- United States

- /

- Software

- /

- NasdaqCM:NN

Is NextNav (NASDAQ:NN) Using Debt Sensibly?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that NextNav Inc. (NASDAQ:NN) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for NextNav

How Much Debt Does NextNav Carry?

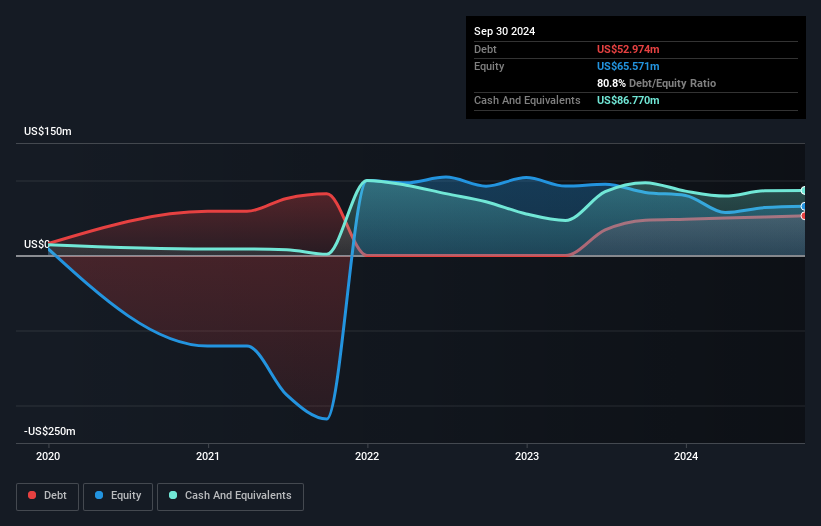

You can click the graphic below for the historical numbers, but it shows that as of September 2024 NextNav had US$53.0m of debt, an increase on US$47.1m, over one year. But on the other hand it also has US$86.8m in cash, leading to a US$33.8m net cash position.

How Strong Is NextNav's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that NextNav had liabilities of US$20.8m due within 12 months and liabilities of US$85.3m due beyond that. On the other hand, it had cash of US$86.8m and US$2.24m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$17.1m.

This state of affairs indicates that NextNav's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$2.19b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, NextNav boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine NextNav's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year NextNav wasn't profitable at an EBIT level, but managed to grow its revenue by 43%, to US$5.0m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is NextNav?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that NextNav had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$41m and booked a US$86m accounting loss. But at least it has US$33.8m on the balance sheet to spend on growth, near-term. With very solid revenue growth in the last year, NextNav may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that NextNav is showing 3 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if NextNav might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NN

NextNav

Provides positioning, navigation, and timing (PNT) solutions in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Lynas Rare Earths: Owning the Policy-Backed Growth Regime, Not Just the Ore Body.

Bunker Hill Mine: A Case For $5 Per Share by 2030

VTEX - A hidden Latin American growth opportunity?

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026