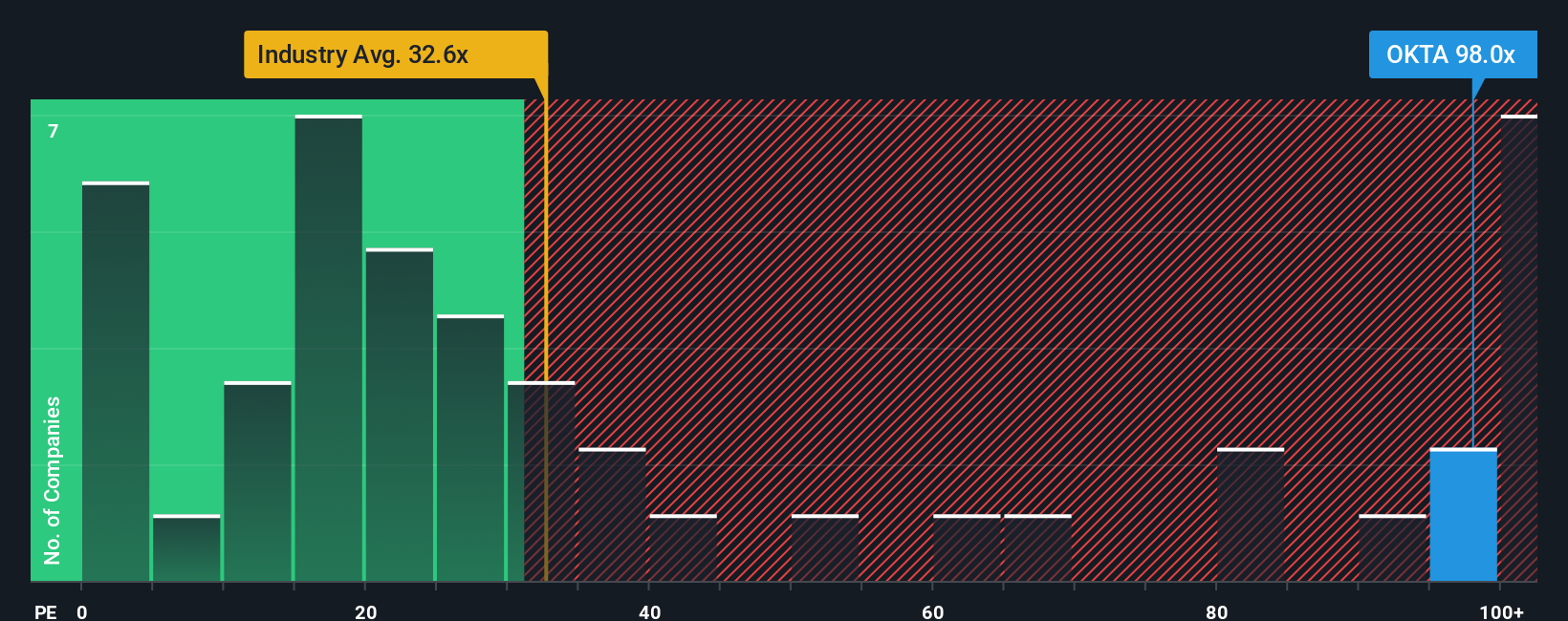

On earnings, the picture flips. Okta trades on a rich 78.1 times earnings, far above both peers at 28.9 times and a fair ratio of 36.9 times. That premium suggests sentiment is already optimistic, raising the question of how much upside the current price truly leaves.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you see the numbers differently or want to stress test your own thesis, you can spin up a personalised Okta story in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Ready for your next investing move?

Okta might fit your strategy, but you could miss standout opportunities if you stop here. Let the Simply Wall Street Screener surface your next great idea.

- Capture potential multibaggers early by scanning these 3571 penny stocks with strong financials that pair tiny market caps with fundamentals and momentum that appear solid.

- Position yourself in the machine learning trend by filtering for these 26 AI penny stocks that are exposed to real world adoption, not just hype.

- Seek attractive income streams by targeting these 15 dividend stocks with yields > 3% that combine established payouts with balance sheets that appear able to support them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026