- United States

- /

- Software

- /

- NasdaqCM:NN

Can NextNav's (NN) Indoor Timing Milestone Redefine Its Competitive Edge in Critical Infrastructure?

Reviewed by Sasha Jovanovic

- Oscilloquartz, an Adtran company, announced the successful integration of NextNav's 5G-based Positioning, Navigation, and Timing (PNT) technology with its GNSS-enabled grandmaster clock, achieving GPS-quality timing and synchronization in both indoor and outdoor environments without relying on satellite signals.

- This milestone highlights a major step toward commercializing highly resilient timing solutions for critical infrastructure, addressing vulnerabilities in GPS-dependent operations across national security, public safety, and enterprise sectors.

- Now, we'll explore how NextNav's progress in delivering GPS-quality timing even in GPS-denied environments could shape its broader investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is NextNav's Investment Narrative?

For those watching NextNav, the recent integration of its 5G-based PNT technology with Oscilloquartz's grandmaster clock stands out as a genuine proof point in their quest to commercialize GPS alternatives for critical infrastructure. This technical milestone addresses one of the big picture beliefs: that the need for resilient, GPS-independent timing solutions is only growing in national security and enterprise settings. In the immediate term, however, the headline news doesn't fundamentally shift the major near-term catalysts, which still center on regulatory approval for NextNav’s 902–928 MHz 5G PNT proposal and progress on licensing and spectrum utilization. While the partnership helps validate real-world use cases and could bolster industry credibility, the company remains unprofitable, faces declining revenue forecasts, and continues to operate with negative equity and a rapidly changing board and management team. Execution risks, from regulatory coordination to commercial uptake, still loom large, but this achievement could offer incremental momentum where technical proof is a gating factor.

But keep in mind, gaining regulatory approval remains a significant hurdle for NextNav.

Exploring Other Perspectives

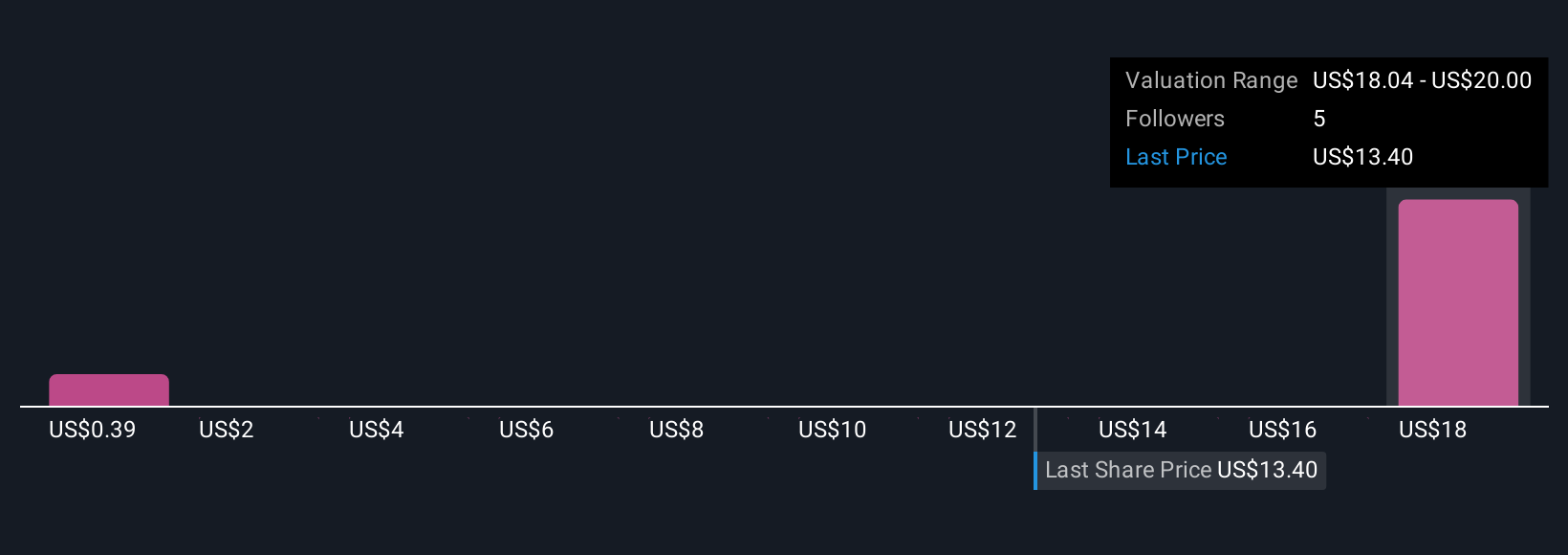

Explore 2 other fair value estimates on NextNav - why the stock might be worth as much as 50% more than the current price!

Build Your Own NextNav Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextNav research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free NextNav research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextNav's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextNav might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NN

NextNav

Provides positioning, navigation, and timing (PNT) solutions in the United States.

Imperfect balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives