- United States

- /

- Software

- /

- NasdaqGS:NCNO

Assessing nCino (NCNO) Valuation After Insight’s Exit and a New $100m Stock Buyback Program

Reviewed by Simply Wall St

nCino (NCNO) just landed in the spotlight after a big shareholder, Insight Holdings Group, fully exited its stake while the company rolled out a fresh 100 million dollar stock buyback program.

See our latest analysis for nCino.

At a share price of $25.68, nCino has seen a modest 1 month share price return of 5.29%, but its 1 year total shareholder return of minus 27.09% shows momentum has been fading despite solid underlying revenue growth.

If this mix of insider exits and buybacks has you reassessing your watchlist, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover other interesting setups.

With shares trading about 36 percent below analyst targets but still reflecting steady growth hopes, the real question is whether nCino is quietly undervalued or if the market already reflects the next leg of expansion.

Most Popular Narrative: 27.7% Undervalued

With nCino last closing at $25.68 against a narrative fair value in the mid 30s, the gap reflects ambitious expectations for profitable growth and AI driven expansion.

The transition to a new outcome based/pricing model that is gaining customer acceptance, often pulled forward by demand for embedded AI, enables price uplifts (targeted at 10%), faster renewal cycles, and improved gross margins. All of these factors are likely to positively impact net earnings.

Curious how steady but unspectacular revenue growth can still back a premium valuation? The narrative leans on a sharp profit swing and a rich future earnings multiple. Want to see the exact assumptions behind that leap? Dive in to uncover the projections driving this fair value call.

Result: Fair Value of $35.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained competitive pressure or slower than expected international traction could derail those upbeat assumptions and force investors to reassess the growth premium.

Find out about the key risks to this nCino narrative.

Another View: Multiples Paint a Richer Picture

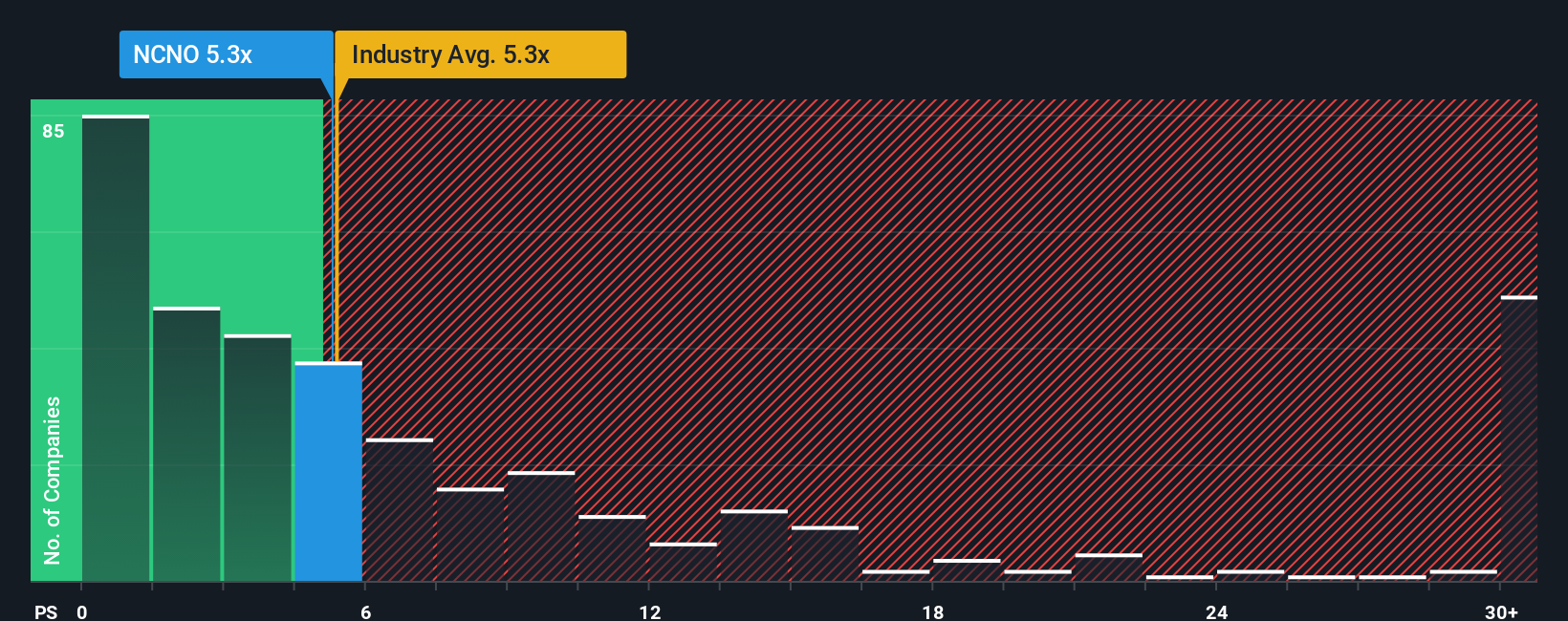

While the narrative fair value suggests upside, nCino trades on a price to sales ratio of about 5 times, slightly above the US software average of 4.9 times and well above its fair ratio of 3.2 times. That gap points to valuation risk, not a simple bargain. Is the growth story strong enough to close it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nCino Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a personalized view in minutes using Do it your way.

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, explore fresh opportunities on the Simply Wall St Screener, where data-backed ideas can help inform your next decision.

- Look for potential mispricings by targeting companies trading below their cash flow value using these 914 undervalued stocks based on cash flows to search for bargains the market may not have fully reflected in the price.

- Search for dividend income opportunities by screening for companies with yields above 3% through these 12 dividend stocks with yields > 3% while staying focused on sustainability, not just headline numbers.

- Explore innovation in digital assets by focusing on businesses at the frontier of this space with these 79 cryptocurrency and blockchain stocks and assess how they might fit into structural changes in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NCNO

nCino

A software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion