- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA) Profitability Shift Reinforces Bullish Margin Narrative After Q3 2026 Results

Reviewed by Simply Wall St

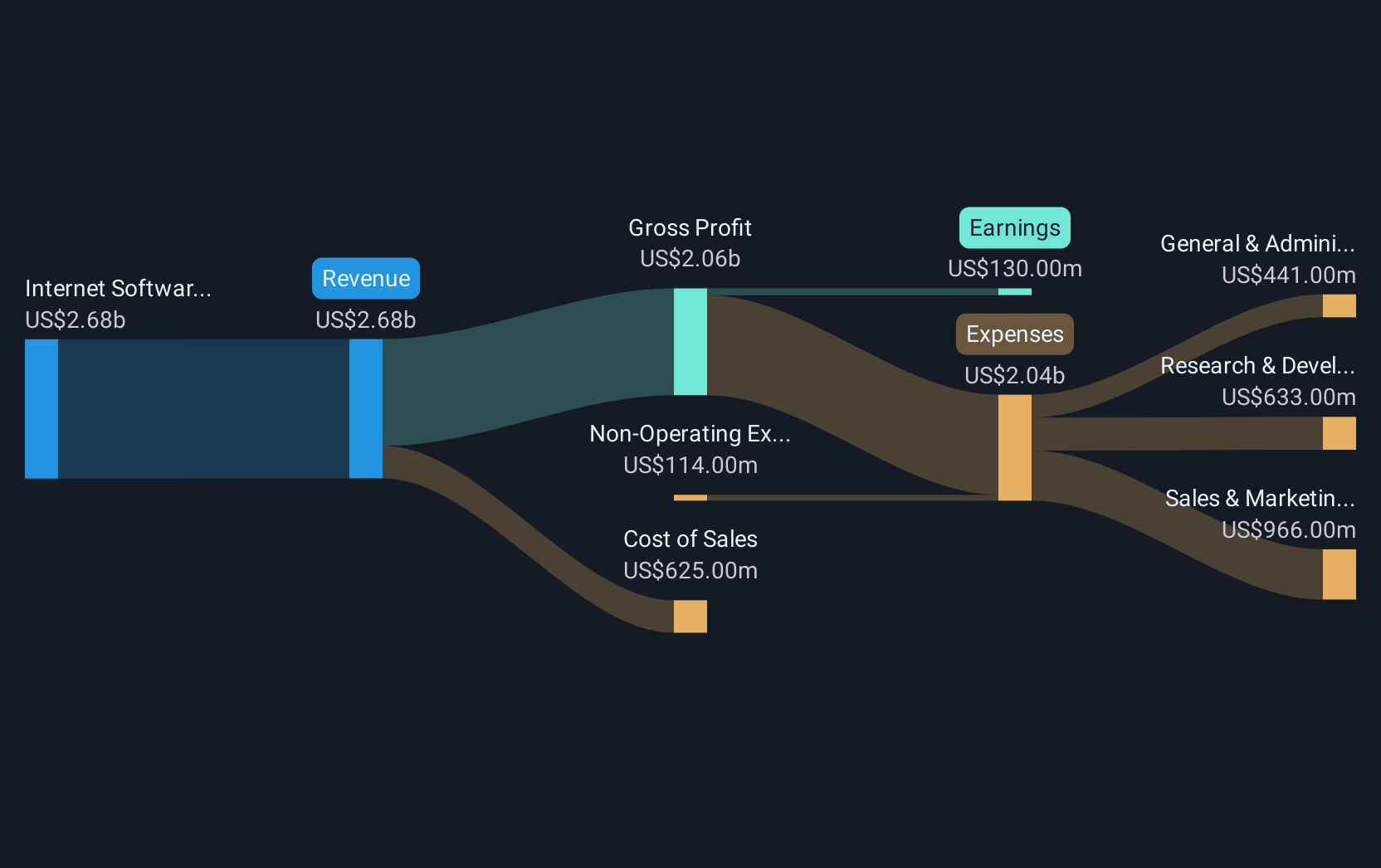

Okta (OKTA) has just posted Q3 2026 numbers with revenue of $742 million and basic EPS of $0.24, while on a trailing twelve month basis revenue sits at about $2.8 billion with EPS of $1.12 as the business continues to consolidate its move into sustained profitability. Looking back over recent quarters, revenue has stepped up from $682 million in Q4 2025 and $665 million in Q3 2025, alongside basic EPS rising from $0.13 and $0.09 in those periods. This sets the stage for investors to focus on how durable these improving margins and profit levels really are.

See our full analysis for Okta.With the latest figures on the table, the next step is to compare these results with the most common narratives around Okta to see which stories the margins now support and which ones start to look out of date.

See what the community is saying about Okta

TTM profits swing from loss to $195 million

- Over the last twelve months, net income moved from a loss of $136 million in Q2 2025 to a profit of $195 million by Q3 2026, with basic EPS rising from negative $0.82 to positive $1.12 over the same span.

- Consensus narrative argues that growing demand for unified cloud identity platforms and security focused suites should make these higher quality profits more durable, yet

- The move from a $39 million loss on about $2.5 billion of revenue in Q3 2025 to $195 million of profit on $2.8 billion of revenue a year later shows earnings improving faster than top line growth, which fits the story of operating leverage and better margins.

- At the same time, the focus on cross sell and upsell within large enterprises means this profitability shift is leaning heavily on existing customers, which is exactly where the narrative flags concentration and integration risks.

Earnings growth far outpaces ~8.5% revenue trend

- Analysts expect earnings to grow about 21.9% per year while revenue is forecast at roughly 8.5% per year, and the last twelve months already show revenue rising from $2.5 billion to $2.8 billion alongside basic EPS climbing from negative $0.82 to positive $1.12.

- Bulls see AI driven security features and a broader platform as key to sustaining this faster earnings growth, and the current numbers partly back that view because

- Margins have expanded enough to take net income from a $136 million loss to a $195 million profit even though revenue only added about $0.3 billion, which is consistent with the idea that higher value products are improving profitability.

- However, with revenue growth forecast to trail the US market while earnings are doing the heavy lifting, the bullish assumption that platform expansion will also re accelerate top line growth is not yet visible in these forecasts.

Premium P/E relies on executing high growth plan

- Okta trades on a trailing price to earnings ratio of about 78.1 times, well above peers at 29 times and the US IT industry at 28.6 times, even though revenue is only expected to grow around 8.5% per year.

- Skeptics focus on this valuation gap and the slower revenue outlook, and the data gives them concrete points because

- The current share price of $86.34 sits below both the $112.15 analyst target and the DCF fair value of about $118.22, yet the stock still commands a much richer multiple than peers, so any stumble in the projected 21.9% earnings growth could hit the multiple as well as the price.

- Analysts already assume Okta would still trade at roughly 74.3 times earnings in 2028 on $3.6 billion of revenue and $414.2 million of earnings, which keeps the bar for long term execution significantly higher than the broader IT industry.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Okta on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and want to stress test your own thesis? You can shape a full narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Explore Alternatives

Okta’s premium valuation and relatively modest revenue growth mean investors are relying heavily on flawless execution, leaving little margin for error if growth stumbles.

If you want potential upside without paying up for such a demanding multiple, use our these 920 undervalued stocks based on cash flows to focus on ideas where the price still lags fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026