- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA): Assessing Valuation After Earnings Beat and Strategic Moves in Identity Security

Reviewed by Simply Wall St

Okta (OKTA) just delivered earnings that outpaced expectations, fueled by new momentum in US government contracts and heightened demand for identity security as AI-powered threats become more sophisticated. In the same stretch, Okta took big steps to solidify its position by broadening its partnership with Palo Alto Networks for unified identity threat protection and acquiring Axiom, a specialist in non-human identity security. For investors weighing what to do next, these moves suggest Okta is not standing still in a market that is moving fast, especially as identity and access management becomes central to business and government defense strategies.

Zooming out, Okta’s share price has grown nearly 21% over the past year, with a 14% gain so far this year alone, even though returns have cooled off in recent months. Still, the company has more than doubled its value over the past three years despite facing swings in sentiment and competition. With expanding alliances, steady revenue growth, and newly announced product integrations, Okta is doubling down on its leadership in cybersecurity, but the stock’s ups and downs this year highlight lingering questions about how much growth is already being reflected in today’s price.

After the recent positive surprise and ongoing industry shifts, is Okta delivering long-term value the market has not fully appreciated, or is the upbeat story already baked into the current share price?

Most Popular Narrative: 39% Undervalued

According to the most-followed narrative by Tokyo, Okta is currently undervalued by a wide margin compared to its fair value estimate. The narrative highlights that the company’s profitability milestone is recent, with key questions now shifting to how Okta capitalizes on its solid foundation to deliver sustainable, profitable growth going forward.

It is not enough to have a better solution than the competition. The key is to find a business model that solves a “problem” for customers so elegantly that they are willing to pay for it, and profitably. CrowdStrike and Okta offer exciting opportunities in this context. A more intensive collaboration or even a merger could strengthen both companies and create a market giant that could have a lasting impact on the security market.

Okta may have cracked the code to long-term value, but the real story is in the financial details behind this valuation. The narrative suggests a profit turnaround, ambitious expectations for future cash flows, and a forward multiple that could surprise. Want to see what sets this company apart from its peers or how bold growth forecasts shape its fair value? You will want to see the figures driving these market-beating projections.

Result: Fair Value of $147.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including slowing net retention rates and questions about whether strong recent gains can be sustained as competition intensifies.

Find out about the key risks to this Okta narrative.Another View: Looking at Market Comparisons

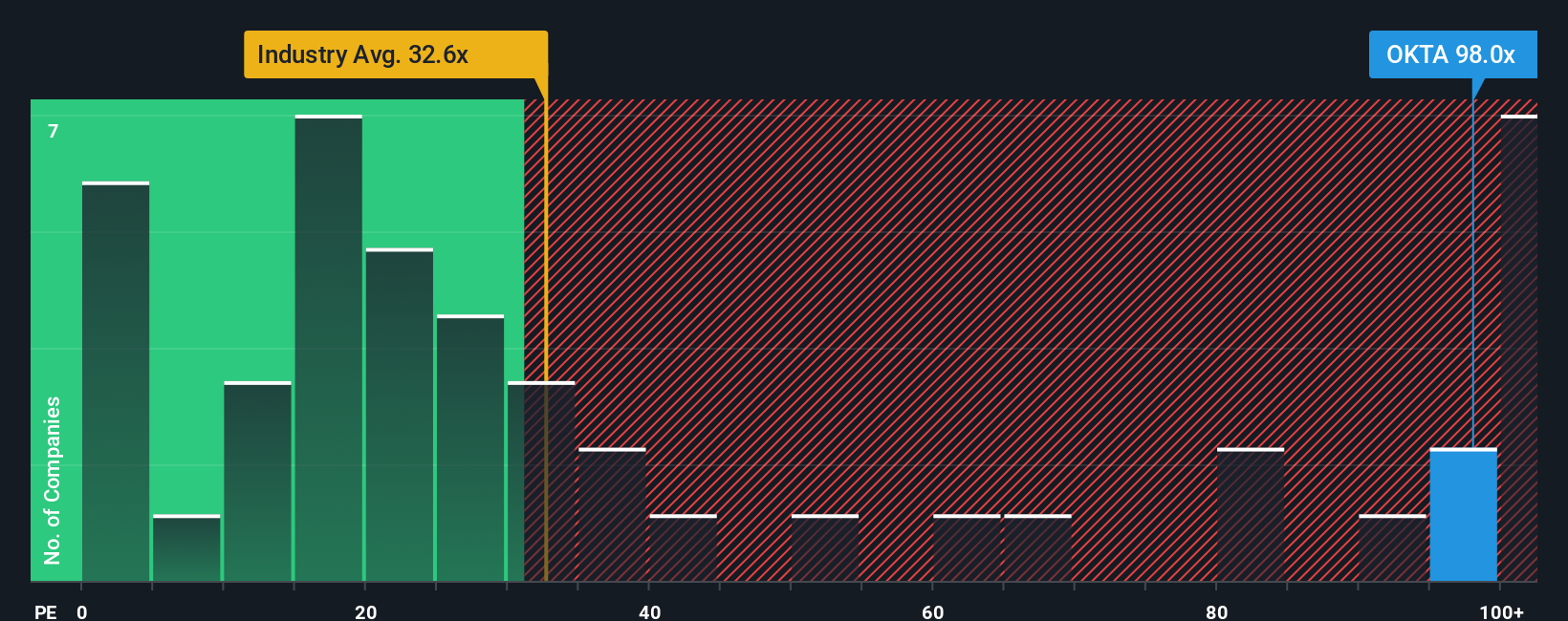

A different valuation approach compares Okta's current share price to industry standards using a common financial yardstick. By this measure, Okta looks expensive relative to similar technology companies. This raises the question of whether cautious optimism is needed or if the market is missing something important.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Okta to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Okta Narrative

If you are interested in exploring the data further or forming your own conclusions, you can review the information and create a personal take in just a few minutes with the Do it your way Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

Take your strategy up a notch and don’t let opportunities slip by. Unlock new potential with these powerful investment themes tailored to current trends and smart moves:

- Capture the potential of high-yielding companies by tracking dividend stocks with yields > 3% boasting consistent payouts above 3%, designed for investors seeking steady returns.

- Unleash the power of tomorrow’s breakthroughs by scanning the latest AI penny stocks at the frontier of artificial intelligence advancement and market disruption.

- Strengthen your portfolio with undervalued picks by zeroing in on stocks backed by healthy fundamentals through the smart undervalued stocks based on cash flows for opportunity seekers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives