- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (NasdaqGS:OKTA) Sees 26% Rise Over Past Month

Reviewed by Simply Wall St

Okta (NasdaqGS:OKTA) has been included in the S&P 1000 and several other indices recently, a development that could enhance investor appeal and visibility. This, alongside the launch of Auth for GenAI on the Auth0 platform, appears to have bolstered the company's profile amid a cautious market environment. The tech market faced some overall declines due to tariff uncertainties and anticipation of the Federal Reserve's announcements, but Okta's share price reflected resistance against market trends by rising 26% over the past month, slightly contrasting with the broader market’s flatter trajectory.

Every company has risks, and we've spotted 1 risk for Okta you should know about.

Over the past three years, Okta's total return, including share price and dividends, was 30.26%. This performance contextually complements a 26% rise in share price over the past month, indicating a significant rebound amid recent market pressures. Comparatively, Okta's performance aligned with the US IT industry, matching its 15.9% return over the past year. While the broader market returned 8.2% in the same timeframe, Okta exceeded this benchmark, highlighting its relative resilience and investor confidence.

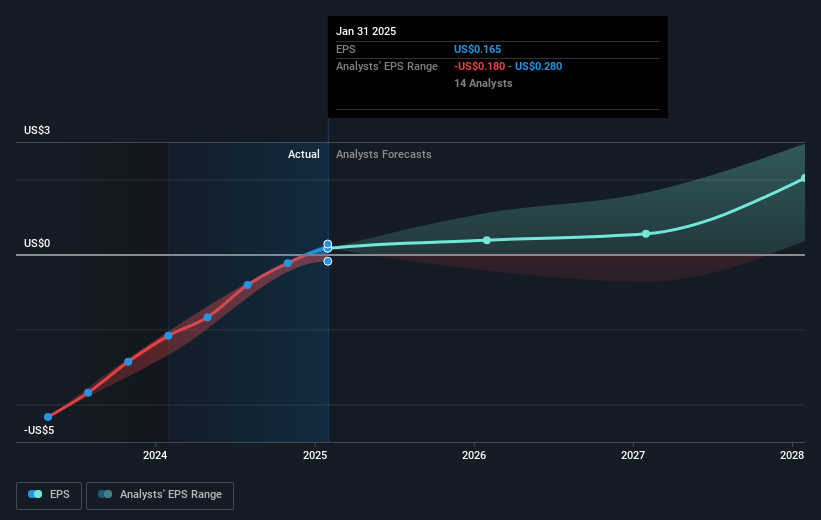

The recent inclusion of Okta in major indices such as the S&P 1000 and the launch of innovations like Auth for GenAI could enhance the company's growth potential. These developments are poised to influence Okta's anticipated revenue and earnings advancements, with projections indicating an 8.8% annual revenue growth, slightly outpacing the market average. Furthermore, Okta's current share price, although experiencing pronounced recent gains, reflects a minor discount relative to consensus analyst price targets of US$118.25. Consequently, the ongoing market recognition and strategic initiatives are likely integrated into these optimistic forecasts, underpinning Okta's competitive positioning and forward outlook.

Review our growth performance report to gain insights into Okta's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives