- United States

- /

- Software

- /

- NYSE:YOU

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.2%, contributing to a remarkable 31% increase over the past year, with earnings anticipated to grow by 16% annually in the coming years. In this favorable environment, identifying high growth tech stocks involves looking for companies that exhibit strong innovation and scalability potential, aligning with current market momentum and future earnings expectations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 44.28% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| Travere Therapeutics | 27.16% | 69.88% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 254 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

nCino (NasdaqGS:NCNO)

Simply Wall St Growth Rating: ★★★★☆☆

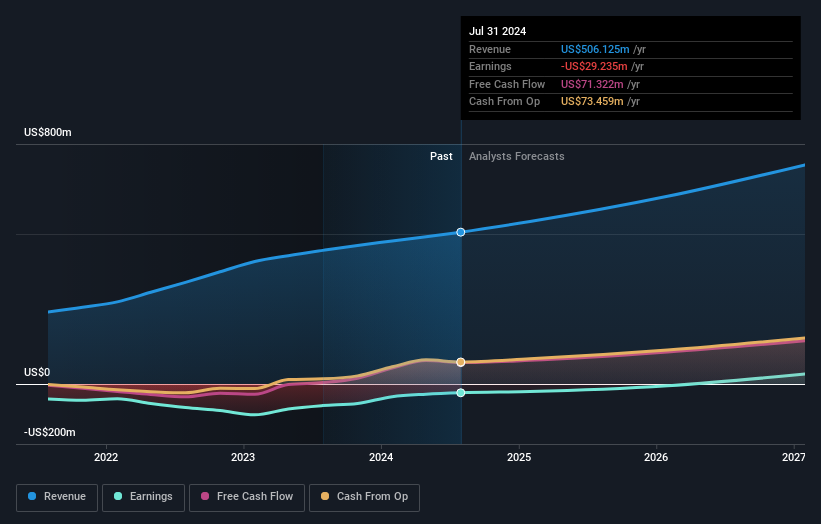

Overview: nCino, Inc. is a software-as-a-service company that offers cloud-based software applications to financial institutions both in the United States and internationally, with a market cap of $3.59 billion.

Operations: nCino generates revenue primarily from its Software & Programming segment, which amounts to $506.13 million. The company's focus on providing cloud-based solutions caters specifically to financial institutions across various regions.

nCino, a player in the tech sector, demonstrates resilience with its recent legal victory and robust financial guidance. Despite past unprofitability, the company's revenue growth forecast at 14.5% annually outpaces the US market average of 8.8%, signaling strong potential. Notably, nCino's commitment to innovation is evident in its R&D expenses, crucial for maintaining competitive edge in software development. With earnings expected to surge by 93.4% annually and a positive shift towards profitability within three years, nCino is strategically positioned to capitalize on evolving market demands while enhancing shareholder value through focused financial management and technological advancements.

- Click here to discover the nuances of nCino with our detailed analytical health report.

Gain insights into nCino's historical performance by reviewing our past performance report.

Clearwater Analytics Holdings (NYSE:CWAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clearwater Analytics Holdings, Inc. offers a SaaS solution for automated investment data services to various sectors globally and has a market cap of $6.19 billion.

Operations: Clearwater Analytics generates revenue primarily through its SaaS solution, which provides automated investment data services such as aggregation, reconciliation, accounting, and reporting. The company caters to a diverse clientele including insurers, investment managers, corporations, institutional investors, and government entities both in the U.S. and internationally.

Clearwater Analytics Holdings, Inc. is navigating the competitive tech landscape with strategic initiatives and a focus on advanced analytics solutions. Recently, the company has seen a notable uptick in its financial performance, with sales reaching $106.79 million in Q2 2024, up from $89.88 million the previous year, reflecting an impressive growth trajectory. The appointment of Fleur Sohtz as Chief Marketing Officer underscores their commitment to scaling operations and enhancing market reach, particularly through high-growth strategies that leverage her extensive experience in transformative marketing within global companies. Moreover, Clearwater's recent product innovations like the CP Issuance tool demonstrate their proactive approach to addressing industry-specific challenges through technology advancements. With expected revenue growth at 18.1% per year and earnings forecasted to surge by 94.6%, Clearwater is poised for significant advancements in both profitability and market influence over the coming years.

Clear Secure (NYSE:YOU)

Simply Wall St Growth Rating: ★★★★★☆

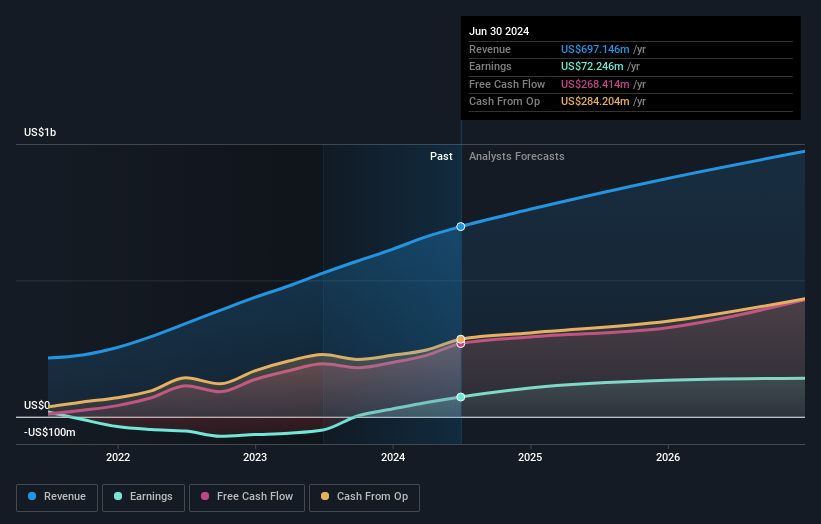

Overview: Clear Secure, Inc. operates a secure identity platform under the CLEAR brand name primarily in the United States, with a market capitalization of approximately $4.45 billion.

Operations: Clear Secure generates revenue primarily through its secure biometric identity verification services, amounting to $697.15 million. The company's market capitalization stands at approximately $4.45 billion.

Clear Secure's recent addition to multiple S&P indices, including the S&P 600 Information Technology Sector, underscores its strengthening market presence. In Q2 2024, the company reported a significant revenue increase to $186.75 million from $149.87 million year-over-year, alongside a net income surge to $24.12 million from $4.01 million, reflecting robust operational efficiency and market adoption of its security solutions. Notably, Clear Secure's R&D investment remains pivotal in driving innovation; however specific figures on R&D spending are crucial for evaluating its commitment to technological advancements compared to industry peers. This strategic focus on research is likely enhancing product offerings and customer satisfaction in a competitive tech landscape where continuous innovation is key to retaining competitive edges.

- Unlock comprehensive insights into our analysis of Clear Secure stock in this health report.

Review our historical performance report to gain insights into Clear Secure's's past performance.

Seize The Opportunity

- Click here to access our complete index of 254 US High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Flawless balance sheet with high growth potential.