- United States

- /

- Software

- /

- NasdaqGS:NTNX

Can Expanded Azure Virtual Desktop Support Deepen Nutanix’s (NTNX) Hybrid Cloud Advantage?

Reviewed by Sasha Jovanovic

- At Microsoft Ignite 2025, Nutanix announced that its Nutanix Cloud Platform will support Microsoft Azure Virtual Desktop for hybrid environments, enabling organizations to run Azure Virtual Desktop on premises using the Nutanix AHV hypervisor.

- This collaboration brings enhanced flexibility and regulatory compliance for industries handling sensitive data, reinforcing Nutanix’s commitment to advancing hybrid cloud solutions.

- We'll explore how Nutanix's expanded Azure Virtual Desktop support could further strengthen its multi-cloud positioning within the investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Nutanix Investment Narrative Recap

To be a Nutanix shareholder, you need to believe in the increasing adoption of hybrid and multi-cloud environments and the company's potential to expand its enterprise infrastructure footprint. The announcement of Azure Virtual Desktop support on Nutanix AHV strengthens its cloud partnerships but does not materially change the current short-term catalyst, capturing more hybrid cloud market share, or the largest risk, which remains intensifying competition from public cloud vendors.

Among recent announcements, Nutanix’s updated earnings guidance for fiscal 2026 is particularly relevant. Management forecasts revenue between US$2.82 billion and US$2.86 billion for the year, reflecting confidence in ongoing enterprise demand and the effects of strategic partnerships, which serve as core drivers behind the company’s near-term growth catalysts.

However, investors should be mindful that despite the enhanced Azure integration, pricing pressure from established IT vendors and cloud providers remains an important risk ...

Read the full narrative on Nutanix (it's free!)

Nutanix's narrative projects $3.9 billion in revenue and $513.0 million in earnings by 2028. This requires 15.3% yearly revenue growth and a $324.6 million earnings increase from the current earnings of $188.4 million.

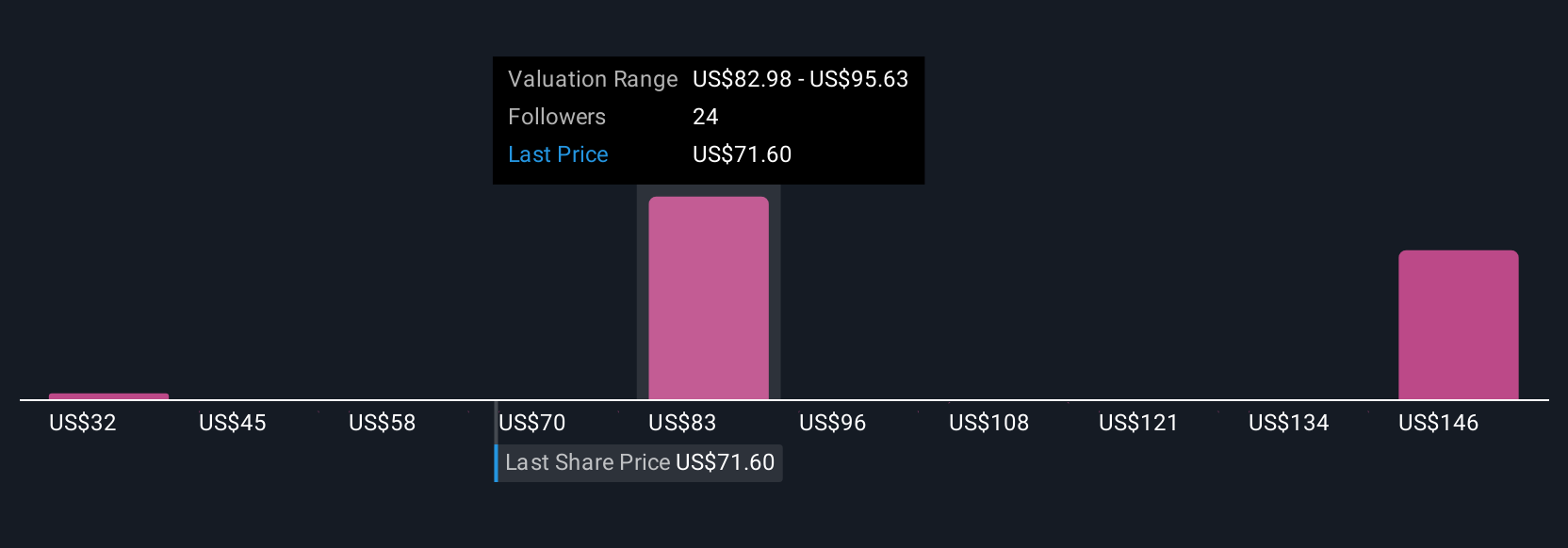

Uncover how Nutanix's forecasts yield a $85.78 fair value, a 82% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided eight fair value estimates for Nutanix, ranging from US$32.34 to US$118.13 per share. While many see potential in hybrid and multi-cloud catalysts, significant differences in opinion reflect how views on competition and future growth can shape your outlook.

Explore 8 other fair value estimates on Nutanix - why the stock might be worth over 2x more than the current price!

Build Your Own Nutanix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutanix research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutanix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutanix's overall financial health at a glance.

No Opportunity In Nutanix?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale