- United States

- /

- Software

- /

- NasdaqCM:NN

How Investors May Respond To NextNav (NN) Turning Profitable Despite Lower Quarterly Sales

Reviewed by Sasha Jovanovic

- NextNav Inc. recently reported its third quarter 2025 financial results, revealing sales of US$887,000 and net income of US$483,000 compared to a net loss in the same period last year.

- An interesting shift is highlighted by the company achieving positive net income in the quarter, despite reporting lower sales compared to the prior year.

- We'll explore how the move to positive quarterly net income influences NextNav's investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is NextNav's Investment Narrative?

To be a shareholder in NextNav right now, you’d need to believe in the company’s ability to convert its technological partnerships and expanding spectrum assets into sustainable financial improvement, despite recent headwinds. The Q3 news revealing positive net income for the quarter is a rare bright spot, especially given the backdrop of declining sales and persistent unprofitability seen throughout the year. If this profitability persists, it could reshape short-term catalysts by shifting focus to operational efficiency and the integration of recent partnerships in 5G and public safety applications. However, the big risks have not disappeared: ongoing revenue contraction, recent leadership changes, and negative equity still loom large. This quarter’s one-off profit is encouraging but does not outweigh the longer-term concerns, so the impact on risks and catalysts will depend on whether this result proves repeatable. On the other hand, executive turnover remains high and could unsettle the company’s direction.

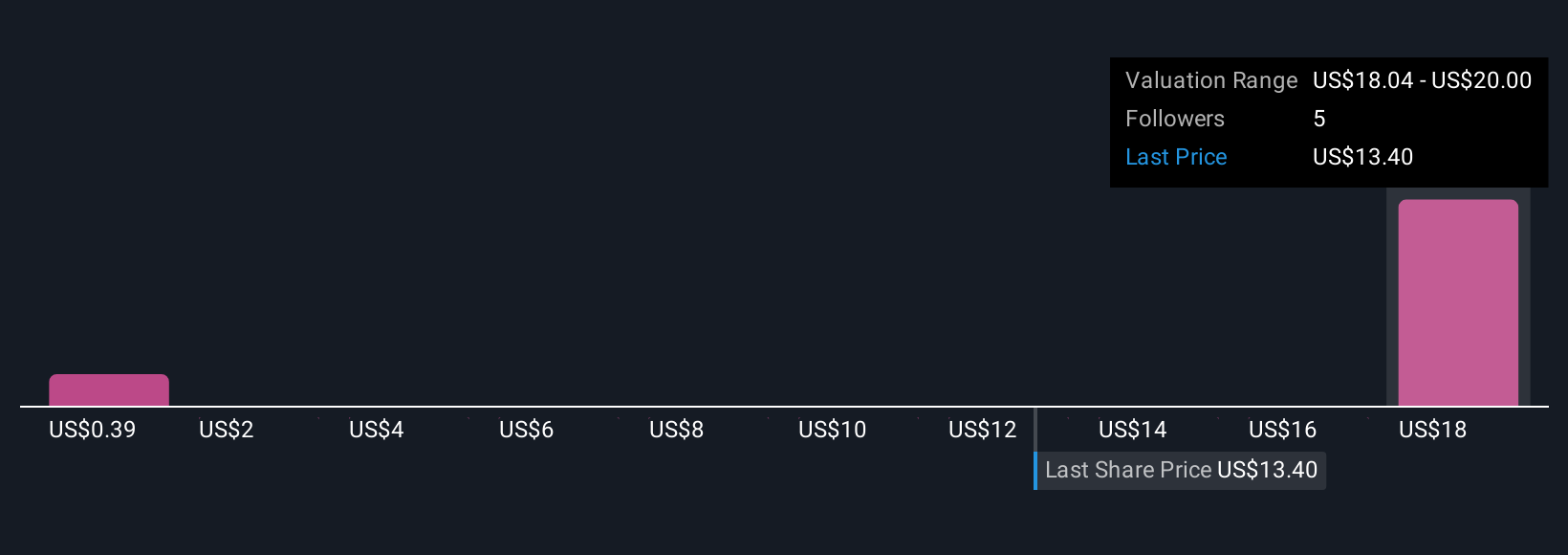

Our valuation report unveils the possibility NextNav's shares may be trading at a premium.Exploring Other Perspectives

Explore 2 other fair value estimates on NextNav - why the stock might be worth less than half the current price!

Build Your Own NextNav Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextNav research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free NextNav research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextNav's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextNav might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NN

NextNav

Provides positioning, navigation, and timing (PNT) solutions in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives