- United States

- /

- Software

- /

- NasdaqCM:NTWK

NetSol Technologies (NASDAQ:NTWK) Has A Rock Solid Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that NetSol Technologies, Inc. (NASDAQ:NTWK) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for NetSol Technologies

What Is NetSol Technologies's Debt?

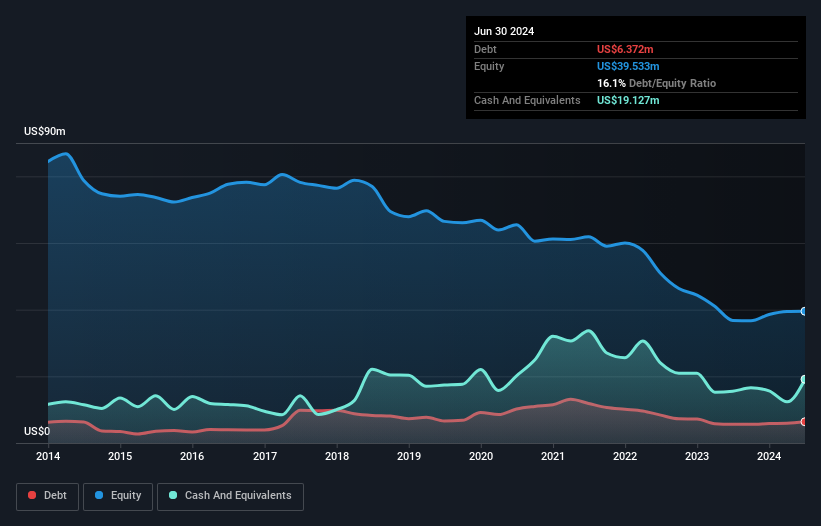

As you can see below, at the end of June 2024, NetSol Technologies had US$6.37m of debt, up from US$5.61m a year ago. Click the image for more detail. But it also has US$19.1m in cash to offset that, meaning it has US$12.8m net cash.

How Healthy Is NetSol Technologies' Balance Sheet?

We can see from the most recent balance sheet that NetSol Technologies had liabilities of US$23.9m falling due within a year, and liabilities of US$784.5k due beyond that. Offsetting this, it had US$19.1m in cash and US$25.7m in receivables that were due within 12 months. So it can boast US$20.2m more liquid assets than total liabilities.

This surplus strongly suggests that NetSol Technologies has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that NetSol Technologies has more cash than debt is arguably a good indication that it can manage its debt safely.

Although NetSol Technologies made a loss at the EBIT level, last year, it was also good to see that it generated US$3.5m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since NetSol Technologies will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While NetSol Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent year, NetSol Technologies recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that NetSol Technologies has net cash of US$12.8m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$2.4m, being 69% of its EBIT. So is NetSol Technologies's debt a risk? It doesn't seem so to us. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with NetSol Technologies , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if NetSol Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NTWK

NetSol Technologies

Engages in the design, development, marketing, and export of enterprise software solutions to the automobile financing and leasing, banking, and financial services industries in North America, Europe, and Asia Pacific.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion