- United States

- /

- IT

- /

- NasdaqGS:OKTA

How Investors Are Reacting To Okta (OKTA) Acquiring Axiom and Expanding AI-Powered Cybersecurity Integration

Reviewed by Simply Wall St

- Okta recently acquired Axiom, a startup specializing in non-human identity security, and has deepened its collaboration with Palo Alto Networks to integrate AI-driven threat protection, addressing emerging cybersecurity needs as AI-based attacks increase.

- This move, along with strong earnings and expanded government contracts, highlights Okta's focus on advanced identity solutions for both human and machine users as digital transformation accelerates.

- We'll examine how Okta's Axiom acquisition and AI-security expansion could influence the company's broader growth and risk outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Okta Investment Narrative Recap

To own Okta shares today, investors need to believe that identity and access management will remain an enterprise priority as digital transformation and AI-driven security threats intensify. The recent Axiom acquisition and partnership with Palo Alto Networks could help Okta maintain its growth momentum in non-human identity security, but the biggest short-term risk is heightened competition from broad security platforms, which has not been materially changed by this news.

The rollout of Okta’s myAuth solution with the U.S. Department of Defense shows practical traction for the company’s technology in large-scale, sensitive environments. This aligns with Okta’s ambitions to capture demand as organizations expand their focus to identities beyond employees, supporting new growth catalysts tied directly to increased government and regulated industry adoption.

But while recent moves strengthen Okta’s position, investors should watch for signals that large customers may increasingly turn to bundled security suites instead of standalone providers, as this is information that investors should be aware of...

Read the full narrative on Okta (it's free!)

Okta's narrative projects $3.6 billion in revenue and $414.2 million in earnings by 2028. This requires 9.5% yearly revenue growth and a $246.2 million earnings increase from $168.0 million today.

Uncover how Okta's forecasts yield a $120.92 fair value, a 34% upside to its current price.

Exploring Other Perspectives

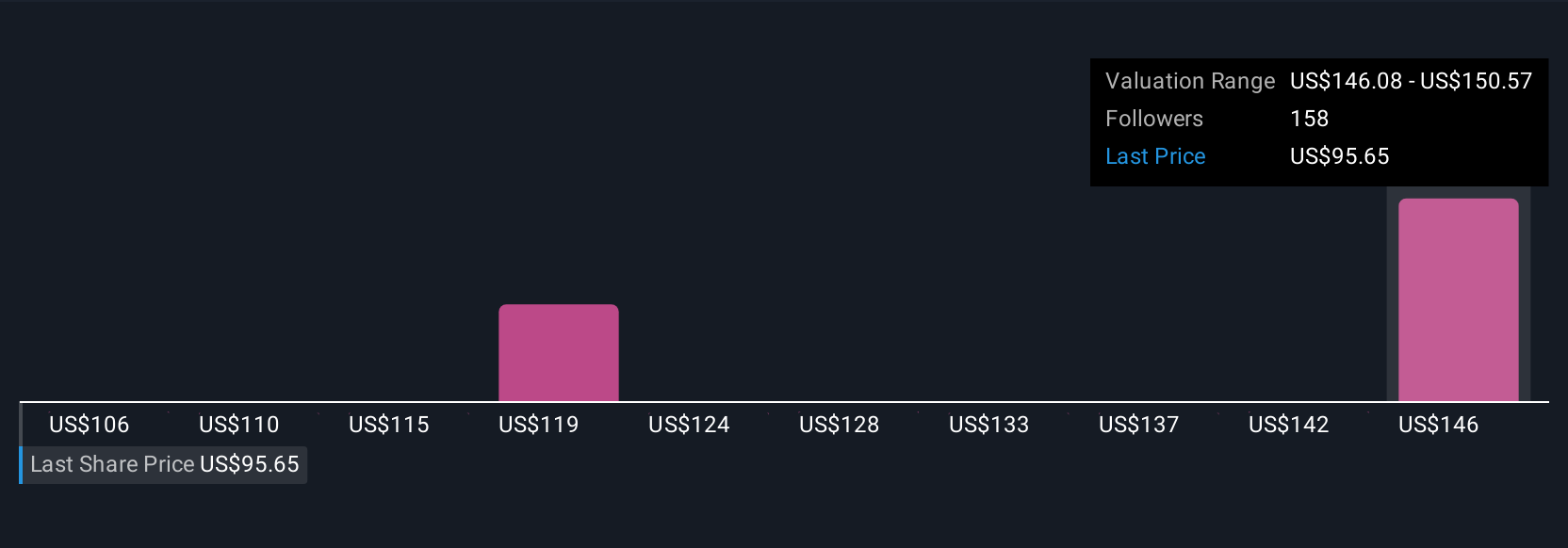

The Simply Wall St Community submitted eight fair value estimates for Okta ranging from US$94.96 to US$147.87 per share. As competition from larger security platforms rises, these differences show how opinion on Okta’s future prospects can widely differ, and readers should consider several viewpoints.

Explore 8 other fair value estimates on Okta - why the stock might be worth as much as 64% more than the current price!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Okta's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 8 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives