- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NasdaqGS:NTNX) Sees Q2 Revenue of US$655M And Net Income of US$56M Reports Strong Earnings Growth

Reviewed by Simply Wall St

Nutanix (NasdaqGS:NTNX) saw a notable 10% increase in its share price over the past month, coinciding with the company's Q2 2025 earnings release. The earnings results revealed a revenue of $655 million, a substantial increase from the previous year's $565 million, and a net income rising to $56 million from $33 million. This impressive performance may have contributed to investor confidence, as reflected in the share price. Alongside the earnings announcement, the company provided optimistic guidance with expected full-year revenue between $2.495 billion and $2.515 billion. Additionally, Nutanix secured a $500 million revolving credit facility, which could bolster its financial flexibility. Meanwhile, broader market dynamics, including mixed stock performance and heightened economic uncertainty, seem to weigh less on NTNX's upward trajectory, as the tech-heavy Nasdaq had a mixed performance amidst news such as Nvidia's earnings and federal policy updates.

Get an in-depth perspective on Nutanix's performance by reading our analysis here.

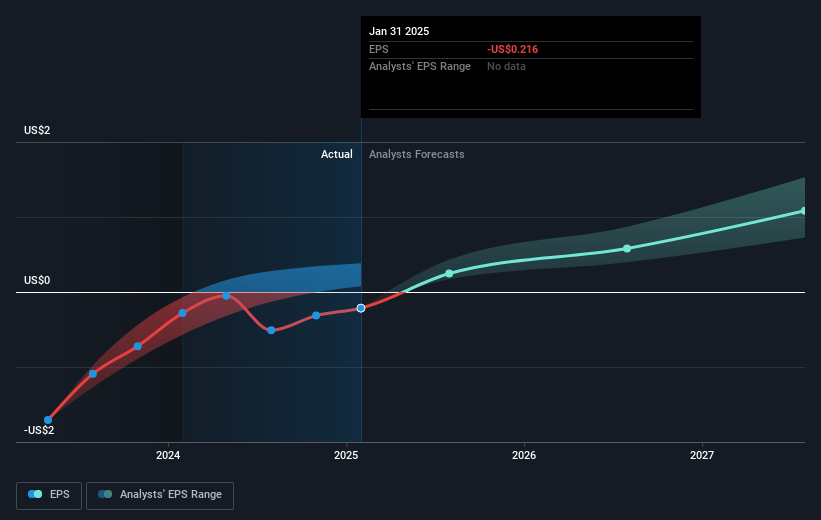

Over the past five years, Nutanix (NasdaqGS:NTNX) achieved a total shareholder return of 203.90%, highlighting significant growth and value creation for its investors. During this period, while still unprofitable, Nutanix reduced its losses at a rate of 32.5% per year. Additionally, the company outpaced the US Software industry's one-year return of 6.7%, emphasizing its competitive momentum.

Key developments during this time include the expansion of the Nutanix Cloud Clusters on AWS and the launch of Nutanix Enterprise AI, driving hybrid and multi-cloud advancements. Nutanix also completed share buybacks, including a tranche of 2.92 million shares for US$151.14 million in late 2024. Furthermore, Nutanix's shares, trading at US$69.35, remain undervalued against the estimated fair value of US$134.31, positioning it as a potentially attractive opportunity for investors.

- Unlock the insights behind Nutanix's valuation and discover its true investment potential

- Gain insight into the risks facing Nutanix and how they might influence its performance—click here to read more.

- Is Nutanix part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nutanix, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives